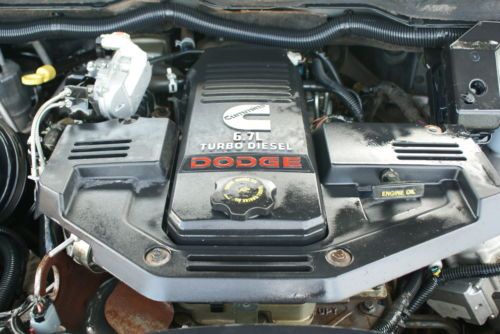

Laramie Mega Cab 4x4 6.7 Liter Diesel Leather Automatic Only 82k Miles Clean on 2040-cars

Montgomery, Texas, United States

Vehicle Title:Clear

Fuel Type:Diesel

Transmission:Automatic

For Sale By:Dealer

Make: Dodge

Cab Type (For Trucks Only): Crew Cab

Model: Ram 2500

Warranty: Unspecified

Mileage: 82,485

Sub Model: 4WD Mega Cab

Options: Leather Seats

Exterior Color: Tan

Safety Features: Driver Airbag

Interior Color: Tan

Power Options: Power Windows

Number of Cylinders: 6

Dodge Ram 2500 for Sale

07 dodge ram 2500 slt lone star edition quad cab long bed 6.7l diesel 4wd(US $22,995.00)

07 dodge ram 2500 slt lone star edition quad cab long bed 6.7l diesel 4wd(US $22,995.00) 2005 ram 2500 diesel 4x4 1-owner quad cab lwb 5.9l cummins carfax(US $17,995.00)

2005 ram 2500 diesel 4x4 1-owner quad cab lwb 5.9l cummins carfax(US $17,995.00) 2004 dodge ram hd laramine with cummins turbo diesel

2004 dodge ram hd laramine with cummins turbo diesel Extended cab long bed 4x4 cummins 5.9l diesel 24-valve slt 115k miles .. mint!!(US $17,980.00)

Extended cab long bed 4x4 cummins 5.9l diesel 24-valve slt 115k miles .. mint!!(US $17,980.00) 05 dodge ram 2500 slt quad cab legendary 5.9l diesel long bed 6 speed 4wd 1ownr(US $19,995.00)

05 dodge ram 2500 slt quad cab legendary 5.9l diesel long bed 6 speed 4wd 1ownr(US $19,995.00) 2009 ram 2500 4x4 quad cab cm flat bed slt cummins turbo diesel auto tow package(US $21,980.00)

2009 ram 2500 4x4 quad cab cm flat bed slt cummins turbo diesel auto tow package(US $21,980.00)

Auto Services in Texas

WorldPac ★★★★★

VICTORY AUTO BODY ★★★★★

US 90 Motors ★★★★★

Unlimited PowerSports Inc ★★★★★

Twist`d Steel Paint and Body, LLC ★★★★★

Transco Transmission ★★★★★

Auto blog

Best car infotainment systems of 2022

Wed, Jul 20 2022Declaring one infotainment system the best over any other is an inherently subjective matter. You can look at quantitative testing for things like input response time and various screen load times, but ask a room full of people that have tried them all what their favorite is, and you’re likely to get a lot of different responses. Some prefer systems that are exclusively touch-based with a simplistic user interface. Others may prefer a non-touch system that is navigable via a scroll wheel. You can compare it to the phone operating system wars. Just like some folks prefer Android phones over iPhones, we all have our own opinions for what makes up the best infotainment interface. All that said, our combined experience tells us that a number of infotainment systems are at least better than the rest. WeÂ’ve narrowed it down to five total systems in their own subcategories that stand out to us. Read on below to see our picks, and feel free to make your own arguments in the comments. Best overall: UConnect — Various Stellantis products If thereÂ’s one infotainment system that all of us agree is excellent, itÂ’s UConnect. Both UConnect 4 and the latest UConnect 5 software are included in this praise, too. It has numerous qualities that make it great, but above all else, UConnect is simple and straightforward to use. Ease of operation is one of the most (if not the single most) vital parts of any infotainment system interface. If youÂ’re expected to be able to tap away on a touchscreen while driving and still pay attention to the road, a complex infotainment system is going to remove your attention from the number one task at hand: driving. UConnect uses a simple interface that puts all of your key functions in a clearly-represented row on the bottom of the screen. Tap any of them, and it instantly pulls up that menu. We like the radio/media interface — itÂ’s super easy to swap stations or sources. The menu structure is easy to grasp, and of course both Apple CarPlay/Android Auto are available if you want them. UConnect 5 is a big visual improvement over UConnect 4, but thankfully it retains the same ease of use as the outgoing system. WeÂ’ll also point out that Stellantis is able to adapt UConnect to different screen shapes and sizes with great success — it works stunningly well in the vertical 12-inch screen of the Ram.

2019 Dodge Challenger Hellcat with twin-scoop hood spied with no camouflage

Mon, May 7 2018Dodge recently teased an updated 2019 Challenger SRT Hellcat sports coupe complete with an all-new hood with dual scoops. It didn't reveal anything else about the vehicle, saying more details were coming. And now we have more details, but not in the way Dodge probably wanted. We can now see the updated Hellcat with the new hood. To be perfectly honest, it's pretty much what we expected. The teaser photos indicated that the hood was the only major body change, and this car confirms it. The rest of the body is identical to a normal Hellcat. The bumpers, grille mesh, even the wheels are all standard Hellcat parts. Even the slotted rotors and Brembo calipers look the same. This car does suggest that the hood will be available on both the narrow-body Hellcat and the Hellcat Widebody, the latter of which was featured in the teaser images. There is actually one other minor difference on this 2019 Hellcat's exterior, and that's the grille badging. There's now a vintage-style badge with "Challenger" written in script off to one side. Currently only one grille and badge design is available on Hellcat, and it features just the SRT Hellcat logo. It appears the SRT badge is still present, but blocked off on this prototype. So it's possible this new badge comes with the new hood as a sort of retro package for Hellcat. We should have all the details on this and other 2019 Challengers when the car is officially revealed later this summer. Related Video: Featured Gallery 2019 Dodge Challenger SRT Hellcat Spy Shots View 11 Photos Image Credit: KGP Photography Spy Photos Dodge Coupe Performance dodge challenger srt hellcat

Hackers stole Jeeps in Texas using FCA's internal dealer software

Fri, Aug 5 2016This article has been updated with details on how the thefts were carried out, and with comments from FCA. It seems the news regarding vehicle hacking continues to get worse, especially when it comes to products from Fiat Chrysler Automobiles. Last year, a Jeep Cherokee in St. Louis, Missouri, was wirelessly hacked from Pittsburgh. Nissan had to shut down its Leaf app because of vulnerabilities. Now, a pair of hackers in Houston, Texas, stole more than 30 Jeeps over a six-month period. The two were arrested by police last Friday while attempting to steal another vehicle. ABC 13 in Houston reports that police had been following Michael Arcee and Jesse Zelay for several months but were unable to catch them in the act until now. The two were using a laptop to connect to and start a vehicle. The thieves were able to access Fiat Chrysler's own DealerCONNECT software. After entering the vehicle identification number, the hackers were able to reprogram the cars' security systems to accept a generic key, according to The Houston Chronicle. Additionally, Automotive News reports that FCA subsequently updated the terms of use for its DealerCONNECT program. These thefts were not related to the UConnect remote hacks from last year. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. In April, this surveillance video showed the theft of a Jeep Wrangler Unlimited. It was this footage that first led the police to Arcee and Zelay. The police began to follow and record the pair. That investigation eventually led to Friday's arrest. Both are charged with unauthorized use of a motor vehicle. In addition, Arcee is charged with felon in possession of a weapon and possession with intent to deliver a controlled substance. According to ABC 13, Homeland Security is investigating more than 100 stolen FCA vehicles that they believe were hacked using this method. After their theft, the vehicles were brought across the border to Mexico. FCA is currently conducting an internal investigation into the matter. After this article was posted, the company reached out to Autoblog, stating "FCA US takes the safety and security of its customers seriously and incorporates security features in its vehicles that help to reduce the risk of unauthorized and unlawful access to vehicle systems and wireless communications. FCA US has been cooperating with Houston Police Department since they first started the investigation.