2001 Dodge Ram 2500 on 2040-cars

Owenton, Kentucky, United States

Transmission:Manual

Vehicle Title:Clean

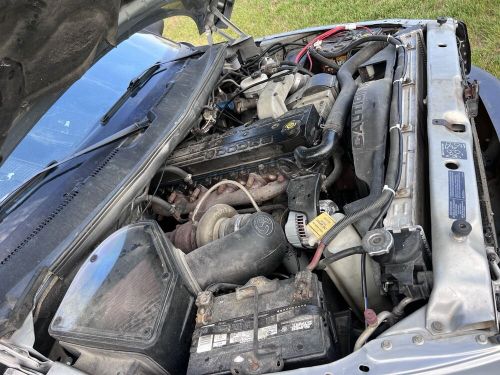

Engine:5.9L Diesel I6

Fuel Type:Diesel

Year: 2001

VIN (Vehicle Identification Number): 1B7KF23601J222441

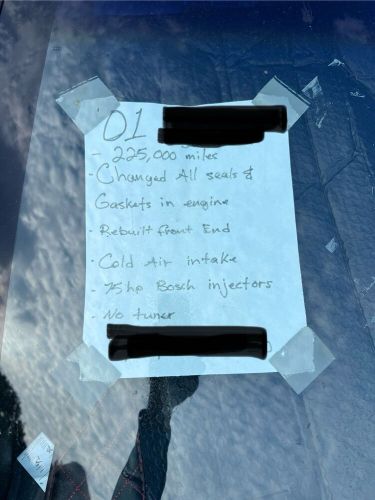

Mileage: 224540

Number of Cylinders: 6

Model: Ram 2500

Exterior Color: Grey

Make: Dodge

Drive Type: 4WD

Dodge Ram 2500 for Sale

2001 dodge ram 2500 5.9l cummins diesel - low miles(US $26,900.00)

2001 dodge ram 2500 5.9l cummins diesel - low miles(US $26,900.00) 2003 dodge ram 2500 b2500(US $19,000.00)

2003 dodge ram 2500 b2500(US $19,000.00) 1999 dodge ram 2500 laramie slt(US $34,500.00)

1999 dodge ram 2500 laramie slt(US $34,500.00) 2000 dodge ram 2500 slt 4dr 4wd extended cab sb(US $28,995.00)

2000 dodge ram 2500 slt 4dr 4wd extended cab sb(US $28,995.00) 2004 dodge ram 2500 slt flatbed w/side guards(US $19,500.00)

2004 dodge ram 2500 slt flatbed w/side guards(US $19,500.00) 2006 dodge ram 2500(US $9,500.00)

2006 dodge ram 2500(US $9,500.00)

Auto Services in Kentucky

Volunteer Auto Parts ★★★★★

Vasquez Auto Sales ★★★★★

United Van & Truck Salvage ★★★★★

Tru-Align Automotive ★★★★★

Tire Discounters Inc ★★★★★

Team Automotive ★★★★★

Auto blog

Is Mopar readying a special-edition Dart for Chicago?

Sat, 26 Jan 2013Chrysler has released the above teaser of a limited-edition Mopar 2013 model that will be unveiled at next month's Chicago Auto Show. Although the automaker doesn't announce what vehicle will get the Mopar treatment, closer investigation of the seats and center console suggest that this car will be a special version of the 2013 Dodge Dart.

This will be the fourth Mopar model in as many years, following on the heels of the Mopar 2010 Challenger, Mopar 2011 Charger and the Mopar '2012 300. There are no details for the Mopar '13 Dart, but we do see that the car will retain the signature black-and-blue color scheme as past Mopar editions. Like these previous models, we expect production of Mopar '13 Dart to be limited to just 500 units.

Scroll down for Chrysler's press release teasing the new Mopar model, and we'll be sure to bring you plenty of live images from the show floor in a couple weeks.

Auto Mergers and Acquisitions: Suicide or salvation?

Tue, Sep 8 2015We love the Moses figure. A savior riding in from stage right with the ideas, the smarts, and the scrappiness to put things right. Alan Mullaly. Carroll Shelby. Lee Iacocca. Andrew Carnegie. Steve Jobs. Elon Musk. Bart Simpson. Sergio Marchionne does not likely view himself with Moses-like optics, but the CEO of Fiat Chrysler Automobiles recently gave a remarkable, perhaps prophetic interview with Automotive News about his interest and the inevitability of merging with a potential automotive partner like General Motors. Marchionne has been overtly public about his notion that GM must merge with FCA. For a bit of context, GM sold 9.9 million vehicles in 2014, posting $2.8 billion in net income, while FCA sold 4.75 million units and earned $2.4 billion in net income, painting a very rosy FCA earnings-to-sales picture. But that's not the entire picture. Most people in the auto industry still remember the trainwreck that was the DaimlerChrysler "merger" written in what turned out to be sand in 1998. It proved to be a master class in how not to fuse two companies, two cultures, two continents, and two management teams. Oh, it worked for the two individuals at both helms pre-merger. They got silly rich. And the industry itself was in a misty romance at the time with mergers and acquisitions. BMW bought Rolls-Royce. Volkswagen Group bought Bentley, Bugatti, and Lamborghini, putting all three brands into their rightful place in both products and positioning. No marriages there, so no false pretense. Finally, Nissan and Renault got married in 1999. A successful marriage requires several rare elements in this atmosphere of gas fumes and power lust. But a successful marriage requires several rare elements in this atmosphere of gas fumes and power lust, the principle part being honesty. Daimler and Chrysler lied to each other. The heads of each unit, the product planners, and finance all presented their then-current and long-range forecasts to each other with less-than-forthright accuracy. Daimler was the far greater equal and no one from the Chrysler side enjoyed that. The cultures were entirely different, too, and little was done to bridge that gap. Which brings me back to the present overtures by Marchionne to GM. "There are varying degrees of hugs," Marchionne stated in the Automotive News piece. "I can hug you nicely, I can hug you tightly, I can hug you like a bear, I can really hug you." Seriously?

Fiat Chrysler dumped 40,000 unordered vehicles on dealers

Thu, Nov 14 2019In a move that echoes recent history, Fiat Chrysler has been making more cars and trucks than dealers in the U.S. are willing to accept, with Bloomberg reporting that at one point the automaker had built up a glut of around 40,000 unordered vehicles. That’s led some dealers to accuse FCA of reviving the dreaded “sales bank” accounting practice of obscuring inventory to improve the balance sheet. The company reportedly began building up its inventory of unordered cars this summer despite an industrywide slowdown in sales and an eagerness by some dealers to thin their inventories because rising interest rates are making it more expensive to hold unsold cars. The inventory build-up also coincided with Fiat ChryslerÂ’s efforts to find a merger partner, first with Renault, which fell through, then last monthÂ’s announcement that it will merge with FranceÂ’s PSA Group. FCA denies any such scheme and tells Bloomberg the rising inventory is down to a new predictive analytics system designed to better square supply with demand from dealers that is helping the company save money and narrow the numbers of unsold vehicles. The company recently agreed to pay a $40 million civil penalty to the U.S. Securities and Exchange Commission to settle a complaint that it paid dealers to report fake sales figures over a span of five years. While no one is suggesting that FCA is in dire financial straits — the company saw higher than expected earnings in the third quarter and record profits in North America — the practice has strong historical precedent by Chrysler, which built up bloated inventories in the run-up to its two federal bailouts, in 1980 and 2009. It was also common at GM and Ford during the 2000s, when all three Detroit automakers struggled with excess manufacturing capacity and plummeting sales in the lead-up to the Great Recession. Back in 2012, CFO Magazine wrote about a report that explained automakersÂ’ rationale for the practice and how it works: Say fixed costs for a given factory are $100, and that the factory can make 50 cars. Consumers, however, demand only 10. Under absorption costing, if the company makes all 50 cars, its cost-per-car is $2. If it makes only up to demand, or 10 cars, the cost-per-car is $10. Although each car adds variable costs for steel and other parts, if those costs are low, the company still has an incentive to make more cars to keep the cost-per-car down.