2004 Dodge Ram 1500 Srt-10 Viper Powered (881 Original Miles) Standard Cab on 2040-cars

Follett, Texas, United States

|

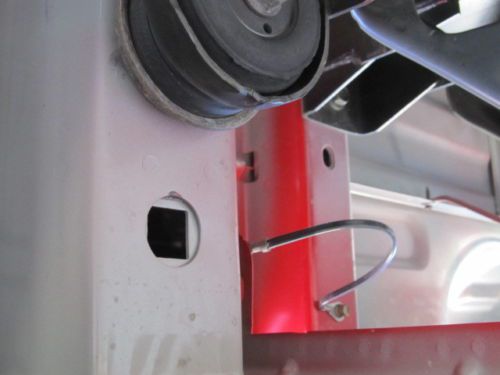

Bidding on an unmolested low mileage(881 original miles) Flame Red 2004 Dodge SRT-10 Viper powered Pickup. It was meticuously maintained by previous owner. Included underbody pictures to show that this is a no excuse pickup. Always had towels on the seats and carpet. You can contact me directly on any questions at (806)653-2115(home) or (806)898-5674(cell). I'm a Texas dealer so any Texas buyers will have to pay texas sales tax and any registration fees. I have this truck advertised so I reserve the right to end the auction early. |

Dodge Ram 1500 for Sale

2005 dodge ram 1500 quad cab 4x4 pickup trucks 4wd hemi truck custom wheels

2005 dodge ram 1500 quad cab 4x4 pickup trucks 4wd hemi truck custom wheels Very nice classic mopar truck....dodge ram. must sell!!! look!!(US $3,899.00)

Very nice classic mopar truck....dodge ram. must sell!!! look!!(US $3,899.00) 2011 dodge ram longhorn crew 4x4 hemi sunroof nav 29k texas direct auto(US $35,980.00)

2011 dodge ram longhorn crew 4x4 hemi sunroof nav 29k texas direct auto(US $35,980.00) 2007 dodge ram1500 quad cab crew-pickup 4x4!! running-boards power-locks 20"whls(US $18,900.00)

2007 dodge ram1500 quad cab crew-pickup 4x4!! running-boards power-locks 20"whls(US $18,900.00) 2013 dodge ram laramie crew 4x4 hemi nav 20" wheels 9k texas direct auto(US $39,780.00)

2013 dodge ram laramie crew 4x4 hemi nav 20" wheels 9k texas direct auto(US $39,780.00) *lifted* must see! free shipping / 5-yr warranty! slt 4wd v8 monster!(US $12,995.00)

*lifted* must see! free shipping / 5-yr warranty! slt 4wd v8 monster!(US $12,995.00)

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

Stellantis will give its brands 10 years to prove they deserve to live

Thu, May 13 2021Formed by the merger of PSA Peugeot-Citroen and Fiat-Chrysler Automobiles, Stellantis has 14 brands under its roof, a number that makes it one of the largest groups in the industry. Rumors claimed not every brand would survive, with Chrysler often earmarked to get axed, but the firm said it will give them all a chance to shine. "We're giving each (brand) a chance, giving each a time window of 10 years and giving funding for 10 years to do a core model strategy. The CEOs need to be clear in brand promise, customers, targets, and brand communications," announced Stellantis boss Carlos Tavares during the Financial Times' Future of the Car event. His comments confirm Chrysler fans and dealers don't need to worry about the future — at least not yet. And, against all odds, Lancia enthusiasts can breathe a sigh of relief, too. Former FCA head Sergio Marchionne warned of the brand's demise on several occasions. Alfa Romeo is safe for now, too, as is Vauxhall, which are basically just Opels sold in the United Kingdom with a different badge. The engagement made by Tavares also means Stellantis won't divest any of its brands to raise capital until at least 2031. It's now up to each executive team to make a case for the brand they run, an unusual survival-of-the-fittest strategy in an era when cutting costs is more common than spending cash. Diving into the vast Stellantis parts bin should help even the most troubled brands turn their fortunes around on a relatively tight budget. It seems likely that survive Chrysler will need to look beyond the 300 and the Pacifica/Voyager, the only models in its range, and completely reinvent its image, which is currently nebulous at best. Lancia, once the champion of luxury, performance, and innovation, faces the same challenge. It's not starting quite from scratch, it's relatively popular in its home country of Italy, but it will need to think globally and expand outside of the city car segment to survive. Featured Gallery 2020 Chrysler 300 View 24 Photos Chrysler Dodge Fiat Jeep RAM Citroen Lancia Opel Peugeot Vauxhall

7 major automakers to build open EV charging network

Wed, Jul 26 2023A new joint venture established by BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz and Stellantis will build a new North American electric vehicle charging network on a scale designed to compete with Tesla's industry-benchmark Supercharger network. The 30,000-plus planned new chargers will accommodate both Tesla's almost-standard North American Charging System (NACS) and existing automakers' Combined Charging System (CCS) options, effectively guaranteeing compatibility with the vast majority of current and upcoming electric models — whether they're from one of the involved automakers or not. "With the generational investments in public charging being implemented on the Federal and State level, the joint venture will leverage public and private funds to accelerate the installation of high-powered charging for customers. The new charging stations will be accessible to all battery-powered electric vehicles from any automaker using Combined Charging System (CCS) or North American Charging Standard (NACS) and are expected to meet or exceed the spirit and requirements of the U.S. National Electric Vehicle Infrastructure (NEVI) program." Critically, the automakers involved will have a say in how the charging tech is implemented, guaranteeing that the hardware will play nicely with each automaker's in-house charging systems. Hyundai and Kia, for example, were hesitant to jump on board the Tesla NACS bandwagon earlier this year over concerns that the Supercharger network is insufficient for powering the two automakers' 800-volt charging systems; similar tech is used by Volkswagen and Porsche. In addition to providing much-needed capacity and high-output charging for America's growing fleet of electric cars and trucks, the new network will integrate seamlessly with each automaker's in-app and in-vehicle features, rather than forcing customers to use third-party tools and payment systems, as is the case with some existing public charging infrastructure. "The functions and services of the network will allow for seamless integration with participating automakersÂ’ in-vehicle and in-app experiences, including reservations, intelligent route planning and navigation, payment applications, transparent energy management and more. In addition, the network will leverage Plug & Charge technology to further enhance the customer experience," the announcement said.

Chrysler recalls 112k family-haulers over airbag controllers

Sun, Feb 7 2016The Basics: Chrysler has issued a recall for an array of minivans and crossovers manufactured in 2007 and 2008. The models affected include the 2009 Dodge Journey, 2008-09 Dodge Grand Caravan, and 2008-09 Chrysler Town and Country. The 2009 Volkswagen Routan, which was manufactured by Chrysler, is also being recalled by FCA. The automaker estimates that 112,001 units in the United States are affected, all told. The Problem: Corrosion in the air bag control unit could prevent the air bags from deploying in the event of a crash, or alternatively deploy prematurely. Chrysler points out that "none of the affected vehicles are equipped with ammonium-nitrate inflators" like those fitted by Takata. Injuries/Deaths: The manufacturer reports seven minor injuries (but no accidents) potentially related to this issue. The fix: Chrysler will replace the air bag control unit, though it has not yet outlined a timeframe for doing so. If you own one: Look for a recall notice in the mail and then schedule service with your local dealership. If you don't receive one, you can contact Chrysler customer service at 1-800-853-1403 and reference recall number S07. Related Video: RECALL Subject : Air Bag Control Unit Power Supply Corrosion Report Receipt Date: JAN 29, 2016 NHTSA Campaign Number: 16V047000 Component(s): AIR BAGS Potential Number of Units Affected: 112,001 Manufacturer: Chrysler (FCA US LLC) SUMMARY: FCA US LLC (Chrysler) is recalling certain model year 2009 Dodge Journey vehicles manufactured December 31, 2007, to August 31, 2008, 2008-2009 Dodge Grand Caravan and Chrysler Town and Country vehicles manufactured June 18, 2007, to August 31, 2008, and 2009 Volkswagen Routan vehicles manufactured August 11, 2008, to August 31, 2008. In the affected vehicles, the air bag control units may corrode and fail. CONSEQUENCE: If the air bag control unit fails, the air bags may not deploy in the event of a crash, increasing the risk of occupant injury. Additionally, the air bags may inadvertently deploy, increasing the risk of a crash. REMEDY: Chrysler will notify owners, and dealers will replace the air bag control unit, free of charge. The manufacturer has not yet provided a notification schedule. Owners may contact Chrysler customer service at 1-800-853-1403. Chrysler's number for this recall is S07. NOTES: Owners may also contact the National Highway Traffic Safety Administration Vehicle Safety Hotline at 1-888-327-4236 (TTY 1-800-424-9153), or go to www.safercar.gov.