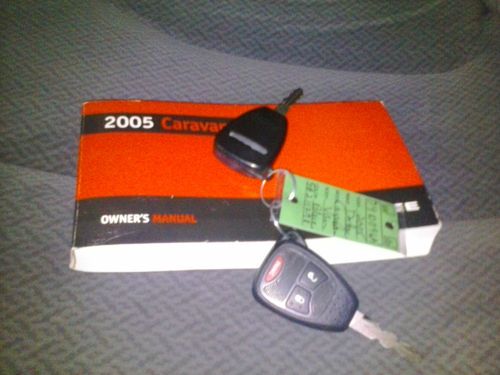

2005 Dodge Grand Caravan Se Mini Passenger Van 4-door 3.3l on 2040-cars

Sunbury, Ohio, United States

Body Type:Mini Passenger Van

Engine:3.3L 3301CC 201Cu. In. V6 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Dealer

Interior Color: Gray

Make: Dodge

Number of Cylinders: 6

Model: Grand Caravan

Trim: SE Mini Passenger Van 4-Door

Warranty: Vehicle has an existing warranty

Drive Type: FWD

Mileage: 148,498

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: SE

Exterior Color: Blue

Dodge Grand Caravan for Sale

2006 dodge grand caravan sxt mini passenger van 4-door 3.8l(US $5,600.00)

2006 dodge grand caravan sxt mini passenger van 4-door 3.8l(US $5,600.00) 2005 dodge grand caravan se mini passenger van 4-door 3.3l

2005 dodge grand caravan se mini passenger van 4-door 3.3l Expres 3.6l power steering power door locks power windows tachometer

Expres 3.6l power steering power door locks power windows tachometer No reserve auction! highest bidder wins! come see this beautiful, clean minivan!

No reserve auction! highest bidder wins! come see this beautiful, clean minivan! 2014 avp/se new 3.6l v6 24v fwd

2014 avp/se new 3.6l v6 24v fwd 2011 expres used 3.6l v6 24v automatic fwd

2011 expres used 3.6l v6 24v automatic fwd

Auto Services in Ohio

Williams Auto Parts Inc ★★★★★

Wagner Subaru ★★★★★

USA Tire & Auto Service Center ★★★★★

Toyota-Metro Toyota ★★★★★

Top Value Car & Truck Service ★★★★★

Tire Discounters Inc ★★★★★

Auto blog

Fiat Chrysler recalls 320,000 Dodge Darts that could roll away

Fri, Apr 19 2019WASHINGTON — Fiat Chrysler Automobiles NV said Friday it is recalling more than 320,000 Dodge Dart compact cars in North America that could roll away because of a defective part that could allow the shift cable to detach from the transmission. The Italian-American automaker said the recall covers 2013 through 2016 model year automatic transmission Dart cars and that the defect could prevent drivers from shifting vehicles into park. The company said it is not aware of any crashes or injuries related to the issue but has several thousand reports of related repairs to vehicles. The company said a cable bushing may degrade after prolonged exposure to high ambient heat and humidity. The company said owners should make sure they shut off the vehicle and engage the parking brake. Fiat Chrysler will replace the transmission side shifter cable bushing, the company said. The company did not said when repairs will be ready. The recall covers about 298,000 U.S. vehicles, 20,117 in Canada, 3,400 in Mexico and about 900 outside of North America. Fiat Chrysler ended production of the Dart in 2016. FCA has had a number of recalls over shifter problems in recent years. Some 1.5 million Ram trucks were recalled in 2017 for a shifter problem, and another 228,000 were recalled in 2018. And 1.1 million Chrysler, Dodge and Jeep models were recalled in 2016 over what the National Highway Traffic Safety Administration called an "unintuitive" shifter design that caused drivers to exit their vehicles thinking they were in Park when in reality they were still in Drive or Reverse. The shifter in Dodge Chargers, Chrysler 300s and Jeep Grand Cherokees was implicated in more than 120 accidents, more than 40 injuries, and in the death of "Star Trek" actor Anton Yelchin.

Mopar updates owner apps to make car ownership easier

Wed, Jun 3 2015Owners of any Fiat Chrysler vehicle will want to head to the Apple App or Google Play store to download the latest version of their brand-specific smartphone app. Developed by Mopar, the new suite of FCA Owner apps specific to each brand pack a number of valuable features. For starters, the apps let owners access information like maintenance schedules, service history and recall notices. The apps also include an array of how-to information and instructional videos, offer push notification for important updates like maintenance offers and recall alerts, and allow customers to schedule test drives and receive quotes from their local dealers for new vehicles. But that's just the tip of the proverbial iceberg. The FCA Owner apps also feature an augmented reality function that helps drivers identify instrument-panel icons. There's a Parking Reminder feature that helps drivers remember where they parked their car, guides them back to their parking spot and tracks the time left on the meter. Finally, there's an Accident Assistant feature that helps drivers record the specifics of an accident, upload insurance information and take photos of the scene. It'll even help find the closest certified collision repair facility, schedule an appointment and access roadside assistance. The apps are available for any Chrysler, Dodge, Ram, Jeep, Fiat or Alfa Romeo built from 2011 till today, and are available for either iOS or Android. If you've got more than one FCA vehicle in your garage, you needn't download multiple versions of the app as they'll work on any model the Italian-American automaker offers. Mopar Enhances FCA Owner Apps - Redesigned FCA Owner apps offer a wide range of VIN-specific information - Owners can access maintenance schedules, service history, recall notices and more - "Augmented reality" function, beginning with 2015 models, allows owners to use camera feature on mobile devices to scan and identify instrument panel icons - Industry-first Accident Assistant feature helps owners easily document important accident information and quickly locate a certified repair facility - Individual brand versions of the app support all FCA brand vehicles - FCA Owner apps are free to download for both iOS and Android mobile devices May 29, 2015 , Auburn Hills, Mich. - The Mopar brand has redesigned and enhanced its suite of FCA Owner apps, putting more resources than ever at owners' fingertips with easier access to vehicle and lifestyle information.

2019 Dodge Challenger, Charger salute troops with Stars and Stripes Edition

Thu, Apr 11 2019For the New York Auto Show, Dodge is showing off a new style package for the 2019 Dodge Challenger and Charger that goes by the name Stars and Stripes. As you may have guessed, the new package is military-themed as a salute to American troops. And since Dodge claims the Challenger and Charger have more active military buyers than any other car in their respective segments, this seems like a good move. What makes the Stars and Stripes models unique starts with a black and silver center stripe along with black wheels, badging, and American flag fender decals. Cars with four-piston Brembo brake calipers get the calipers painted in bronze. This matches the interior, which is finished in black cloth with bronze stitching everywhere from the steering wheel to the door panels. The finishing touches are bronze embroidered stars on the seats. The whole package is available on Scat Pack and R/T versions of the Challenger and Charger, plus the Challenger GT and the Charger GT RWD. It also adds $1,995 to the base price of each car. Besides the Stars and Stripes package, Dodge has expanded availability of two other packages. The first is the Painted Satin Black Appearance Package, which was initially exclusive to the Demon and Challenger Hellcat, but will now be available on the Charger Hellcat. It adds a hand-painted hood, roof, trunk and spoiler to the car and runs $3,450. The other package is the Brass Monkey Package. It's now available on Challenger and Charger Scat Pack, R/T and Challenger GT and Charger GT RWD models. It adds bronze-painted 20-inch wheels, satin black badging, fuel door lid and spoiler, and it costs $795.