Sport Quad Cab 4x4 And Free Shipping on 2040-cars

Romney, West Virginia, United States

|

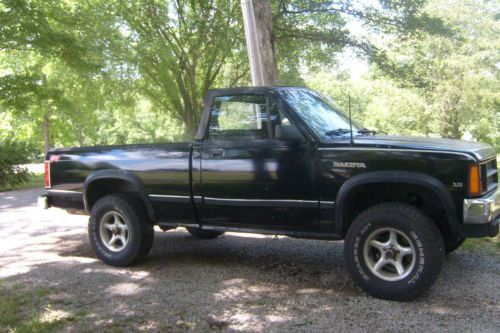

Hello, Here to sell my truck everything is in good condition, matched color truck cap seen picture, DVD/TV on ceiling seen picture, all 4 tires in good condition about 75% tread left, inside looked good, truck body looked good but has some starches and small dent, engine and transmission in good condition still run strong, been replaced transfer case, and only thing wrong with truck is brake and abs light on dash board stay on but all brake still good condition just electrical or brake senor issue whatever it is which Is not big deal. I'm offer truck for $ 6,500 dollars with free shipping up to 250 miles. feel free ask me any question and Thank you ! GOOD LUCK ! |

Dodge Dakota for Sale

970 506 9777 2010 dodge dakota v8 1 owner topper low miles automatic 970 5069777

970 506 9777 2010 dodge dakota v8 1 owner topper low miles automatic 970 5069777 --!!*forced to sell*!!-- 2002 dodge dakota sport quad-cab(US $2,300.00)

--!!*forced to sell*!!-- 2002 dodge dakota sport quad-cab(US $2,300.00) 1998 dodge dakota base standard cab pickup 2-door 2.5l

1998 dodge dakota base standard cab pickup 2-door 2.5l 1989 dodge dakota sport convertible pickup

1989 dodge dakota sport convertible pickup 2002 dodge dakota crew cab 4x4 wrecked salvage damaged junk title(US $1,300.00)

2002 dodge dakota crew cab 4x4 wrecked salvage damaged junk title(US $1,300.00) 2003 dodge dakota r/t extended cab pickup 2-door 5.9l(US $7,500.00)

2003 dodge dakota r/t extended cab pickup 2-door 5.9l(US $7,500.00)

Auto Services in West Virginia

Valley Collision Repair Inc ★★★★★

S & M Auto Repair ★★★★★

Ohio Valley Tire ★★★★★

I-77 Ford ★★★★★

Felouzis Auto Repair ★★★★★

Atkins Transmission & Auto ★★★★★

Auto blog

Dodge Hellcat orders on hold due to 'unprecedented demand'

Sun, Mar 15 2015Want to get your hands on a 707-horsepower Dodge Challenger or Charger Hellcat to call your very own? We don't blame you, and you're not alone. According to Motor Authority and confirmed by a spokesperson from Chrysler, Dodge has gotten so many orders for its stable of Hellcats that it simply cannot keep up with demand: "Due to unprecedented demand for the 2015 Dodge Charger and Challenger SRT Hellcats, we are temporarily restricting orders while we validate current orders that are in the system." Put another way, if you're waiting for a Hellcat, your wait is likely to be a lot longer than you'd like. We've reached out to Chrysler to find out how long it might take for a new customer to get a new Hellcat, and we'll update if and when we hear back. Related Video: Featured Gallery 2015 Dodge Challenger SRT Hellcat View 88 Photos News Source: Motor Authority Chrysler Dodge Car Buying Ownership Coupe Performance Sedan dodge hellcat dodge challenger hellcat dodge charger hellcat autoblog black

2015 Dodge Charger configurator opens up shop

Thu, Dec 11 2014Itching to get your hands on a new 2015 Dodge Charger? Your day is almost nigh, my friend While you're waiting, you can spec out how you'd want your muscle sedan to look as Dodge has included the revised four-door in its online configuration tool. Though it's not the most impressive or interactive of configurators we've seen, the site lets you choose any color you want (from the limited array available anyway) along with all the key options packages and such. First you'll need to choose a trim level though, but we're afraid the Hellcat version isn't part of this site, and the SRT site hasn't launched a configurator yet for the world's fastest production sedan, so you'll have to choose between SE, SXT and R/T trim levels. Related Video:

Gas prices down, 707-hp engine production up... USA!

Tue, Jun 30 2015On Saturday, the United States of America will celebrate its 239th birthday. That means fireworks, barbecues, block parties, and, oh yeah, Hellcat engines and low fuel prices. The most American of (Mexican-built) powerplants, the big, loud, supercharged, 707-horsepower Hemi is slated for yet another production boost to match up with some serious demand, while the dino juice it runs on is cheaper than it's been in over half a decade. The Saltillo, Mexico engine factory already produces some 4,000 Hellcat engines each year – that's in addition to the Tigershark four-cylinder, the 5.7-liter Hemi, and 6.4-liter SRT Hemi V8s – and it's not entirely clear how many more might get added to that total. What we do know, though, is that Fiat Chrysler can't build the engines fast enough. "We're going to build more [Hellcats] for 2016," SRT boss Tim Kuniskis told Automotive News. "It's a small sliver of what we sell, but it really creates a halo for the rest of the lineup. For example, the next highest car, the Scat Pack Challenger, I have essentially a zero-day supply. It's sold out." This bit of good news comes on the back of something equally good – low summer gas prices. According to the US Energy Information Administration, the nationwide average for for "all formulations" of fuel in June sits at $2.885. Ignoring the remarkably low prices we saw in January and February of this year – figures that themselves hadn't been seen since May of 2009 – the national average hasn't sat that low since October 2010. So yes, it's a very a good time to be an American gearhead. News Source: Automotive News - sub. req., US Energy Information AdministrationImage Credit: US EIA Green Plants/Manufacturing Dodge Fuel Efficiency Coupe Performance Sedan dodge challenger srt tim kuniskis dodge charger srt