2014 Dodge Charger R/t on 2040-cars

15502 Manchester Rd, Ellisville, Missouri, United States

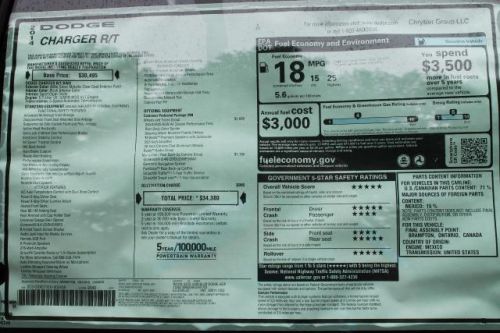

Engine:5.7L V8 16V MPFI OHV

Transmission:5-Speed Automatic

VIN (Vehicle Identification Number): 2C3CDXCT1EH303439

Stock Num: D79047

Make: Dodge

Model: Charger R/T

Year: 2014

Exterior Color: Billet Silver Metallic Clearcoat

Interior Color: Black

Options: Drive Type: RWD

Number of Doors: 4 Doors

Hurry in today! We'll have the keys waiting for you! PLEASE CALL TOLL FREE 877-452-3007 FOR DETAILS. WHEN YOU COME IN, PLEASE BE SURE TO ASK FOR INTERNET SALES TO RECEIVE YOUR INTERNET DISCOUNT. WE OFFER A WARRANTY ON ALL VEHICLES. CALL US FOR MORE DETAILS!

Dodge Charger for Sale

2014 dodge charger r/t

2014 dodge charger r/t 2010 dodge charger sxt(US $14,485.00)

2010 dodge charger sxt(US $14,485.00) 2010 dodge charger sxt(US $14,497.00)

2010 dodge charger sxt(US $14,497.00) 2014 dodge charger sxt

2014 dodge charger sxt 2010 dodge charger base(US $15,987.00)

2010 dodge charger base(US $15,987.00) 2006 dodge charger r/t(US $12,994.00)

2006 dodge charger r/t(US $12,994.00)

Auto Services in Missouri

Wodohodsky Auto Body ★★★★★

West County Nissan ★★★★★

Wayne`s Auto Body ★★★★★

Superior Collision Repair ★★★★★

Superior Auto Service ★★★★★

Springfield Transmission Inc ★★★★★

Auto blog

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN — Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 — possibly by the end of June — and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Germany threatens to ban FCA vehicles over diesel emissions dispute

Tue, May 24 2016Germany is threatening to ban sales of FCA products over diesel emissions. According to the newspaper Bild Am Sonntag, Germany's Federal Motor Transport Authority found evidence of a so-called defeat device that shuts down certain emissions controls after running for 22 minutes. A standard diesel emissions test in the European Union reportedly takes 20 minutes to complete. FCA denies the allegations. "We believe all our vehicles respect EU emissions standards and we believe Italian regulators are the competent authority to evaluate this," the company said in a statement. The latter part of that statement drew ire from German authorities, especially after FCA declined to meet with German transport minister Alexander Dobrindt to discuss the issue. Graziano Delrio, the Italian Minister of Infrastructure and Transport, vowed to work with German authorities on behalf of FCA. According to EU law, FCA is required to homologate its vehicles in Italy because that's where its regional operations are based. When will the diesel-scented soap opera end? We wish we knew, but our Magic 8 Ball is covered in soot. Related Video: News Source: Financial TimesImage Credit: Giuseppe Aresu/Bloomberg via Getty Government/Legal Green Chrysler Dodge Fiat Jeep RAM Emissions Diesel Vehicles FCA

China-FCA merger could be a win-win for everyone but politicians

Tue, Aug 15 2017NEW YORK — Fiat Chrysler boss Sergio Marchionne has said the car industry needs to come together, cut costs and stop incinerating capital. So far, his words have mostly fallen on deaf ears among competitors in Europe and North America. But it appears Marchionne has finally found a receptive audience — in China. FCA shares soared Monday after trade publication Automotive News reported the $18 billion Italian-American conglomerate controlled by the Agnelli family rebuffed a takeover from an unidentified carmaker from the Chinese mainland. As ugly as the politics of such a combination may appear at first blush, a transaction could stack up industrially, and perhaps even financially. A Sino-U.S.-European merger would create the first truly global auto group. That could push consolidation to the next level elsewhere. Moreover, China is the world's top market for the SUVs that Jeep effectively invented, so it might benefit FCA financially. A combo would certainly help upgrade the domestic manufacturer; Chinese carmakers have gotten better at making cars, but struggle to build global brands, and they need to develop export markets. Though frivolous overseas shopping excursions by Chinese enterprises are being reined in by Beijing, acquisitions that support the modernization and transformation of strategic industries still receive support, and the government considers the automotive industry to be strategic. A purchase of FCA by Guangzhou Automobile, Great Wall or Dongfeng Motors would probably get the same stamp of approval ChemChina was given for its $43 billion takeover of Syngenta. What's standing in the way? Apart from price (Automotive News said FCA's board deemed the offer insufficient) there's the not-insignificant matter of politics. Even as FCA shares soared, President Donald Trump interrupted his vacation to instruct the U.S. Trade Representative to look into whether to investigate China's trade policies on intellectual property. Seeing storied Detroit brands like Jeep, Chrysler, Ram and Dodge handed off to a Chinese company would provoke howls among Trump's economic-nationalist supporters. It might not play well in Italy, either, to see Alfa Romeo and Maserati answering to Wuhan instead of Turin — though Automotive News said they might be spun off separately. Yet, as Morgan Stanley observes, "cars don't ship across oceans easily," and political considerations increasingly demand local manufacture of valuable products.