2011 Dodge Challenger Srt-8 392 Hemi. 6 Speed Manual. 1 Owner Clean History. on 2040-cars

Fort Lauderdale, Florida, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:6.4L 6424CC 392Cu. In. V8 GAS OHV Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Make: Dodge

Model: Challenger

Warranty: Unspecified

Trim: SRT8 Coupe 2-Door

Options: Sunroof, Leather Seats, CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 32,436

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: 2dr Cpe SRT8

Exterior Color: Gray

Interior Color: Gray

Vehicle Inspection: Inspected (include details in your description)

Number of Cylinders: 8

Number of Doors: 2

Dodge Challenger for Sale

New 2014 dodge challenger r/t classic - plum crazy(US $33,800.00)

New 2014 dodge challenger r/t classic - plum crazy(US $33,800.00) 2010 r/t 5.7l pink

2010 r/t 5.7l pink 2010 detonator yellow dodge challenger srt8 coupe 2-door 6.1l hemi(US $31,327.00)

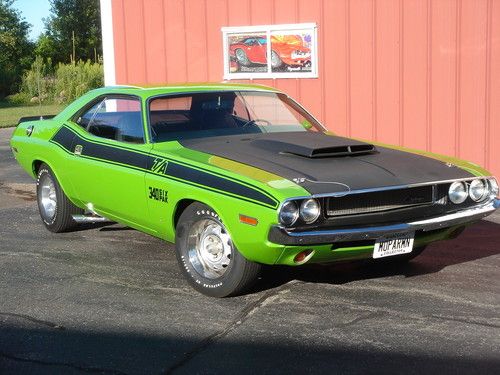

2010 detonator yellow dodge challenger srt8 coupe 2-door 6.1l hemi(US $31,327.00) Rare sassy grass, ta, original paint, survivor, #'s match, 4spd, owner history(US $79,777.00)

Rare sassy grass, ta, original paint, survivor, #'s match, 4spd, owner history(US $79,777.00) Dodge coronet super bee matching# 383 magnum,4speed,ramcharger,eb5 bright blue(US $34,900.00)

Dodge coronet super bee matching# 383 magnum,4speed,ramcharger,eb5 bright blue(US $34,900.00) 1971 dodge challenger

1971 dodge challenger

Auto Services in Florida

Yesterday`s Speed & Custom ★★★★★

Wills Starter Svc ★★★★★

WestPalmTires.com ★★★★★

West Coast Wheel Alignment ★★★★★

Wagen Werks ★★★★★

Villafane Auto Body ★★★★★

Auto blog

Is America's last cheap minivan worth it?

Wed, Dec 16 2015Take a good look at this beauty. Because once she's gone there may be no turning back. The minivan market has been completely decimated over the past fifteen years. I could list all the former brands (dead and alive) that once formed the lynchpin of parenthood for this inherently conservative market. But that would involve at least fourteen commas, three sets of parentheses, and possibly even one 2000s-style recount. Back then, middle-class America loved these people-movers and even the well-to-do were glad to load them up with unique luxuries such as power sliding doors, captain's chairs, integrated child seats, and DVD players that entombed cacophonous kids into a temporary silence. Back in the '90s, the minivan market regularly realized well over a million sold units a year. In 2000, minivans finally hit their familial peak of 1.4 million vehicles in a year with the help of two top-20 bestsellers: the Dodge Grand Caravan and Chrysler Town & Country. Today the minivan just isn't popular. This year it'll likely represent only a half-million in annual sales, with not a single minivan hitting America's top 30 in overall volume. But as I always tell folks, "If you want a deal, you have to hit 'em where they ain't." So you want a cheap and affordable minivan for cash money that isn't a 15-year-old Plymouth in purple? Does it have to be new? Really? Well, if you're married to that type of person, this Grand Caravan with the American Value Package is the cheapest thing going. Deals can also be had on the mini-minivan Mazda5, but since it's been discontinued due to low demand, let's focus on the still-popular Chrysler minivan. The cost for this 2016 Dodge Grand Caravan according to TrueCar is right around $19,500 depending on where you live in the USA. But let's take a look at the 2015 models instead since they tend to have even stronger discounts during the wintertime thanks to manufacturers and dealers who are busy shoveling out all this older inventory. If you opt for a 2015 model instead, you're looking at a market price right around $17,800 and luckily these minivans are still sitting in multitude. Wanna click those rebate and incentive buttons? If you currently lease or finance a FIAT or Chrysler product, have AAA coverage, and finance the car with FCA, you can make off like the proverbial bandit for a price of only $15,229 before the dealer inflicts their bogus fee money dance.

Bob Bondurant driving school closes a month after entering Chapter 11

Tue, Nov 13 2018On Oct. 2, the Bob Bondurant School of High Performance Driving filed for Chapter 11 bankruptcy protection. In its filing, the 50-year-old racing school said it owed between 50 and 99 creditors an amount between $1 million and $10 million, and had $1 million to $10 million. The school released a statement at the time saying, "Our plan is to emerge from this process as a stronger company and continue to drive this company into the next 50 years." Instead, on Monday, Nov. 12, the Chandler, Arizona-based facility closed its doors with no official explanation. On top of its classes for aspiring racers, law enforcement authorities, and general population students, Bondurant has been the official driving school for Dodge SRT vehicles since 2015. Over the past two years, Dodge has included a one-day training course for any SRT buyers and lessees, redeemable within a year after finalizing the deal for the vehicle. To read the tale of one Hellcat owner at the Hellcat.org forum, even the school's instructors didn't see the closure coming. Forum member Av62nv arrived at Bondurant Monday to start his four-day experience. After a lengthy pause in the middle of the day, Av62nv wrote that the instructor walked in and told the class, "Sorry guys, don't know how to say this, but as some may know the school is in Chapter 11 bankruptcy, and it looks like 7 now. We are closed." Another poster in the forum, CubeMan, wrote that "Technicians and staff loaded their toolboxes, and paychecks have apparently bounced." Apparently family scion Jason Bondurant arrived and tried to explain; the short of it was that the good thing had come to an abrupt end, but there was "a chance it could come back." Other posters in the forum noted how they have reservations as far out as June 2019, or haven't been able to get to their classes yet because of delivery delays with their SRT cars, and have no idea what's happening. The website is still up, but a Bondurant spokesman confirmed the closure to Classic Cars, and a note on the school door reads, "School is closed. Direct all inquiries to Pat Bondurant." Pat is Bob Bondurant's wife, who married the former race driver in 2010 at the Monaco Grand Prix. A month ago, Bondurant's Chapter 11 bankruptcy statement said, "We will continue operating and serving our students and corporate groups as usual while we develop new business relationships to ensure the vitality of the company in the future." Obviously, that won't happen.

Chrysler slows minivan production, hasn't built VW Routan this year

Wed, 13 Mar 2013Chrysler has slowed production of its Town and Country and Dodge Grand Caravan minivans this week, Automotive News reports. The Windsor, Ontario plant will cut its three shifts from eight hours each to four hours each in an effort "to align production with market demand," a Chrysler spokesperson told AN. Chrysler also builds the closely related Routan minivan for Volkswagen at its Ontario facility, but has not built a single example thus far in 2013.

Sales of Chrysler's minivans fell 15 percent for the first two months of 2013, and a large part of that has to do with the 26-percent drop of the Grand Caravan alone (the T&C was only down by one percent). According to Automotive News data, as of March 1, Chrysler had an unsold inventory of 24,713 Town and Country models and 18,547 Grand Caravans - a 69- and 43-day supply, respectively.

"No sense running full speed now, then have a lot of vehicles sitting around a few months down the line," Chrysler spokeswoman Jodi Tinson told AN. Full production is expected to resume again on March 18.