Silver Black One Owner Finance Wheels Power Leather Cruise Dvd Sirius Mp3 Camera on 2040-cars

Temple Hills, Maryland, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

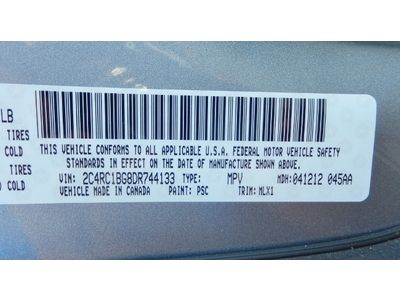

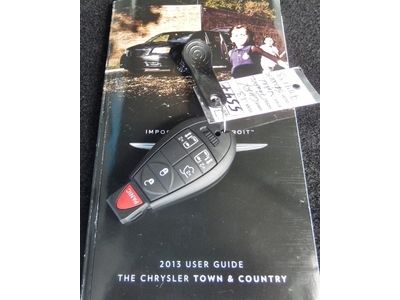

Make: Chrysler

Warranty: Vehicle has an existing warranty

Model: Town & Country

Mileage: 16,278

Options: Leather Seats

Sub Model: Touring

Safety Features: Side Airbags

Exterior Color: Silver

Power Options: Power Windows

Interior Color: Black

Number of Cylinders: 6

Vehicle Inspection: Inspected (include details in your description)

Chrysler Town & Country for Sale

2003 chrysler town and country lxi handicap wheelchair van "super clean"(US $11,500.00)

2003 chrysler town and country lxi handicap wheelchair van "super clean"(US $11,500.00) 2003 chrysler town & country lx mini van fwd no reserve clean carfax

2003 chrysler town & country lx mini van fwd no reserve clean carfax 1 owner-service record-new tires-pwr sliding doors/liftgate-rear air-non smoker!(US $10,986.00)

1 owner-service record-new tires-pwr sliding doors/liftgate-rear air-non smoker!(US $10,986.00) Town and country woody convertible 1948

Town and country woody convertible 1948 2009 touring used 3.8l v6 12v automatic fwd premium(US $17,981.00)

2009 touring used 3.8l v6 12v automatic fwd premium(US $17,981.00) 2000 chrysler town and country lx (great condition) runs great(US $2,995.00)

2000 chrysler town and country lx (great condition) runs great(US $2,995.00)

Auto Services in Maryland

Wiygul Automotive Clinic ★★★★★

Ware It`s At Custom Auto Refinishing ★★★★★

Vehicle Outfitter ★★★★★

Tire World ★★★★★

T & D Automotive Inc ★★★★★

S A Best Tires Inc ★★★★★

Auto blog

Lee Iacocca, Chrysler's savior and godfather of the Mustang, dies at 94

Wed, Jul 3 2019Lee Iacocca, a charismatic U.S. auto industry executive and visionary, who gave America the Ford Mustang and Chrysler minivan, and was celebrated for saving Chrysler from going out of business, died at the age of 94, the Washington Post reported. He died Tuesday at his home in Bel-Air, California of complications from Parkinson's disease, his daughter Lia Iacocca Assad told the Post. During a nearly five-decade career in Detroit that began in 1946 at Ford Motor Co, the proud son of Italian immigrants made the covers of Time, Newsweek and the New York Times Sunday Magazine in stories portraying him as the avatar of the American Auto Age. One of the first celebrity U.S. chief executives, his autobiography made best-seller lists in the mid-1980s. Iacocca was a cracker-jack salesman. He encouraged his design teams to be bold, and they responded with sports cars that appealed to baby boomers in the 1960s, fuel-efficient models when gasoline prices soared in the 1970s, and the first-ever, family-oriented minivan in the 1980s that led its segment in sales for 25 years. "I don't know an auto executive that I've ever met who has a feel for the American consumer the way he does," late United Auto Workers Union President Douglas Fraser had said. "He's the greatest communicator who's ever come down the pike in the history of the industry." Iacocca also had some duds, such as the Ford Pinto, an economy car that became notorious for exploding fuel tanks. "You don't win 'em all," he said of the Pinto. Iacocca won a place in business history when he pulled Chrysler, now part of Fiat Chrysler Automobiles, from the brink of collapse in 1980, rallying support in U.S. Congress for $1.2 billion in federally guaranteed loans and persuading suppliers, dealers and union workers to make sacrifices. He cut his salary to $1 a year. Iacocca was often described as a demanding and volatile boss who sometimes clashed with fellow executives. "He could get mad as hell at you, and once it was done he let it go. He wouldn't stay mad," said Bud Liebler, vice president of communications at Chrysler during the 1980s and 1990s. "He liked to bring an issue to its head, get it resolved. You always knew where you stood with him." Iacocca often spoke of his immigrant roots and how America rewards hard work.

Fiat Chrysler parts firm Magneti Marelli sold for $7.1B

Mon, Oct 22 2018TOKYO/MILAN — Japan's Calsonic Kansei, owned by U.S. private equity firm KKR, has agreed to buy Fiat Chrysler's Magneti Marelli for 6.2 billion euros ($7.1 billion) to form the seventh-largest independent car parts supplier. The first big deal by FCA's newly-appointed chief executive Mike Manley, who took over in July after the sudden death of long-time boss Sergio Marchionne, creates a company with revenue of 15.2 billion euros ($17.5 billion), the companies said. The newly formed Magneti Marelli CK Holdings is likely to cut costs through synergies and expand its customer base as components makers try to keep up with a shift by carmakers into autonomous driving, connected cars and electric vehicles. "This combination with Calsonic Kansei has emerged as an ideal opportunity to accelerate Magneti Marelli's future growth," Manley said on Monday of the FCA unit, which specializes in lighting, powertrain and high-tech electronics. FCA shares were up 5.2 percent at 0906 GMT as investors welcomed the hefty price tag, which will boost FCA's net cash position and raises expectations of a share buyback. "Getting this transaction completed at the price agreed is a significant early milestone and accomplishment," George Galliers, an analyst at Evercore ISI, said of Manley and his team's ability to match Marchionne's deal-making reputation. Marchionne had set in motion a process to spin off the unit and distribute its shares to FCA shareholders by early 2019, but said in June that FCA would still be "receptive" to an offer. Neither FCA nor its top shareholder, Fiat's founding Agnelli family, will have a stake in the combined business, but FCA said it would enter into a multi-year agreement to secure supplies to its plants and also to maintain operations and staff in Italy. Part of a global expansion KKR bought Calsonic from Nissan and other shareholders in 2016, saying it would help the parts maker, which relies on the Japanese carmaker for most of its sales, to expand globally. Calsonic has been in talks with FCA for months and made an initial 5.8 billion euro bid, sources have said. FCA does not break out earnings for Magneti Marelli, which sits within its components unit alongside robotics specialist Comau and castings firm Teksid. The unit employs around 43,000 people and operates in 19 countries. A takeover of Magneti Marelli had remained elusive as potential bidders were offering too little or were only interested in some parts of the business.

FCA compromises with France, moving Renault merger bid forward

Tue, Jun 4 2019FRANKFURT/PARIS – Renault directors were preparing to review Fiat Chrysler's $35 billion merger offer on Tuesday, after the Italian-American carmaker resolved differences with the French government overnight, three sources said. The compromise on French government influence over a combined FCA-Renault may clear the way for Renault's board to approve a framework agreement beginning the long process of a full merger, unless new issues surface at the meeting. France, Renault's biggest shareholder with a 15% stake, had been pressing for its own guaranteed seat on the new board and an effective veto on CEO appointments. But after late-night talks with FCA Chairman John Elkann, the French government has accepted a compromise that would see it occupy one of four board seats allocated to Renault, balanced by four FCA appointees, the sources said. Renault would also cede one of its two seats on a four-member CEO nominations committee to the French state, they said. Renault, FCA and the French government all declined to comment on the discussions. The same evening that the compromise was was negotiated, activist hedge fund CIAM wrote to the board of Renault to say it "strongly opposed" a planned $35 billion merger with Fiat Chrysler. Calling the deal "opportunistic," the fund said the current deal terms strongly favored Fiat Chrysler and offered no control premium. (Reporting by Arno Schuetze and Laurence Frost; additional reporting by Giulio Piovaccari in Milan and Simon Jessop; editing by Jason Neely and Rachel Armstrong) Government/Legal Chrysler Fiat Mitsubishi Nissan Renault merger