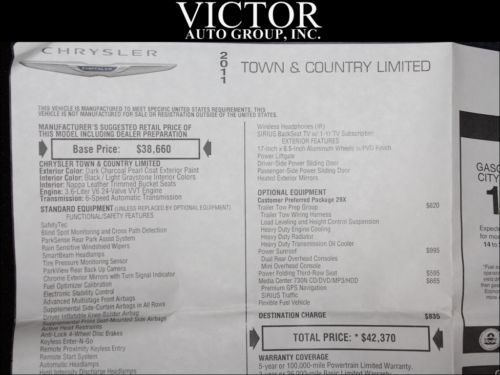

Limited Navigation Sunroof Dvd Entertainment Towing Package Htd Steering Wheel on 2040-cars

Batavia, Illinois, United States

Chrysler Town & Country for Sale

2006 chrysler town & country touring

2006 chrysler town & country touring 2005 linen gold town & country minivan

2005 linen gold town & country minivan 1997 chrysler town & country make best offer

1997 chrysler town & country make best offer 11k one 1 owner miles 2014 chrysler town & country touring rear entertainment

11k one 1 owner miles 2014 chrysler town & country touring rear entertainment Extra clean 2006 chrysler town & country signature series,leather,moon,dvd power(US $6,500.00)

Extra clean 2006 chrysler town & country signature series,leather,moon,dvd power(US $6,500.00) Touring ethanol - ffv 3.6l cd front wheel drive power steering abs luggage rack(US $19,000.00)

Touring ethanol - ffv 3.6l cd front wheel drive power steering abs luggage rack(US $19,000.00)

Auto Services in Illinois

Woodfield Nissan ★★★★★

West Side Tire and Alignment ★★★★★

U Pull It Auto Parts ★★★★★

Trailside Auto Repair ★★★★★

Tony`s Auto & Truck Repair ★★★★★

Tim`s Automotive ★★★★★

Auto blog

Autoblog Minute: New car customer satisfaction down according to latest ACSI report

Wed, Sep 9 2015Customers have spoken and automobile satisfaction is down in 2015. Autoblog's Chris McGraw reports on this edition of Autoblog Minute. Show full video transcript text [00:00:00] Customers have spoken and automobile satisfaction is down in 2015. I'm Chris McGraw and this is your Autoblog Minute. The American Customer Satisfaction Index or ACSI released its updated numbers and according to the survey, new car buyer satisfaction is down for the third straight year. According to an ACSI press release, customer satisfaction with new automobiles has fallen 3.7 percent, to 79 on its 100-point scale. The ACSI report is based on over 4,100 customer surveys collected in the second quarter of 2015 Sitting at the top of the industry in customer satisfaction is Toyota's Lexus brand with a score of 84. Which was good enough to dethrone Mercedes-Benz, which fell 3% to a score of 83. Of the Big Three, Ford was the only domestic automaker to maintain overall customer satisfaction with its score of 81. General Motors slipped 3% to 79 and Fiat Chrysler had a 5% drop, registering a score of 75 out the possible 100. What's driving this trend of customer dissatisfaction? ASCI points to the rise in recalls and car prices. Where do you land on customer satisfaction spectrum? Sound off in the comments with your thoughts on the current state of car ownership and brand quality. For Autoblog, I'm Chris McGraw. Autoblog Minute is a short-form video news series reporting on all things automotive. Each segment offers a quick and clear picture of what's happening in the automotive industry from the perspective of Autoblog's expert editorial staff, auto executives, and industry professionals. Chrysler Fiat Ford GM Lexus Mercedes-Benz Car Buying Ownership Autoblog Minute Videos Original Video

The Plug-In Hybrid Chrysler Pacifica | Translogic 212

Thu, Dec 15 2016Unless you've been living under a rock, you probably know that minivans have a bit of a rep for being uncool. The poor minivan has been relegated to that of a tool solely intended to get kids to and from soccer games. Here at Autoblog, we're already proponents of the minivan for its incredibly utility and under-the-radar, nearly hipster-like ironic coolness. This year, the good folks at Chrysler are working to change the soccer-mom stereotype by giving its people-hauler a much needed injection of style, lots of new tech, and a plug-in hybrid option in the form of the new Pacifica. Translogic host Jonathon Buckley sat down with Matt McAlear, Senior Manager of Chrysler Brand Product Marketing to discuss how Chrysler went from inventing the segment all the way back in 1984 to reinventing it in 2016. Matt explains that not only is the Pacifica "...the first hybrid in the minivan segment," but it's alsm one of the most functional hybrids available. With room for 7 passengers plus cargo and 30 miles of all-electric range, the features on the van are nothing to scoff at. After the chat, Bucko takes the minivan to someone who will be able to appreciate it even more than him, a mom of two. Click here to find more episodes of Translogic Click here to learn more about our host, Jonathon Buckley

Chrysler shows off new 'Synthesis' cockpit demonstrator at CES

Wed, Jan 4 2023As auto enthusiasts, we get used to seeing vehicle exteriors teased endlessly while interiors often remain under wraps until the very last second. And then once a year, CES happens and our focus shifts briefly to glimpses of arguably the single most important part of a car for most drivers: the many touch points between man and machine. Chrysler will be among those offering in-person demonstrations of its vision for future tech, and in this case, a little bit more. Chrysler says it will be the standard-bearer for the company's forthcoming AI-based technologies that can both adapt to driver preferences and automate certain functions — up to and including driving. Chrysler is calling it "Advanced Technology For Real Life" and says it will "create smooth, efficient and connected experiences between the customer and the vehicle." This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Chrysler Synthesis Cockpit Demonstrator at CES 2023 The demonstrator itself shows off the next generation of interior materials ("vegetable-tanned, suspended seats wrapped with an arctic upcycled chrome-free soft trim embellished by a unique constellation-style perforation") and design themes. Chrysler calls it "Harmony in Motion," but rest assured that it will remain stationary for all of its demonstrations. Its simulation is meant to represent a day in the life of a typical owner. It optimizes the day's drive routes, coordinates with other smart ecosystems (home, phone, etc.) and even takes the wheel to allow for multi-tasking (simulating level 3 self-driving). Check it out at Chrysler's booth starting tomorrow, Jan. 5. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Chrysler Unveils Airflow Concept