2014 Chrysler Town & Country S on 2040-cars

701 S Main St, High Point, North Carolina, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

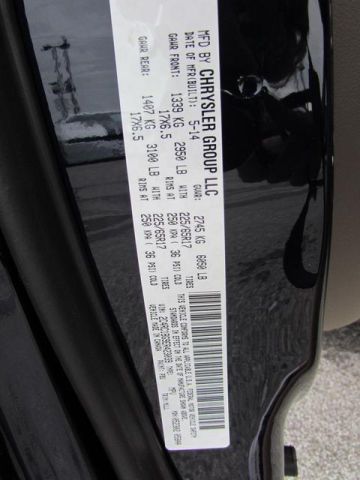

VIN (Vehicle Identification Number): 2C4RC1HG4ER194972

Stock Num: 1821

Make: Chrysler

Model: Town & Country S

Year: 2014

Exterior Color: Brilliant Black Crystal Pearlcoat

Interior Color: Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Full of comfort and space in this all new 2014 Chrysler Town and Country S! Equipped with, Black Leather-Trimmed Seats with Cloth Insert, ParkView Rear Back-up Camera, Dual DVD / Blu-Ray Entertainment, Second-Row Overhead 9-Inch VGA Video Screen, Third-Row Overhead 9-Inch VGA Video Screen, Uconnect 430N CD/DVD/MP3/HDD/NAV, SiriusXM Satellite Radio, Bluetooth Streaming Audio, 6.5-Inch Touch Screen Display, All Power Features, 17-Inch x 6.5-Inch Painted Black Wheels, and Premium Fog Lamps! Family owned and operated for 87 years. Visit our store today, you will see that we deliver the best dealership experience you have ever had. New vehicle prices include Factory incentives and rebates for SEBC (VA, NC, SC, GA, FL), RAM Trucks and Chrysler 200s (except convertibles) include $500 Chrysler Capital Financing. On approved credit

Chrysler Town & Country for Sale

2014 chrysler town & country touring-l(US $34,732.00)

2014 chrysler town & country touring-l(US $34,732.00) 2014 chrysler town & country touring-l(US $36,450.00)

2014 chrysler town & country touring-l(US $36,450.00) 2014 chrysler town & country s(US $34,950.00)

2014 chrysler town & country s(US $34,950.00) 2014 chrysler town & country touring(US $33,050.00)

2014 chrysler town & country touring(US $33,050.00) 2014 chrysler town & country touring(US $33,285.00)

2014 chrysler town & country touring(US $33,285.00) 2014 chrysler town & country s(US $34,950.00)

2014 chrysler town & country s(US $34,950.00)

Auto Services in North Carolina

Young`s Auto Center & Salvage ★★★★★

Wright`s Transmission ★★★★★

Wilson Off Road ★★★★★

Whitman Speed & Automotive ★★★★★

Webster`s Import Service ★★★★★

Vester Nissan ★★★★★

Auto blog

Mopar highlights wild SEMA creations, AWD Challenger Concept

Tue, Nov 3 2015Thanks to 15,345 square feet of display area, FCA US' Mopar division certainly has ample space to display its parts and accessories at the SEMA Show. To lure attendees to check out all of those cars and components, the company is now revealing ten tuned vehicles for this year's aftermarket event. This isn't even the brand's whole fleet for the show, but it includes some major highlights for Dodge and Ram fans. A lack of traction traditionally makes rear-wheel-drive muscle cars dismal to drive when the weather gets slippery, but the Dodge Challenger GT AWD Concept (above) solves that age-old problem at SEMA. In addition to powering all four wheels through an eight-speed automatic, it boasts an angry-looking, wide-body kit with aggressively flared wheel arches. The asymmetrical stripe with Header Orange accents also adds some extra panache to the Destroyer Grey and Matte Black color scheme. The coupe can back up the macho look thanks to the Scat Pack 3 Performance Kit that adds 75 horsepower and 44 pound-feet of torque to the 5.7-liter V8. However, before you get too excited about driving one this winter, FCA US spokesperson Ariel Gavilan tells Autoblog: "It is only a concept." Mopar isn't done tuning Dodges for SEMA. The Charger Deep Stage 3 shows what's possible with the company's catalog by packing the Scat Pack 3, strut tower braces, coilover suspension kit, and bigger brakes. Meanwhile, the blacked-out Dart GLH Concept tries to harken back to the style of the famous Omni GLH by fitting a red-accented body kit, including a Mopar Performance aluminum hood. If the standard Ram 1500 Rebel is somehow too subdued, check out the Rebel X (right) in a vibrant shade called Copper. To be ready for anything offroad, it wears some muscular flares to fit 17-inch beadlock wheels and 35-inch Toyo tires. A concept, two-piece front skid plate protects the front. Drivers should also be comfortable no matter where they drive thanks to prototype Katzkin leather seats and a concept air-ride suspension. Chrysler enjoys some mods, as well. The 300 Super S has suave style with Matte Cerulean paint, concept 22-inch wheels, and a grille with little Mopar Ms dotted around it. Performance also sees a boost with a tuned engine, bigger brakes, and coilover kit. The gray 200 S Mopar is similarly stylish with a complete body kit, including a conceptual, dual-vented hood. Fiat and Ram's commercial models aren't left out of the SEMA fun, either.

FCA recalls Fiat 500e to fix cruise control

Thu, Jun 11 2015Fiat is recalling almost 4,000 of its 500e electric vehicles because of a malfunction related to the model's cruise-control feature. The glitch causes the car's powertrain to be put into neutral under certain situations. It's the second recall on the 500e this year. Specifically, Chrysler-Fiat is recalling 3,975 cars. The issue is that the car's system can misread the motor's torque figures in cruise control, causing the sprightly EV to mistakenly shift into neutral in what was designed as a safety-precaution measure. The good news is that restarting the vehicle gets the car back to normal, but being dropped into neutral in highway mode is certainly no fun. Chrysler-Fiat said in a statement this week that it was "unaware" of injuries, accidents, or customer complaints caused by the issue. In April, the 500e was subject to a recall that impacted about 5,600 vehicles and stemmed from a March 2015 update. The update allowed the car to go into so-called "Limp Home Mode" to better extend range. The problem is that it inadvertently caused the car to stall. Range anxiety, indeed. Take a look at Chrysler-Fiat's press release on the most recent recall below. Related Video: Statement: Software Upgrade June 9, 2015 , Auburn Hills, Mich. - FCA US LLC is voluntarily recalling an estimated 3,975 cars to upgrade cruise-control software. A review of warranty data led to an investigation by FCA US LLC engineers. The investigation discovered certain Fiat 500e hatchbacks were inadvertently equipped with software that may misread torque levels generated by their motors, causing them to shift into neutral – a prescribed failsafe mode. This condition may occur only while cruise-control is engaged and the driver attempts to override the feature with accelerator-pedal applications or rapid tapping of the accelerate/decelerate buttons. Restarting the vehicle restores normal function. The campaign is limited to certain model-year 2013-2015 vehicles. The Company is unaware of any related injuries, accidents or customer complaints. New software will be available when affected customers are advised of this action by FCA US. Service instructions are being sent to FCA US dealers today. Customers with questions may call the FCA US Customer Information Center at 1-800-853-1403.

Buy Ford and GM stock and make 5%

Tue, Feb 2 2016Want to make a five-percent return when 10-year treasuries are paying around two percent? Ford (F) and General Motors (GM) have solid balance sheets, strong cash flow, solid earnings, and growing markets. By all accounts, they are smart investments. But the market is down on these stocks. Why? Some of the stupid excuses include: They are cyclical companies The Detroit 3 have lost 3.5 million in sales since 2000 The world economy is shaky GM recently filed for bankruptcy Their markets have peaked They haven't changed their ways Let's take these criticisms one by one: They Are Cyclical Companies Yes, they are cyclical. Every company is cyclical. Every industry is cyclical. Some more than others, but not every company is immune from swings in the market. Banks used to be 'non-cyclical' leader, not anymore. Airline stocks are just as cyclical as auto stocks, yet they are trading at multiples greater than the auto industry. Why? And what accounts for the irrational stock price for Tesla (TSLA)? At least Ford (F) and General Motors (GM) make money and have positive cash flows. In fact, both companies have a net positive cash position. They have more cash on hand than liabilities. Auto sales in the United States hit a record 17.5 million vehicles in 2015. During the Great Recession, Ford (F) and General Motors (GM) cut their break even points to 10 million vehicles per year. Anything above an annual U.S. volume of 10 million vehicles is profit. And what a profit they make. Sales of Ford's F-150 continues to be the best-selling vehicle in the United States for over 30 years. Detroit 3 Have Lost 3.5 million in Sales Since 2000 Automotive News reports General Motors (GM), Ford (F) and Chrysler (FCA) have lost a combined 3.5 million vehicles sales since 2000. So how can they be making more money? Two big reasons – Fleet Sales and the UAW. Fleet Sales The Detroit 3 used to own car rental companies to keep their factories running. Ford owned Hertz (HTZ), General Motors owned all of National Car Rental and 29 percent of Avis, and Chrysler, the forerunner to Fiat Chrysler (FCA), used to own Thrifty Car Rental and Dollar Rent-A-Car. The Detroit 3 owned these rental companies to have a place to sell their bad product and keep their factories running. These were low margin sales, and in many cases, were money losers for the Detroit 3. They no longer own auto rental companies.