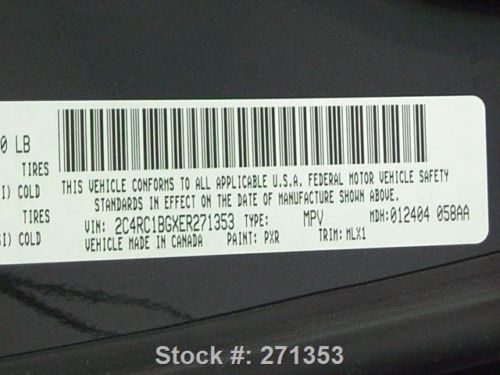

2014 Chrysler Town & Country Touring Leather Dvd 19k Mi Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Engine:See Description

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Body Type:Van Minivan

Certified pre-owned

Year: 2014

Warranty: Vehicle has an existing warranty

Make: Chrysler

Model: Town & Country

Options: Leather, CD Player

Power Options: Power Seats, Power Windows, Power Locks, Cruise Control

Mileage: 19,752

Sub Model: REARVIEW CAM

Exterior Color: Black

Number Of Doors: 4

Interior Color: Black

Inspection: Vehicle has been inspected

Number of Cylinders: 6

CALL NOW: 281-410-6042

Seller Rating: 5 STAR *****

Chrysler Town & Country for Sale

Clean florida 2006 chrysler town & country 55k miles! (caravan)(US $6,500.00)

Clean florida 2006 chrysler town & country 55k miles! (caravan)(US $6,500.00) 2003 chrysler town & country ex

2003 chrysler town & country ex Touring leather dvd remote start satellite radio(US $11,800.00)

Touring leather dvd remote start satellite radio(US $11,800.00) Flexfuel roof rack 3rd row stow n go mp3 sirius xm uconnect navigation camera

Flexfuel roof rack 3rd row stow n go mp3 sirius xm uconnect navigation camera Signature series, (loaded)

Signature series, (loaded) 2003 chrysler limited navigation dvd fl van leather heated seats great condition(US $7,900.00)

2003 chrysler limited navigation dvd fl van leather heated seats great condition(US $7,900.00)

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

Stellantis announces ‘Circular Economy’ business to drive revenue, decarbonization

Tue, Oct 11 2022Stellantis has already announced its plans to reach net-zero carbon emissions by 2038. Today, the automaker has announced a new business unit to help it reach that goal while generating 2 billion euros per year in revenue by 2030. The “Circular Economy” business will help make revenue less dependent on finite, rare and ecologically problematic materials. The Circular Economy model features what Stellantis calls a “4R” strategy, comprising remanufacturing, repair, reuse and recycling. The goal is to make materials last as long as they can, reducing reliance on the acquisition of those precious new materials in the future by returning them to the business loop when theyÂ’ve reached the end of their first life. Through these processes, Stellantis says it can save up to 80% raw material and 50% energy compared to manufacturing a new part. Remanufacturing, or “reman” in Stellantis shorthand, means dismantling, cleaning and rebuilding parts to OEM spec. Nearly 12,000 remanufactured parts are available for customers to purchase. Some remanufacturing is done in-house, and some with partners and through joint ventures. Repair is pretty obvious — fixing parts to put back into vehicles. This also consists of reconditioning, to make a vehicle feel like new. Stellantis boasts 21 “e-repair” centers for repairing electric vehicle batteries. Reuse refers to parts still in good condition from end-of-life vehicles sold as-is. Stellantis says it has 4.5 million multi-brand parts in inventory. These are sold in 155 countries through the B-Parts e-commerce platform. Reuse also refers second-life options, such as using batteries outside of automotive purposes. Recycling involves dismantling parts and scraps back into raw material form that is then looped back into the manufacturing process. Stellantis says it has collected 1 million parts for recycling in the past six months. Recycling doesnÂ’t get counted in that aforementioned 2 billion euros of revenue, but it does save the company money on acquisition of raw materials. As for batteries, specifically, Stellantis expects this recycling business to ramp up after 2030, when the packs currently in service begin to reach the end of their lifecycle. Stellantis will use its new “SUSTAINera” label to denote parts that are offered as part of its Circular Economy business.

Apple picks up former FCA quality boss Doug Betts

Wed, Jul 22 2015Apple made a significant personnel move that further signals its entry into the automotive world, hiring former Fiat Chrysler executive Doug Betts for an unspecified role. The information was obtained by The Wall Street Journal, which cites Betts' LinkedIn page. His career included stints at Toyota and Nissan before joining Chrysler Group (now FCA US LLC) in 2007, although his time there didn't end well. He left FCA, where he served as the automaker's head of quality, after the company's dismal showing in Consumer Reports' 2014 Annual Auto Reliability Survey. According to Betts' LinkedIn profile, which has since been pulled down, his job title reads "Operations – Apple Inc" in the San Francisco Bay area. Apple, meanwhile, was unwilling to divulge anything to the WSJ, although there's plenty to infer based on the hire. Betts wasn't the only big auto-related hire. According to the WSJ, Cupertino also lured an unnamed but "leading" autonomous vehicle researcher from Europe, who will be part of a team being setup to study driverless systems. Related Video:

Chrysler fires protest organizer at MI assembly plant

Tue, 12 Mar 2013Chrysler has reportedly fired a Warren Stamping Plant worker for what the company is calling a violation of its code of conduct. Alex Wassell (left), a 20-year veteran with the automaker, was suspended without pay after he was quoted in an article in The Detroit News. The 63-year-old welder repairman helped organize a demonstration against a new work schedule and was protesting outside the Michigan plant on February 28 when he was interviewed. Chrysler then fired Wassell when the paper published his comments. Wassell, has since filed a grievance and says that he's looking for an amicable settlement between his union and his former employer.

Meanwhile, multiple civil liberties groups have spoken out against Chrysler's decision to dismiss Wassell. Both the National Lawyer's Guild and the American Civil Liberties Union have released statements on the situation, with the ACLU saying "Employees have a right to air their grievances, even if that means a public demonstration or a comments to the media."

According to The Detroit News, Chrysler spokesperson Jodi Tinson said that Wassell was fired for "engaging in activity constituting or appearing to constitute a conflict with the interest of the company."

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.039 s, 7947 u