2013 Chrysler Town & Country Limited on 2040-cars

3455 South Orlando Drive, Sanford, Florida, United States

Engine:Gas V6 3.6L/220

Transmission:6-Speed

VIN (Vehicle Identification Number): 2C4RC1GG3DR649424

Stock Num: 35933A

Make: Chrysler

Model: Town & Country Limited

Year: 2013

Exterior Color: Gold

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 26596

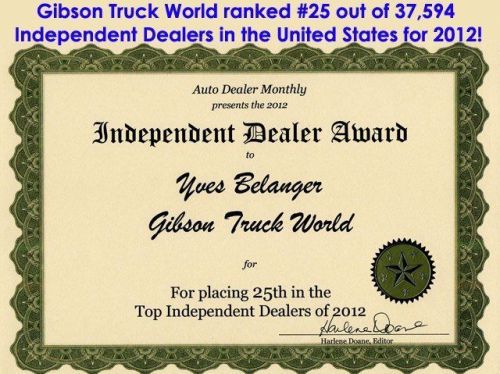

WWW.GIBSONTRUCKWORLD.COM*2013 Chrysler Town & Country Limited* Carfax 1 Owner under full factory warranty, good thru 12/28/15 or 36k miles. Also comes with powertrain warranty, good thru 12/28/17 or 100k milles. Vehicle comes equipped with dual power heated leather seating with memory, dual screen DVD player, power sliding moonroof, backup camera & sensors, adjustable pedals, CD player, steering wheel controls, tilt steering, cruise control, third row seating, keyless entry with alarm, power windows, power mirrors, power door locksSTILL UNDER FACTORY WARRANTY, Gibson Truck World Gibson Truck World in Sanford, FL has the lowest price for used trucks period! Gibson specializes in pre-owned Ford trucks, Dodge trucks, Chevrolet trucks, GMC trucks, Jeeps and SUVs. Gibson Truck World sells, ships trucks across the country & worldwide. We have a large selection of F150, F250, F350, F450, F550, RAM 3500, 2500, 1500 Chevy or GM 3500, 2500, 1500 quality pre-owned pickup trucks.

Chrysler Town & Country for Sale

2013 chrysler town & country touring(US $22,000.00)

2013 chrysler town & country touring(US $22,000.00) 2013 chrysler town & country touring(US $21,000.00)

2013 chrysler town & country touring(US $21,000.00) 2006 chrysler town & country(US $6,000.00)

2006 chrysler town & country(US $6,000.00) 2013 chrysler town & country touring(US $22,870.00)

2013 chrysler town & country touring(US $22,870.00) 2013 chrysler town & country touring(US $22,995.00)

2013 chrysler town & country touring(US $22,995.00) 2013 chrysler town & country touring(US $22,995.00)

2013 chrysler town & country touring(US $22,995.00)

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Strains between France and Italy risk Renault-FCA merger

Thu, May 30 2019PARIS/ROME — Fiat Chrysler's proposed $35 billion merger with Renault has cheered investors, won conditional support from Paris and Rome and even earned cautious backing from trade unions. Beneath this veneer, however, the bold attempt to create the world's third-largest carmaker risks becoming rapidly embroiled in the fraught relationship between France's europhile President Emmanuel Macron and Italy's euroskeptic leaders. For while Deputy Prime Minister Matteo Salvini hailed the proposal as a "brilliant operation," Italy's creaking, state-subsidized Fiat factories are likely to bear the brunt of any production-related cost savings. FCA and Renault said this week that more than 5 billion euros ($5.6 billion) of annual savings would come mainly from combining platforms, consolidating powertrain and electrification investments and the benefits of increased scale. Salvini and France's Finance Minister Bruno Le Maire, who called the deal a "good opportunity" to build a European industrial champion able to compete with China and the United States, have both said they want guarantees on local jobs. "It's not every day that I agree with Salvini," said Le Maire, whose government appears to hold the trump cards. When it comes to where any job cuts fall, France will be helped by its existing 15 percent holding in Renault, whose superior efficiency at its five French plants makes it better placed to handle a supply glut, the demise of the petrol engine and the investments needed for electric and autonomous vehicles. "It will take many, many years to find real savings, and ugly political and operational realities can often swamp the potential of such new entities," Bernstein analyst Max Warburton said of the FCA-Renault plan to rival Japan's Toyota and Germany's Volkswagen. Advantage France? As well as Italy's government having to cope with the aftermath of European elections, which coincided with news of the FCA-Renault plans, political leaders in Rome were only informed shortly before the deal was made public, an FCA source said. This contrasted with the way the French government was treated, with Fiat Chrysler Chairman John Elkann, a fluent French speaker, letting it know of his merger proposal to Renault weeks ago, a French government official said.

Google's new Android Autos OS unveiled, will be in cars this year [w/video]

Wed, 25 Jun 2014Connected cars are coming en-masse. We know this much. How, though, remains something of an open question, especially as two of the world's largest tech companies are preparing to battle for control of your car's dashboard. On the one hand, we have Apple and its CarPlay system. And now, we know what Google has been working on with Auto Link.

Its new name is Android Auto, and yes, it's based off the Android architecture that is the primary challenger to Apple's iOS mobile operating system. Announced at Google's I/O conference today, Android Auto functions similarly to CarPlay - owners will need to plug their smartphones into their cars to access the full breadth of capability.

In Android Auto's case, that means a wealth of voice controls to limit distracted driving. Google's marquee apps will be available when the interface arrives in production models later this year, including Google Play Music, Google Maps and voice-activated texting and text playback. Meanwhile, developers will be able to begin designing custom apps for the new system via an upcoming software development kit.

2022 Chrysler Pacifica Hybrid loses base Touring trim, starts at $48,255

Thu, Oct 28 2021The Chrysler Voyager is going fleet-only for 2022 while the standard 2022 Pacifica picked up some price hikes and some gains and losses in the equipment department. Time to dish on the 2022 Pacifica Hybrid, which, unsurprisingly, follows the majority of the non-hybrid Pacifica template. Mopar Insiders got info on pricing for the revisions Chrysler made to the lineup. The most important change to the overall Pacifica range, according to MI, is that model and option rationalization leaves just 53 combinations instead of the previous 3,550. That's way more than the Honda Odyssey at just seven permutations, but well behind the Toyota Sienna that has 206. The 3.6-liter Pentastar V6 and its eFlite variable transmission don't change, nor does the inability to spec all-wheel drive. What does get added are the new rear-seat reminder and Clean Air Filtration system that Stellantis is sprinkling throughout all its models. That filtration unit captures 95% of particulates in the air including bacteria, allergens, and pollen. The color palette goes the same way as on the non-hybrid Pacifica, dropping from 10 free colors to seven with just three free. Only Bright White, Brilliant Black, and Ceramic Grey will be no charge. Granite Crystal and the new Silver Mist, which replaces Billet Silver, will cost $95. Fathom Blue and Velvet Red will cost $395.  Product planners pulled the AWD option on the non-hybrid Pacifica Touring. For the hybrid, the Touring trim gets pulled completely, and in fact, it's already happened for the end of 2021. That makes the Touring L the new base model, and it makes this year's optional $995 Safety Sphere Group standard equipment for next year. That installs features like ParkSense for front, parallel, and perpendicular parking, and a 360-degree surround view camera. Conversely, the roof rack and side sunshades won't come as standard equipment anymore. MI says next year's MSRP will be $48,255 after the $1,495 destination charge. Comparing that price to the MSRP on Chrysler's 2021 configurator, next year's van will bring a $1,840 increase over 2021. Next year's Limited trim will add the $1,895 Premium and Safety Sphere Group as standard equipment. The package adds the parking aids from above as well as a 19-speaker Harman Kardon audio system with a 760-watt amplifier. There's a change up top, though, this trim giving up its three-pane sunroof for a dual-pane sunroof, as well as shedding the side sunshades.