2013 Chrysler Town & Country Touring L Wheelchair Ramp Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Engine:See Description

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Body Type:Wagon

Certified pre-owned

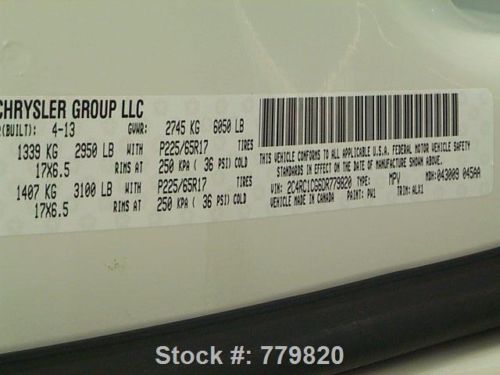

Year: 2013

Warranty: Vehicle has an existing warranty

Make: Chrysler

Model: Town & Country

Power Options: Power Seats, Power Windows, Power Locks, Cruise Control

Mileage: 2,086

Sub Model: HANDICAP VAN

Disability Equipped: Yes

Exterior Color: White

Number Of Doors: 4

Interior Color: Gray

Inspection: Vehicle has been inspected

Number of Cylinders: 6

CALL NOW: 281-854-2524

Seller Rating: 5 STAR *****

Chrysler Town & Country for Sale

Silver minivan, tow package, roof rack

Silver minivan, tow package, roof rack 2010 chrysler touring

2010 chrysler touring 2008 chrysler town & country ltd leather nav dual dvd texas direct auto(US $14,480.00)

2008 chrysler town & country ltd leather nav dual dvd texas direct auto(US $14,480.00) Touring mygig 3dvd remoteenginestart powerleatherheatedseats rearviewcam carfax(US $13,300.00)

Touring mygig 3dvd remoteenginestart powerleatherheatedseats rearviewcam carfax(US $13,300.00) 2008 chrysler town and country 4.0l fully loaded must sell walla walla/seattle(US $8,700.00)

2008 chrysler town and country 4.0l fully loaded must sell walla walla/seattle(US $8,700.00) Loaded 2005 chrysler town and country touring blue low miles clean & reduced(US $7,500.00)

Loaded 2005 chrysler town and country touring blue low miles clean & reduced(US $7,500.00)

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Dodge Demon's deliverer? FCA files for 'Angel' trademark

Thu, Aug 3 2017We've driven the Dodge Demon, and despite its satanic overtones and 840 freakin' horsepower under the hood, the car is actually quite well-behaved. At least it didn't bite our head off or drag us into any sort of inferno. Still, Dodge might be looking to balance its lineup with something with a bit more righteous, as FCA has filed for a trademark of the moniker "Angel."... According to the United States Patent and Trademark Office, FCA filed the application on July 17, 2017, and it applies to "Motor vehicles, namely, passenger automobiles, their structural parts, trim and badges." Essentially, that's all the information we have to go on at this point. It could mean that Dodge is planning to further capitalize on the Demon name by creating another variant, or a completely different car. But what's the opposite of the Demon? Could it be a more road-friendly version of the drag-focused Demon? (And wouldn't that just be a Hellcat Widebody with more power?) Maybe it's a performance hybrid, as FCA CEO Sergio Marchionne recently said that the automaker would electrify half its fleet by 2022. For now, we can merely speculate as to what the Angel would be. And you can, too. Get at it in the comments section, below. And while you're at it, what name do you think FCA should trademark next, and what sort of car would that be?Related Video: Related Gallery 2018 Dodge Challenger SRT Demon: First Drive View 37 Photos News Source: US Patent and Trademark Office via FCA Authority Auto News Chrysler Dodge Future Vehicles Performance FCA trademark dodge demon

Stellantis won't race to split electric vehicles from fossil fuel cars

Fri, May 6 2022MILAN - Stellantis is not considering splitting its electric vehicle (EV) business from its legacy combustion engine operation, its finance chief said on Thursday, as the carmaker presented above-expectation revenue data for the first quarter. Chief Financial Officer Richard Palmer told analysts he did not see huge benefits in the kind of separations pursued by rivals such as France's Renault and U.S. Ford. "We need to manage the company and the assets we have through this transition," he said. "There are benefits to having the cash flow being generated by the internal combustion business for the investments we need to make." Palmer said the group, formed by a merger last year of Fiat Chrysler and Peugeot maker PSA, was not averse to considering adjusting its structure "but we aren't anticipating any big changes." Palmer's comments came after the world's fourth largest carmaker said its net revenue rose 12% to 41.5 billion euros ($44.1 billion) in the January-March period, as strong pricing and the type of vehicles sold helped offset the impact of the semiconductor shortage on volumes. That topped analyst expectations of 36.9 billion euros, according to a Reuters poll. Milan-listed shares were up 0.5% by 1415 GMT, in line with Italy's blue-chip index. The impact of the chip crunch was evident in the decline in shipment figures which fell 12% in the quarter to 1.374 million vehicles. It was a similar story for Germany's BMW which posted higher revenues on Thursday and a decline in car sales. Riding the Recovery Stellantis, whose brands also include Citroen, Jeep and Maserati, confirmed its 2022 forecasts for a double-digit adjusted operating income margin, after 11.8% last year, and a positive cash-flow despite supply and inflationary headwinds. Morgan Stanley analysts said after the results that Stellantis had better management than many peers and benefited from its significant exposure to a stronger U.S. economy and a European recovery from the COVID-19 pandemic. They also said it was less affected by a slowing Chinese economy. Palmer said it was important for the group to maintain double-digit margins and keep delivering positive cash flows. "A 12% increase in revenue with a 12% decrease in volumes indicates a very strong performance on price and mix, which augurs well for our margin performance," he said. He said semiconductor supply problems were expected to ease this year with continued improvements in 2023.

Mopar boss promoted at FCA, still runs Mopar

Thu, May 21 2015Fiat Chrysler Automobiles is appointing Pietro Gorlier as its new chief operating officer for components. The change in title is effective June 30 and means that he reports directly to Sergio Marchionne. He already runs Mopar globally. Gorlier is replacing Eugenio Razelli, who is leaving the automaker. Even with the new position, Gorlier continues to be the boss at Mopar and retains his seat on FCA's global executive council, which is the company's top decision-making group. This is essentially one more step up the ladder for the Turin-born executive. Gorlier became CEO of Mopar service, parts, and customer care for FCA US in 2009 and took over that role worldwide in 2011. FCA announces new appointment Fiat Chrysler Automobiles N.V. (NYSE: FCAU / MI: FCA) announced today that effective June 30, 2015, Pietro Gorlier is appointed Chief Operating Officer Components reporting directly to the Chief Executive Officer Sergio Marchionne. Mr. Gorlier will also retain his current responsibilities as Head of Parts & Service (MOPAR) and member of the Group Executive Council. Mr. Gorlier will succeed Eugenio Razelli, who elected to leave the Group after several years of dedicated service. "We extend our sincere appreciation to Eugenio for his leadership and contribution to the organization" said Sergio Marchionne. Pietro Gorlier is Head of Parts & Service (MOPAR) and a member of the Group Executive Council (GEC) since September 1, 2011. He joined the Group in 1989 in Iveco and held various positions in Logistics, After Sales, and Customer Care before joining the automobile business in 2006 in Network Development. He holds a Master of Economics from the University of Turin. London, 18 May 2015 Related Video: News Source: FCA Hirings/Firings/Layoffs Chrysler Fiat FCA fiat chrysler automobiles fca us

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.038 s, 7929 u