2012 Town And Country With Handicap Conversions, Blue Pearl, Only 209 Miles!! on 2040-cars

Houston, Texas, United States

|

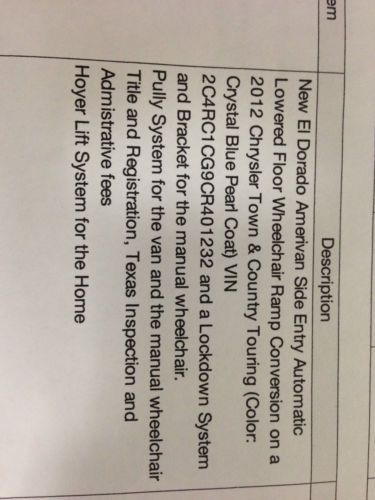

Condition: New. Original Owner. Only 209 Miles!! Garage kept. Amerivan Conversion. No mechanical problems, no scratches, door dings or dents. Non Smoker. Clear title. Purchased from Lift-Aids/Bill Kays Tempe Mobility.

|

Chrysler Town & Country for Sale

2003 chrysler lx low miles! 3.8 v6 fwd

2003 chrysler lx low miles! 3.8 v6 fwd 2010 touring 3.8l auto bright silver metallic clearcoat(US $13,885.00)

2010 touring 3.8l auto bright silver metallic clearcoat(US $13,885.00) We finance!!! 2010 chrysler town & country limited nav tv's leather texas auto(US $20,998.00)

We finance!!! 2010 chrysler town & country limited nav tv's leather texas auto(US $20,998.00) 2005 touring edition *nicely equipped* fully powered doors - 3rd row seating -(US $5,900.00)

2005 touring edition *nicely equipped* fully powered doors - 3rd row seating -(US $5,900.00) 2007 chrysler town & country

2007 chrysler town & country 2002 chrysler town & country

2002 chrysler town & country

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Chrysler banks $507 million in Q2, trims 2013 earnings forecast

Tue, 30 Jul 2013Chrysler has some good news and some bad news. First, profits were up 16 percent over the second quarter of 2012, bringing the Auburn Hills, Michigan-based manufacturer $507 million on the back of strong demand for trucks and SUVs (a recurring theme this quarter, particularly in the US). Q2 revenue was up as well, from $16.8 billion in 2012 to $18 billion in 2013. The bad news is that the Pentastar's overall earnings forecast for net income in 2013 has been trimmed from $2.2 billion to between $1.7 and $2.2 billion, according to Automotive News.

In addition to the adjusted net income forecast, Chrysler tweaked its operating profit from $3.8 billion to between $3.3 and $3.8 billion. This has gone largely unexplained by Chrysler, perhaps hoping the news of a three-percent increase in its transaction prices for Q2 will allow it to sweep this adjustment under the rug.

The star of the show for Chrysler has been its US sales, which saw a 10-percent jump, both bettering the industry average of eight percent and improving over the same stretch of 2012. As with the increase in transaction prices, Chrysler has the new Ram pickup and Jeep Grand Cherokee to thank. Perhaps most worrying from this report, though, is that every brand in the automaker's stable saw an increase in sales... except for the Chrysler brand itself.

Chrysler's next-gen minivans will get more expensive

Mon, Feb 2 2015Chrysler introduced the value-oriented Great American Package on the base model Chrysler 300 in 2005. That morphed into the American Value Package available as an option on the Dodge Grand Caravan in 2012, which made it the lowest-priced minivan in the country, now with an MSRP of $21,395. Automotive News reports that Chrysler is going to kill the value package when the new Town & Country arrives for 2017, because the new platform and technology of the coming minivan make it "a difficult price point to get to." AN says the next-generation haulers will come in around $26,000 and can go beyond $45,000 with options; clicking every "Add" button we could find on the Town & Country build page, we couldn't get past $43,000 for today's model. That entry pricing in 2017 would eliminate the first three trims on the Dodge option, the American Value Package, the SE that starts at $24,195, and the SE Plus that starts at $24,995. This makes us think the next-generation haulers will take a sizable step upscale in terms of feel, content, and trim, a la the Chrysler 200. In this writer's opinion, if they do as good a job as they've been doing recently, the extra money will be worth it. There have been spy shots and a lot of rumors about it, like the Caravan minivan going away and becoming a crossover, but we'll see it revealed at the 2016 Detroit Auto Show. News Source: Automotive News - sub. req. Chrysler Dodge Car Buying Minivan/Van chrysler town and country price dodge grand caravan

FCA CEO Manley says alliances are still possible but aren't necessary

Mon, Aug 5 2019DETROIT — Fiat Chrysler Automobiles Chief Executive has a message for Renault SA and other would-be partners: We are happy to talk, but we can go it alone. "Strategically, we have a solid future and clear plans that are being invested in and are underway now," Mike Manley said during a session with reporters the day after the company released better than expected second-quarter results. "That isn't to say if there is a better future through an alliance or partnership or merger we wouldnÂ’t be open and interested to it." Fiat Chrysler is open to re-starting merger negotiations with French automaker Renault, Manley said, but added the French car maker is not the only potential partner to gain scale or plug gaps in Fiat Chrysler's technology or vehicle lineup. "To say are they the only opportunity, the answer to that question would be a definitive ‘No,Â’" Manley said. Fiat Chrysler in June withdrew a $35 billion merger proposal with Renault after French government officials intervened in the talks and sought to delay a decision on the deal. The Wall Street Journal reported on Friday that Renault and Nissan are trying again to reshape their alliance and resolve disagreements that helped to derail the merger talks with Fiat Chrysler. Fiat Chrysler has a commercial vehicle partnership with French rival Peugeot SA, and the two companies discussed a broader combination before Fiat Chrysler made its offer to Renault, people familiar with the situation have said. Manley said automakers are not the only potential partners. "There are cooperations that can help in specific technologies. There are cooperations as we think about the consumer-car interface," he said. "You could see collaborations that never would be there in the past." Fiat Chrysler's North American business is strong thanks to Ram trucks and Jeep SUVs, but in other markets the automaker faces continued challenges. The company is overhauling its mass-market business in Europe, which is anchored by the Fiat brand. Fiat Chrysler's Europe, Middle East and Africa operations were marginally profitable in the second quarter and achieved 1.8% profit margin in 2018. Manley has set a goal of 3% operating margins, well short of the 10% margins the company forecast for North America.