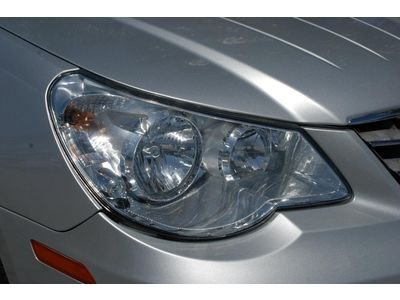

2009 Chrysler Sebring Touring Convertible 2.7l Flex V6 Auto 6-cd Power Driver on 2040-cars

Fort Myers Beach, Florida, United States

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 6

Make: Chrysler

Model: Sebring

Mileage: 54,170

Warranty: Vehicle does NOT have an existing warranty

Sub Model: Conv Touring

Exterior Color: Silver

Interior Color: Gray

Chrysler Sebring for Sale

1999 chrysler sebring jxi convertible 2-door 2.5l

1999 chrysler sebring jxi convertible 2-door 2.5l New vehicle: premium cloth seats, uconnect mp3 - free ship/airfare kchydodge(US $18,040.00)

New vehicle: premium cloth seats, uconnect mp3 - free ship/airfare kchydodge(US $18,040.00) (US $4,500.00)

(US $4,500.00) 2002 chrysler sebring limited convertible 2-door 2.7l(US $5,460.00)

2002 chrysler sebring limited convertible 2-door 2.7l(US $5,460.00) 2006 chrysler sebring gtc convertible 2-door 2.7l

2006 chrysler sebring gtc convertible 2-door 2.7l 1999 chrysler sebring jx convertible 2-door 2.5l(US $2,500.00)

1999 chrysler sebring jx convertible 2-door 2.5l(US $2,500.00)

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Ferrari, Fiat, McLaren, Nissan join coronavirus ventilator efforts

Thu, Mar 19 2020Siare Engineering, Italy's largest manufacturer of hospital ventilators, has turned to Italian automakers Ferrari and Fiat to investigate the possibility that the automakers might help produce more of the live-saving machines that are urgently needed to fight the coronavirus pandemic. The Italian government has asked Siare to increase ventilator production from 160 per month to 500 as the country's death toll has surpassed 3,400 and is climbing rapidly. "We're talking to Fiat Chrysler, Ferrari and Marelli to try to understand if they can lend us a hand in this process for the electronics part," Gianluca Preziosa, Siare's chief executive said in an interview quoted by Reuters, adding that the car companies' expertise in electronics and pneumatics could make them ideal partners. Preziosa said that another advantage of partnering with carmakers was their purchasing power, making them more likely to obtain parts that his small firm was struggling to secure amid coronavirus-related disruption to global supply chains. A spokesman for Exor, parent of both FCA and Ferrari, said that meetings with Siare had taken place on Thursday to study the feasibility of the idea and that a decision was expected in the coming hours. Two main options were being considered: either to help Siare engineer a capacity increase at its plant, with the support of technicians provided by FCA and Ferrari, or outsource production of ventilator parts to the carmakers' facilities. A source familiar with the matter told Reuters that Ferrari would be ready to start manufacturing ventilator parts in its famous Maranello headquarters, which lies close to the Siare factory, but that the luxury carmaker had yet to make a final decision. Automakers worldwide are being drafted for ventilator duty. In addition to Ford and GM making plans with the U.S. government; British Prime Minister Boris Johnson reaching out to Ford, Honda and Rolls-Royce; and an Elon Musk tweeted offer to build ventilators "if there is a shortage," other automakers and aerospace companies are joining in. In Europe, three groups have formed. Meggitt, which builds components including oxygen systems for civil aerospace and military fighter programs, is leading one consortium alongside engineers GKN, Thales and Renishaw. The other two teams are being led by carmakers McLaren, which is looking at how to design a simple version of a ventilator, and Nissan, which is working with others to support existing ventilator producers.

Ralph Gilles responds to Dodge rumors, says brand is 'here to stay'

Fri, 12 Jul 2013This is why we love Ralph Gilles. While in Italy hanging out with a group of Viper Club members in Europe, the SRT boss took the time to respond to a question directed at him on Instagram in regards to the future of Dodge.

Recent reports have painted a bleak picture for Dodge, but Gilles defended Chrysler's full-line brand by stating that the rumors are, "all rumors, Dodge is here to stay! It may get more focused going forward but not killed!" The idea of a "more focused" Dodge brand could lend some credibility to reports that the Grand Caravan and Durango are on their way out, which would leave Dodge solely as a car, or car-based, automaker.

Small number of 2013 Chrysler 200 and Dodge Avenger models recalled

Sun, 24 Feb 2013A small number of units of the 2013 Chrysler 200 (inset) and 2013 Dodge Avenger are being recalled over a broken control valve in the fuel tank assembly. The potential 1,785 sedans were manufactured late last year, and if affected with a broken control valve could suffer from stalling or fuel leakage.

A bulletin from the National Highway Traffic Safety Administration notes that the recall should begin next month, at which time owners can take their cars to dealers for repair free of charge. The full release with more information is just below.