2008 Sebring Convt Touring~only 9,261 Miles~1 Owner~heated Leather~power Top~new on 2040-cars

Lansing, Illinois, United States

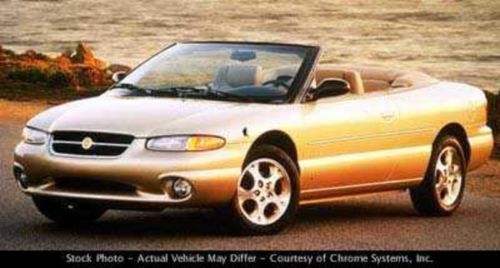

Chrysler Sebring for Sale

2008 chrysler sebring -- convertible -- excellent condition -- automatic -(US $9,990.00)

2008 chrysler sebring -- convertible -- excellent condition -- automatic -(US $9,990.00) 2002 chrysler sebring lxi sedan 4-door 3.0l

2002 chrysler sebring lxi sedan 4-door 3.0l 1999 chrysler jxi(US $6,490.00)

1999 chrysler jxi(US $6,490.00) 2005 chrysler seabring very clean(US $4,500.00)

2005 chrysler seabring very clean(US $4,500.00) 2008 chrysler sebring convertible(US $7,500.00)

2008 chrysler sebring convertible(US $7,500.00) 1998 chevy sebring no rserve

1998 chevy sebring no rserve

Auto Services in Illinois

West Side Motors ★★★★★

Turi`s Auto Collision Center ★★★★★

Transmissions R US ★★★★★

The Autobarn Nissan ★★★★★

Tech Auto Svc ★★★★★

T Boe Inc ★★★★★

Auto blog

Chrysler recalling hundreds of thousands of Jeep Grand Cherokee and Commander SUVs

Wed, 23 Jul 2014The public might associated ignition switch recalls with General Motors - and with good cause - but that's not the only automaker calling its vehicles back in to fix that sort of issue.

Last month we reported that the National Highway Traffic Safety Administration was investigating an array of Chrysler Group vehicles for electrical-related safety issues. The administration and Chrysler subsequently issued a recall for 700,000 Dodge Journey crossovers, Dodge Grand Caravan minivans and Chrysler Town & Country minivans. But while the Jeeps that were also under investigation were not covered in that recall, they are being addressed in a separate one now.

Although Chrysler reports that it is only aware of a single accident stemming from this issue, it is "committing now to conduct a recall out of an abundance of caution." The recall affects the 2006-2007 Jeep Commander and 2005-2007 Jeep Grand Cherokee, of which it reports there are 792,300 on the road: 649,900 in the United States, 28,800 in Canada, 12,800 in Mexico and a further 100,800 outside of North America.

FCA goes big on little Fiat 500 EV, plans to build 80,000

Thu, Jul 11 2019TURIN, Italy — Fiat Chrysler plans to invest 700 million euros ($787 million) in an electric makeover of its iconic Fiat 500, a top executive said on Thursday, as the automaker seeks to move on from its failed bid to merge with France's Renault. FCA's chief operating officer for Europe, Middle East and Africa, Pietro Gorlier, announced the investment — the Italian-American company's biggest single bet on an electric vehicle — at its Mirafiori plan in Turin, northern Italy. "The plan is confirmed," Gorlier told reporters, when asked if FCA's investment in electric vehicle technology would remain unchanged after its $35 billion plan to merge with Renault, an electric car pioneer, collapsed last month. He said FCA would invest the 700 million euros to build a new production line at Mirafiori to turn out 80,000 of the new 500 BEV, its first battery electric vehicle to be marketed in Europe after a smaller, initial foray in the United States. Production will start in the second quarter of 2020, with capacity to be expanded later, Gorlier said. The 500 compact car is one of the group's most famous models, launched by Fiat in the late 1950s and quickly becoming a symbol of Italian urban design. The 700 million euros investment is part of a plan announced last year to invest 5 billion euros in Italy up to 2021. In abandoning its merger offer for Renault, FCA blamed French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Featured Gallery Fiat 500e Green Chrysler Fiat Electric

France tries to dodge blame for blowing up FCA-Renault merger deal

Thu, Jun 6 2019PARIS — France sought to fend off a hail of criticism on Thursday after it was blamed for scuppering a $35 billion-plus merger between carmakers Fiat-Chrysler and Renault only 10 days after it was officially announced. Shares in Italian-American FCA and France's Renault fell sharply in early trading after FCA pulled out of talks, saying "the political conditions in France do not currently exist for such a combination to proceed successfully." French finance minister Bruno Le Maire said the government, which has a 15% stake in Renault, had engaged constructively, but had not been prepared to back a deal without the endorsement of Renault's current alliance partner Nissan. Nissan had said it would abstain at a Renault board meeting to vote on the merger proposal. However, a source close to FCA played down the significance of Nissan's stance in the discussions, believing French President Emmanuel Macron was looking for a way out of the deal after coming under pressure at home. Context The FCA-Renault talks were conducted against the backdrop of a French public outcry over 1,044 layoffs at a General Electric factory. The U.S. company had promised to safeguard jobs there when it acquired France's Alstom in 2015. The collapse of the deal, which would have created the world's third-biggest carmaker behind Japan's Toyota and Germany's Volkswagen, revives questions about how both FCA and Renault will meet the challenges of costly investments in electric and self-driving cars on their own. The merger had aimed to achieve 5 billion euros ($5.6 billion) in annual synergies, with FCA gaining access to Renault's and Nissan's superior electric drive technology and the French firm getting a share of FCA's lucrative Jeep and Ram brands. FCA has long been looking for a merger partner, and some analysts say its search for a deal is becoming more urgent as it is ill-prepared for tougher new regulations on emissions. It previously held unsuccessful talks with Peugeot maker PSA Group, in which the French state also owns a stake. French budget minister Gerald Darmanin said the door should not be closed on the possibility of a deal with Renault, adding Paris would be happy to re-examine any new proposal from FCA. "Talks could resume at some time in the future," he told FranceInfo radio.