2008 Chrysler Sebring Lx Convertible 2-door 2.4l on 2040-cars

Lumberville, Pennsylvania, United States

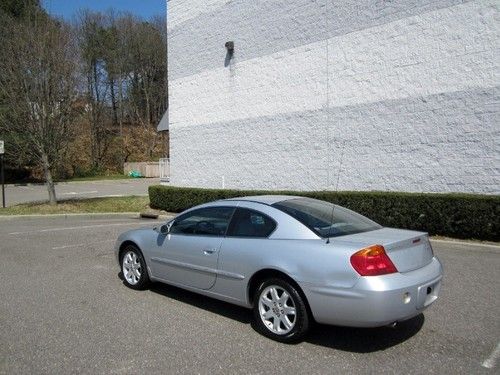

Body Type:Convertible

Vehicle Title:Clear

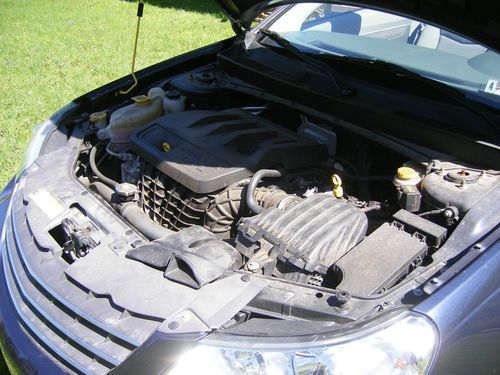

Engine:2.4L 2360CC 144Cu. In. l4 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Chrysler

Model: Sebring

Trim: LX Convertible 2-Door

Options: CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 40,000

Exterior Color: Blue

Interior Color: Gra

Number of Doors: 2

Number of Cylinders: 4

Selling my Moms Sebring with under 40K miles. Everything works as it should on this car. There are some dings and scratches but the car looks great as you can see in the pictures. Matching tires in great shape all around. My wife and I just did a road trip and got 30 MPG!!!

Please ask questions and I'll answer as quick as I can. If you want me to call send your #. I will need a $500 deposit within 24 hours of end of auction, Payment in full within 2 weeks through paypal or cash when picking up. The car is for sale locally so I may end auction early. Thank you for looking! Jimmy

Chrysler Sebring for Sale

2004 chrysler sebring convertible,gtc,loaded,low miles,new top,$99.00 no reserve

2004 chrysler sebring convertible,gtc,loaded,low miles,new top,$99.00 no reserve 2002 chrysler sebring coupe lxi(US $2,750.00)

2002 chrysler sebring coupe lxi(US $2,750.00) 2006 chrysler sebring touring convertible 2-door 2.7l

2006 chrysler sebring touring convertible 2-door 2.7l 2004 chrysler sebring lxi

2004 chrysler sebring lxi 1997 chrysler sebring runs good no reserve auction

1997 chrysler sebring runs good no reserve auction Low miles! florida car! 2006 touring convertible! cd v6 leather! best deal! wow!(US $7,950.00)

Low miles! florida car! 2006 touring convertible! cd v6 leather! best deal! wow!(US $7,950.00)

Auto Services in Pennsylvania

Wayne Carl Garage ★★★★★

Union Fuel Co ★★★★★

Tint It Is Incorporated ★★★★★

Terry`s Auto Glass ★★★★★

Terry`s Auto Glass ★★★★★

Syrena International Ltd ★★★★★

Auto blog

Chrysler recalls 350k vehicles over ignition switches

Thu, 25 Sep 2014Chrysler has announced a recall covering 349,442 vehicles due to ignition switches that can either become stuck or move without warning. All of the affected vehicles are from the 2008 model year, and were built before May 12, 2008.

The automaker has learned that ignition keys on some vehicles "may not fully return to the 'ON' position after rotation to the 'START' position during engine-startup," the company said in a statement. Additionally, "an ignition key may not fully return to the 'ON' position after rotation to the 'START' position and may inadvertently move through the 'ON' position to 'ACCESSORY' or 'OFF.'"

Chrysler says it is unaware of any related injuries, and notes that while reduced braking, engine or steering power is possible in such instances, the airbags are not affected. The later stands in contrast to General Motors' recent rash of high-profile recalls, and it's an important distinction that Chrysler (understandably) felt necessary to call out in bold print in its press release.

GM, FCA retain financial advisors amid merger rumors

Thu, Jun 18 2015Well, here we go again. Despite allegedly shutting down the idea of a merger, General Motors has retained financial advisors to, well, advise it on Fiat Chrysler Automobiles' advances. GM brought in New York-based Goldman Sachs, while FCA is currently working with Switzerland's UBS. Another source told Reuters that GM was working with Morgan Stanley, as well. But what does all this mean? Well, as we know, FCA boss Sergio Marchionne still has his eyes set very much on merging his automaker to combat what he claims are the prohibitive costs that come from developing today's vehicles. And while GM has said "no thanks," to a merger, the FCA boss is still looking to shareholders of the world's third-largest automaker to force the issue. Rather than a sign of an impending merger, voluntary or otherwise, between the two automotive powers – analysts called a hostile move by FCA "beyond ambitious," after all – retaining financial advisors on both sides could be viewed as just good business. News Source: ReutersImage Credit: Paul Sancya / AP Chrysler Fiat GM Sergio Marchionne FCA

FCA earnings improve in first quarter

Thu, Apr 30 2015Following on the recent global financial releases from Ford and from General Motors for the first quarter of 2015, FCA is now putting out its own numbers, and things look quite good for the company. The automaker posted adjusted earnings before taxes and interest of $895 million, a 22-percent jump from Q1 2014, and net profits of $103 million, a $296-million boost from last year. Revenue was also up 19 percent to $30 billion. Despite the favorable figures, actual worldwide shipments fell slightly by 2 percent to 1.1 million vehicles. FCA is giving some credit for these strong Q1 results to the automaker's performance in the NAFTA region. Shipments grew 8 percent to 633,000 vehicles, and net revenue jumped a strong 38 percent to $18.1 billion. Adjusted earnings reached $672 million, compared to $425 million in 2014. The company especially praised the Jeep Renegade, Chrysler 200, and Ram 1500 for helping the bottom line. The numbers could have been even higher, but the corporation admitted that "higher warranty and recall costs" partially drug things down. For the full year in 2015, FCA expects to ship between 4.8 and 5 million vehicles worldwide and post up to $5 billion in adjusted earnings. There should be about $1.3 billion in net profit, as well. FCA CLOSED Q1 WITH NET REVENUES OF ˆ26.4 BILLION, UP 19% AND ADJUSTED EBIT AT ˆ800 MILLION, UP 22% 30/04/15 FCA closed Q1 with net revenues of ˆ26.4 billion, up 19% and adjusted EBIT at ˆ800 million, up 22%. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion. Full year guidance confirmed. Worldwide shipments were 1.1 million units, 2% lower than Q1 2014, reflecting strong performance in NAFTA and weak market conditions in LATAM. Jeep's positive performance continued with worldwide shipments up 11% and sales up 22%. Net revenues were up 19% to ˆ26.4 billion (+4% at constant exchange rates, or CER). Adjusted EBIT was ˆ800 million, up ˆ145 million from Q1 2014, with all segments except LATAM posting positive results. The positive impact of foreign exchange translation was offset by negative impacts at a transactional level. Net profit was ˆ92 million, up ˆ265 million compared to the net loss of ˆ173 million in Q1 2014. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion from year-end mainly due to timing of capital expenditures and working capital seasonality. Liquidity remained strong at ˆ25.2 billion. The Group confirms its full-year guidance.