2004 Chrysler Sebring Limited Convertable Low Miles on 2040-cars

Monroe, Wisconsin, United States

Body Type:Convertible

Vehicle Title:Clear

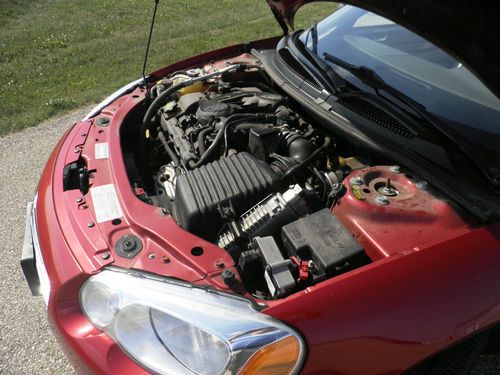

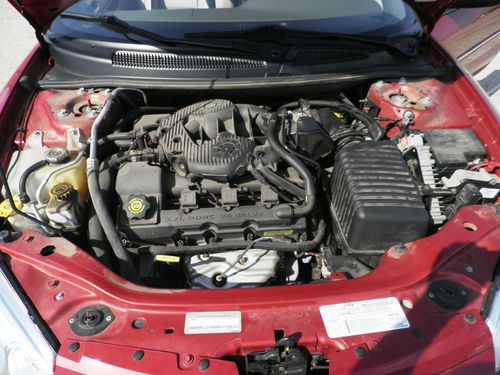

Engine:2.7

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Sebring

Warranty: Vehicle does NOT have an existing warranty

Trim: Limited

Options: Leather Seats, CD Player, Convertible

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 58,080

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Red

Interior Color: Grey

Number of Cylinders: 6

Excellent condition, no rust or damage Top of the line "Limited" model. All the options are standard, I am the third owner, first was the dealers wife and then a local banker. Local garage kept car. Adult driven, Never smoked in.

$1,000 pay pal deposit takes it off the market, Cash or wire transfer on pick up. If you would not buy it after your personal inspection your deposit will be refunded 100%

Chrysler Sebring for Sale

2008 chrysler sebring touring model,blk & grey/7" dvd player/runs and looks mint(US $5,500.00)

2008 chrysler sebring touring model,blk & grey/7" dvd player/runs and looks mint(US $5,500.00) We finance!! 2011 chrysler 200 limited convertible nav heated leather texas auto(US $22,998.00)

We finance!! 2011 chrysler 200 limited convertible nav heated leather texas auto(US $22,998.00) 2005 chrysler sebring convertible low miles florida car new top(US $5,900.00)

2005 chrysler sebring convertible low miles florida car new top(US $5,900.00) 2004 chrysler sebring gtc convertible (low miles)(US $3,200.00)

2004 chrysler sebring gtc convertible (low miles)(US $3,200.00) Steel blue . two owners . south florida(US $3,900.00)

Steel blue . two owners . south florida(US $3,900.00) 2003 chrysler sebring lx convertible 2-door 2.7l(US $1,750.00)

2003 chrysler sebring lx convertible 2-door 2.7l(US $1,750.00)

Auto Services in Wisconsin

Van`s Auto Salvage ★★★★★

Trans-X-Press Transmissions ★★★★★

Sullivans Two Unlimited ★★★★★

Steve`s Service ★★★★★

South Milwaukee Automotive Service ★★★★★

Schmit Bros Chrysler Dodge Jeep RAM ★★★★★

Auto blog

For some, getting a Fiat 500e last week was almost free

Sun, Mar 22 2015Auto-racing clubs know a thing or two about moving fast. And a couple of them out in California appeared to do just that when a bunch of incentives for the Fiat 500e electric vehicle added up to a pretty sweet deal. Actually, a borderline free one. Green Car Reports was kind enough to do the math on the calculation of an $83-a-month, three-year lease deal on that included a $2,100 perk and required an $11,000 downpayment on the $32,000 car. California and federal government incentives for EVs cut that downpayment down to $1,000 out of pocket once the incentives ($7,500 from the feds, $2,500 from the state) were factored in by the leasing company. Then, Fiat-Chrysler was throwing in another $1,000 for folks who were leasing a car from another car company, hence the freebie. That means some lucky people, at least temporarily, were able to work basically a zero-downpayment agreement for a three-year lease on a car whose monthly payment is the equivalent of about two full tanks of gas. Once word of those perks got around to some California racing clubs, about 100 500e vehicles to be moved off of California lots during the past week or so. Plugged in, indeed. Related Videos: Featured Gallery 2013 Fiat 500e: Review View 40 Photos News Source: Green Car Reports Green Chrysler Fiat incentives fiat 500e

Honda poised for growth, Detroit to hold steady, Car Wars study says

Fri, Jun 5 2015The automotive industry is expected to keep booming in the US over the next several years, but the train might start running out of steam in the long term, according to 2015's Car Wars report from Bank of America Merrill Lynch analyst John Murphy. The forecast focuses on changes between the 2016 and 2019 model years, and the latest trends appear similar in some cases to the past predictions. Sales are expected to keep growing and reach a peak of 20 million in 2018, according to the Detroit Free Press. The expansion is projected to come from a quick pace of vehicle launches, with an average of 48 introductions a year – 26 percent more than in 1996. Crossovers are expected to make up a third of these, maintaining their strong popularity. However, Murphy predicts a decline, as well. By 2025, total sales could fall to around 15 million units. As of May 2015, the seasonally adjusted annual rate for this year stands at 17.71 million. Like last year, Honda is predicted to be a big winner in the future thanks to products like the next-gen Civic. "Honda should be the biggest market share gainer," Murphy said when presenting the report, according to Free Press. Meanwhile, in a situation similar to Car Wars from 2012, a lack of many new vehicles is expected to cause a drop for Hyundai, Kia, and Nissan. Based on this forecast, Ford, General Motors, and FCA US will all generally maintain market share for the coming years. The report does make some future product predictions, though. The next Chevrolet Silverado and GMC Sierra might come in 2019, which is earlier than expected. Also, Lincoln could get a Mustang-based coupe for 2017, a compact sedan for 2018 and an Explorer-based model in 2019, according to the Free Press. Related Video: News Source: The Detroit Free PressImage Credit: Nam Y. Huh / AP Photo Earnings/Financials Chrysler Fiat Ford GM Honda Lincoln Car Buying fca us

Chrysler 300 diesel could get green light

Wed, 03 Apr 2013Word has it Chrysler is keen to shove its new turbo diesel V6 into a range of models. Wards Auto reports Chrysler President and CEO Saad Chehab has made it clear the automaker is investigating the possibility of using the 3.0-liter oil-burner in the 300. While speaking at an Automotive Press Association luncheon, Chehab said, "It's a matter of how much the customer is willing to pay for that premium. That's the only issue with it."

The Chrysler 300 is sold as the Lancia Thema in Europe complete with a diesel of its very own, and since the Jeep Grand Cherokee is now available with the diesel V6 here in the States, it only makes sense that the engine could potentially show up on the 300 order sheet. Opting for the 3.0 V6 in the Jeep Grand Cherokee will set you back an additional $4,500, however.

Chehab also said the engine could make an appearance in the next-generation Chrysler 200, which is set to debut next year.