2004 Chrysler Sebring Base Sedan 4-door 2.4l on 2040-cars

Sturtevant, Wisconsin, United States

|

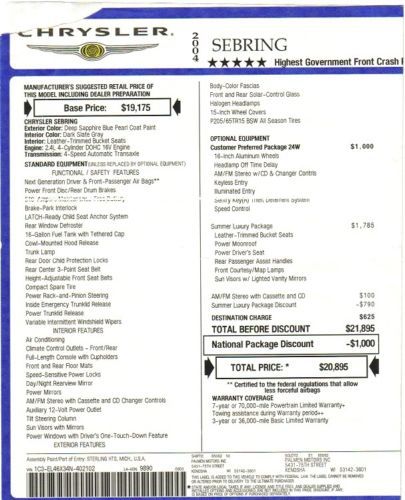

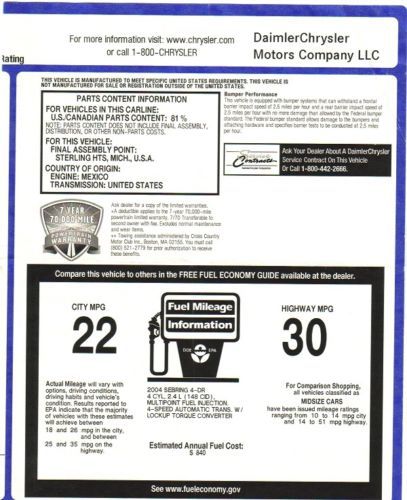

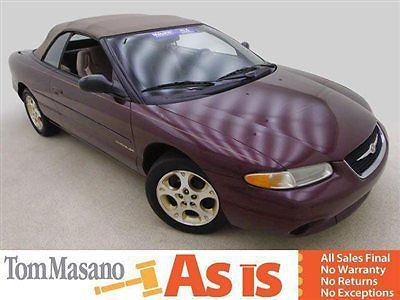

2004 CHRYSLER SEBRING Runs great. Affordable gas mileage: 22/30 MPG. See window sticker pictures for more details. Interior in very good condition. Leather seats in excellent condition. Includes spare tire, jack/wrench, tire inflator compressor. Passenger side door and fender dented. Driver side headlight damage. Minor radiator leak (needs topping). Radiator reservoir does not work. Vent fan works on high setting. Sold as is. No returns. |

Chrysler Sebring for Sale

2006 sebring touring edition dark blue 4 door sedan nice ride(US $4,500.00)

2006 sebring touring edition dark blue 4 door sedan nice ride(US $4,500.00) Low low mile excellent condition, lady driven only on special occasions

Low low mile excellent condition, lady driven only on special occasions 2000 chrysler sebring convertible - florida car(US $4,500.00)

2000 chrysler sebring convertible - florida car(US $4,500.00) 1999 chrysler sebring (53012a) ~ absolute sale ~ no reserve

1999 chrysler sebring (53012a) ~ absolute sale ~ no reserve 2004 chrysler sebring convertible mechanics special needs head gasket clean

2004 chrysler sebring convertible mechanics special needs head gasket clean 2002 chrysler sebring runs & drive can drive it home

2002 chrysler sebring runs & drive can drive it home

Auto Services in Wisconsin

Young`s Auto Repair ★★★★★

Whealon Towing & Service Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Tower Auto Body CARSTAR ★★★★★

Sternot Auto Repair Inc ★★★★★

State Auto Body ★★★★★

Auto blog

NHTSA, IIHS, and 20 automakers to make auto braking standard by 2022

Thu, Mar 17 2016The National Highway Traffic Safety Administration, the Insurance Institute for Highway Safety and virtually every automaker in the US domestic market have announced a pact to make automatic emergency braking standard by 2022. Here's the full rundown of companies involved: BMW, Fiat Chrysler Automobiles, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen, and Volvo (not to mention the brands that fall under each automaker's respective umbrella). Like we reported yesterday, AEB will be as ubiquitous in the future as traction and stability control are today. But the thing to note here is that this is not a governmental mandate. It's truly an agreement between automakers and the government, a fact that NHTSA claims will lead to widespread adoption three years sooner than a formal rule. That fact in itself should prevent up to 28,000 crashes and 12,000 injuries. The agreement will come into effect in two waves. For the majority of vehicles on the road – those with gross vehicle weights below 8,500 pounds – AEB will need to be standard equipment by September 1, 2022. Vehicles between 8,501 and 10,000 pounds will have an extra three years to offer AEB. "It's an exciting time for vehicle safety. By proactively making emergency braking systems standard equipment on their vehicles, these 20 automakers will help prevent thousands of crashes and save lives," said Secretary of Transportation Anthony Foxx said in an official statement. "It's a win for safety and a win for consumers." Read on for the official press release from NHTSA. Related Video: U.S. DOT and IIHS announce historic commitment of 20 automakers to make automatic emergency braking standard on new vehicles McLEAN, Va. – The U.S. Department of Transportation's National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety announced today a historic commitment by 20 automakers representing more than 99 percent of the U.S. auto market to make automatic emergency braking a standard feature on virtually all new cars no later than NHTSA's 2022 reporting year, which begins Sept 1, 2022. Automakers making the commitment are Audi, BMW, FCA US LLC, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Maserati, Mazda, Mercedes-Benz, Mitsubishi Motors, Nissan, Porsche, Subaru, Tesla Motors Inc., Toyota, Volkswagen and Volvo Car USA.

CES 2022 was huge for EVs | Autoblog Podcast #711

Fri, Jan 7 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. CES took place this week, and there were some nice electric surprises from automakers, especially General Motors. John has been driving the Ram 1500 Power Wagon, as well as what seems to be its polar opposite, the electric Mini Cooper SE. Greg talks about the differences between the Acura TLX A-Spec long-termer (which is back in the shop) and the Type S loaner that's filling in for it. John's also got some interesting thoughts on leather interiors. Finally, the editors reach into the mailbag and help a repeat customer decide on a suitable replacement for a 2008 Lexus GX 470 in this week's Spend My Money segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #711 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown CES 2022 2024 Chevy Silverado EV revealed: 664 hp — and Midgate's back 2024 Chevy Silverado EV vs. 2022 Ford F-150 Lightning | How do they compare? Chevy Equinox EV and Blazer EV confirmed for production in 2023 Chrysler Airflow concept previews the brand's all-electric future Mercedes-Benz Vision EQXX shoots for 620-mile range Cadillac InnerSpace reimagines the personal luxury coupe What we're driving: 2022 Ram 1500 Power Wagon 2021 Acura TLX A-Spec and Type S long-termers 2022 Mini Cooper SE John's unpopular opinion: Let's do away with leather for good Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video:

Major automakers post mixed US June sales figures

Mon, Jul 3 2017General Motors, Ford and Fiat Chrysler Automobiles NV posted declines in US new vehicle sales for June on Monday, while major Japanese automakers reported stronger figures. Once again, demand for pickup trucks and crossovers offset a decline in sedan sales. Automakers' shares rose as overall industry sales still came in above Wall Street expectations. The US auto industry is bracing for a downturn after hitting a record 17.55 million new vehicles sold in 2016. Analysts had predicted that overall, US vehicle sales would fall in June for the fourth consecutive month. As the market has shown signs of cooling, automakers have hiked discounts and loosened lending terms. Car shopping website Edmunds said on Monday the average length of a car loan reached an all-time high of 69.3 months in June. "It's financially risky, leaving borrowers exposed to being upside down on their vehicles for a large chunk of their loans," said Jessica Caldwell, Edmunds' executive director of industry analysis. GM said its sales fell about 5 percent versus June 2016, but that the industry would see stronger sales in the second half of 2017 versus the first half. "Under the current economic conditions, we anticipate US retail vehicle sales will remain strong for the foreseeable future." GM shares were up 2.4 percent in morning trading, while Ford rose 3.3 percent and FCA shares jumped 6 percent. "US total sales are moderating due to an industry-wide pullback in daily rental sales, but key US economic fundamentals clearly remain positive," said GM chief economist Mustafa Mohatarem. "Under the current economic conditions, we anticipate US retail vehicle sales will remain strong for the foreseeable future." Ford said its sales for June were hit by lower fleet sales to rental agencies, businesses, and government entities, which fell 13.9 percent, while sales to consumers were flat. But it sold a record 406,464 SUVs in the first half of the year, with Explorer sales increasing 23 percent in June. And sales of the F-150 had their strongest June since 2001. On a media call, Ford executives said an initial read of automakers' sales figures indicated a seasonally adjusted annualized rate of around 17 million new vehicles for the month, which would be better than 16.6 million units analysts had predicted. FCA said June sales decreased 7 percent versus the same month a year earlier.