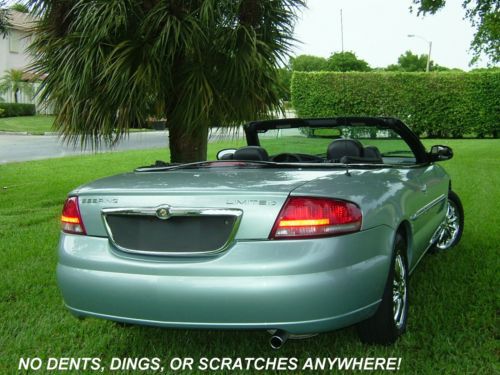

2002 Chrysler Sebring Limited Convertible From Floria! Low Miles And Like New!! on 2040-cars

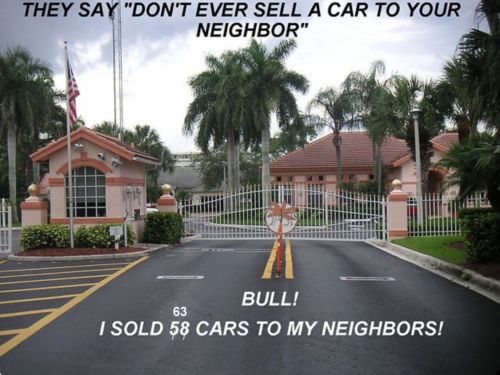

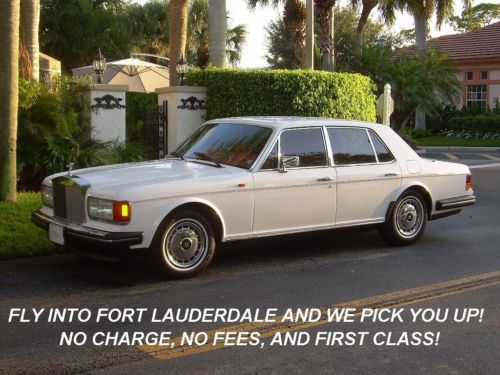

Pompano Beach, Florida, United States

Chrysler Sebring for Sale

2001 chrysler sebring lx coupe, auto, as-is,2.4l,cruise,pw,pl,cloth(US $3,680.00)

2001 chrysler sebring lx coupe, auto, as-is,2.4l,cruise,pw,pl,cloth(US $3,680.00) 2001 chrysler sebring 2dr convertible

2001 chrysler sebring 2dr convertible 1998 chrysler sebring lx coupe 2-door 2.5l(US $1,300.00)

1998 chrysler sebring lx coupe 2-door 2.5l(US $1,300.00) 2002 chrysler sebring convertible 2 4l great on gas.

2002 chrysler sebring convertible 2 4l great on gas. New seafoam green canvas top w/glass~new tires~rare limited~chrome~05 06(US $6,411.00)

New seafoam green canvas top w/glass~new tires~rare limited~chrome~05 06(US $6,411.00) Ethanol - ffv 2.7l front wheel drive power windows a/c(US $7,795.00)

Ethanol - ffv 2.7l front wheel drive power windows a/c(US $7,795.00)

Auto Services in Florida

Youngs` Automotive Service ★★★★★

Winner Auto Center Inc ★★★★★

Vehicles Four Sale Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Auto Glass ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

FCA's profit rises ahead of Peugeot merger

Thu, Feb 6 2020MILAN — Fiat Chrysler (FCA) posted a 7% rise in fourth-quarter profit on Thursday, boosted by strong business in North America and better results in Latin America as it heads into a merger with France's PSA. The Italian-American carmaker said adjusted earnings before interest and tax (EBIT) rose to 2.12 billion euros ($2.3 billion), in line with a 2.11 billion forecast in Reuters poll of analysts. That left its adjusted operating profit for the year at 6.67 billion euros ($7.34 billion), just shy of its target of over 6.7 billion euros. Its adjusted EBITDA margin came in at 6.2%, in line with its target of more than 6.1%. A trader said Fiat Chrysler results were "a touch above" expectations and the carmaker's shares in Milan were up 3.4% at 1300 GMT following the results. Fiat Chrysler and Peugeot maker PSA agreed in December to combine forces in a $50 billion deal to create the world's No. 4 carmaker, in response to slower global demand and the mounting cost of making cleaner cars amid tighter emissions rules. Chief Executive Mike Manley said last month that talks with PSA were progressing well and that he hoped to complete the deal by early 2021. FCA reiterated its plan to boost adjusted EBIT to above 7 billion euros ($7.7 billion) this year. In slides prepared for an analyst call, FCA said it was monitoring the global impact of coronavirus in China. FCA operates in the country through a loss-making joint venture with Guangzhou Automobile Group (GAC) and has a 0.35% share of the Chinese passenger car market. Reporting by Giulio Piovaccari; Additional reporting by Danilo Masoni; Editing by Stephen Jewkes, Jason Neely and David Clarke. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

FCA goes big on little Fiat 500 EV, plans to build 80,000

Thu, Jul 11 2019TURIN, Italy — Fiat Chrysler plans to invest 700 million euros ($787 million) in an electric makeover of its iconic Fiat 500, a top executive said on Thursday, as the automaker seeks to move on from its failed bid to merge with France's Renault. FCA's chief operating officer for Europe, Middle East and Africa, Pietro Gorlier, announced the investment — the Italian-American company's biggest single bet on an electric vehicle — at its Mirafiori plan in Turin, northern Italy. "The plan is confirmed," Gorlier told reporters, when asked if FCA's investment in electric vehicle technology would remain unchanged after its $35 billion plan to merge with Renault, an electric car pioneer, collapsed last month. He said FCA would invest the 700 million euros to build a new production line at Mirafiori to turn out 80,000 of the new 500 BEV, its first battery electric vehicle to be marketed in Europe after a smaller, initial foray in the United States. Production will start in the second quarter of 2020, with capacity to be expanded later, Gorlier said. The 500 compact car is one of the group's most famous models, launched by Fiat in the late 1950s and quickly becoming a symbol of Italian urban design. The 700 million euros investment is part of a plan announced last year to invest 5 billion euros in Italy up to 2021. In abandoning its merger offer for Renault, FCA blamed French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Featured Gallery Fiat 500e Green Chrysler Fiat Electric

GM, Ford, Honda winners in 'Car Wars' study as industry growth continues

Wed, May 11 2016General Motors' plans to aggressively refresh its product lineup will pay off in the next four years with strong market share and sales, according to an influential report released Tuesday. Ford, Honda, and FCA are all poised to show similar gains as the auto industry is expected to remain healthy through the rest of the decade. The Bank of America Merrill Lynch study, called Car Wars, analyzes automakers' future product plans for the next four model years. By 2020, 88 percent of GM's sales will come from newly launched products, which puts it slightly ahead of Ford's 86-percent estimate. Honda (85 percent) and FCA (84 percent) follow. The industry average is 81 percent. Toyota checks in just below the industry average at 79 percent, with Nissan trailing at 76 percent. Car Wars' premise is: automakers that continually launch new products are in a better position to grow sales and market share, while companies that roll out lightly updated models are vulnerable to shifting consumer tastes. Though Detroit and Honda grade out well in the study, many major automakers are clumped together, which means large market-share swings are less likely in the coming years. Bank of America Merrill Lynch predicts the industry will top out with 20 million sales in 2018 and then taper off, perhaps as much as 30 percent by 2026. Not surprisingly, trucks, sport utility vehicles and crossovers will be the key battlefield in the next few years, Car Wars says. FCA will launch a critical salvo in 2018 with a new Ram 1500, followed by new generations of the Chevy Silverado and GMC Sierra in 2019, and then Ford's F-150 for 2020, according to the study. Bank of America Merrill Lynch analyst John Murphy said the GM trucks could be pulled ahead even earlier to 2018, prompting Ford to respond. "This focus on crossovers and trucks is a great thing for the industry," Murphy said. Cars Wars looks at Korean (76 percent replacement rate) and European companies more vaguely (70 percent), but argues their slower product cadence and lineups with fewer trucks puts them in weaker positions than their competitors through 2020. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery 2016 Chevrolet Silverado View 11 Photos Image Credit: Chevrolet Earnings/Financials Chrysler Fiat Ford GM Honda Nissan Toyota study FCA