2024 Chrysler Pacifica Touring L on 2040-cars

Engine:3.6L V6 24V VVT

Fuel Type:Gasoline

Body Type:4D Passenger Van

Transmission:Automatic

For Sale By:Dealer

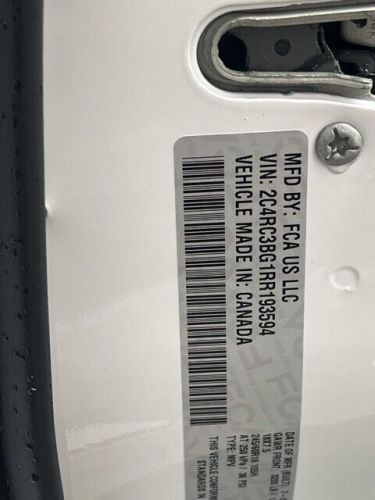

VIN (Vehicle Identification Number): 2C4RC3BG1RR193594

Mileage: 9

Make: Chrysler

Trim: Touring L

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2019 chrysler pacifica limited(US $27,550.00)

2019 chrysler pacifica limited(US $27,550.00) 2022 chrysler pacifica touring l(US $19,790.00)

2022 chrysler pacifica touring l(US $19,790.00) 2023 chrysler pacifica touring l(US $27,673.00)

2023 chrysler pacifica touring l(US $27,673.00) 2022 chrysler pacifica touring l(US $17,252.00)

2022 chrysler pacifica touring l(US $17,252.00) 2022 chrysler pacifica touring l(US $17,594.00)

2022 chrysler pacifica touring l(US $17,594.00) 2022 chrysler pacifica touring l(US $16,894.00)

2022 chrysler pacifica touring l(US $16,894.00)

Auto blog

Consumer Reports no longer recommends Honda Civic

Mon, Oct 24 2016Consumer Reports annual Car Reliability Survey is out, and yes, there are some big surprises. First and foremost? The venerable publication no longer recommends the Honda Civic. In fact, aside from the walking-dead CR-Z and limited-release Clarity fuel-cell car, the Civic is the only Honda to miss out on CR's prestigious nod. At the opposite end there's a surprise as well – Toyota and Lexus remain the most reliable brands on the market, but Buick cracked the top three. That's up from seventh last year, and the first time for an American brand to stand on the Consumer Reports podium. Mazda's entire lineup earned Recommended checks as well. Consumer Reports dinged the Civic for its "infuriating" touch-screen radio, lack of driver lumbar adjustability, the limited selection of cars on dealer lots fitted with Honda's popular Sensing system, and the company's decision to offer LaneWatch instead of a full-tilt blind-spot monitoring system. Its score? A lowly 58. The Civic isn't the only surprise drop from CR's Recommended ranks. The Audi A3, Ford F-150, Subaru WRX/STI, and Volkswagen Jetta, GTI, and Passat all lost the Consumer Reports' checkmark. On the flipside, a number of popular vehicles graduated to the Recommended ranks, including the BMW X5, Chevrolet Camaro, Corvette, and Cruze, Hyundai Santa Fe, Porsche Macan, and Tesla Model S. Perhaps the biggest surprise is the hilariously recall-prone Ford Escape getting a Recommended check – considering the popularity of Ford's small crossover, this is likely a coup for the brand, as it puts the Escape on a level playing field with the Recommended Toyota RAV4, Honda CR-V, and Nissan Rogue. While Ford is probably happy to see CR promote the Escape, the list wasn't as kind for every brand. For example, of the entire Fiat Chrysler Automobiles catalog, the ancient Chrysler 300 was the only car to score a check – there wasn't a single Dodge, Fiat, Jeep, Maserati, or Ram on the list. That hurts. FCA isn't alone at the low end, either. GMC, Jaguar Land Rover, Mini, and Mitsubishi don't have a vehicle on CR's list between them, while brands like Mercedes-Benz, Volvo, Nissan, Lincoln, Infiniti, and Cadillac only have a few models each. You can check out Consumer Reports entire reliability roundup, even without a subscription, here.

Fiat Chrysler global HQ lands in London's ultra-posh West End

Thu, 18 Sep 2014It seems Fiat is bent on bolstering its image as a global automaker, as word has leaked out that the Italian/American conglomerate has chosen to locate its global headquarters in a rather swanky neighborhood in London. According to Bloomberg, the rental location on St. James Street in London's West End is a 10-minute walk from Buckingham Palace, and Fiat Chrysler Automobiles will fill up three complete floors of an office building that also houses The Economist magazine.

As a neutral location between Italy and the United States, the London-based headquarters makes sense, though, at $277 per square foot, this area is said to be the most expensive office space in the world. There's no mention of what FCA has actually agreed to pay for renting the space, but we're certain it isn't coming cheap.

Not surprisingly, Bloomberg also cites research indicating that the largest number of immigrants moving into London from January through August of this year hail from Italy, which makes sense considering the number of Italian executives and workers we'd expect would have to relocate to the UK in order to work at Fiat's new home. The company reportedly plans to be in place in London by the time it holds its next round of board meetings in October.

Chrysler Uconnect gets dealer-activated navigation, new infotainment features

Mon, 07 Jan 2013Get in just about any mid-level Chrysler product these days, and you'll see a touchscreen head unit that would be perfect for a navigation system. The only thing is that some of these cars equipped with the head unit for Chrysler's Uconnect infotainment system were not optioned up with navigation at the time of purchase, leaving drivers looking for turn-by-turn directions relying on either an aftermarket nav system or a smartphone. Starting on select new Chrysler products, however, customers with Uconnect will now be able to upgrade to navigation as a dealer-activated option.

Announced at the 2013 Consumer Electronics Show, this new element of Uconnect will allow owners to have an in-dash navigation system installed quickly and easily; Chrysler said that this will be a major benefit for used-car buyers. Unfortunately, it doesn't sound like this system will be retroactive on previous Uconnect head units, but it will launch this year on the 2013 Ram 1500, 2013 SRT Viper and the 2014 Fiat 500L. Chrysler did not announce the expected MSRP to have dealers activate the navigation capabilities.

Another infotainment option for Chrysler buyers is the Uconnect Access system that can allow WiFi, voice text messaging, emergency assistance, remote vehicle operation (such as starting the engine or locking/unlocking the doors) and limited POI searches using Bing. Also introduced at CES, the new Uconnect Access via Mobile system builds on this by allowing users to add in-car apps such as iHeart Radio, Pandora and Slacker by connecting to the system via a smartphone. This system will first be offered on the 2013 Ram and Viper.