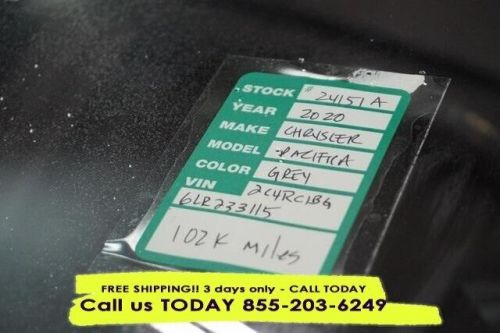

2020 Chrysler Pacifica Touring L on 2040-cars

Tomball, Texas, United States

Engine:6 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1BG6LR233115

Mileage: 103282

Make: Chrysler

Trim: Touring L

Drive Type: FWD

Features: --

Power Options: --

Exterior Color: Gray

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2017 chrysler pacifica(US $13,900.00)

2017 chrysler pacifica(US $13,900.00) 2017 chrysler pacifica touring l(US $15,000.00)

2017 chrysler pacifica touring l(US $15,000.00) 2022 chrysler pacifica touring l(US $18,393.90)

2022 chrysler pacifica touring l(US $18,393.90) 2020 chrysler pacifica touring l / advanced safety and technology group(US $18,995.00)

2020 chrysler pacifica touring l / advanced safety and technology group(US $18,995.00) 2020 chrysler pacifica touring l(US $17,241.70)

2020 chrysler pacifica touring l(US $17,241.70) 2020 chrysler pacifica touring(US $16,264.50)

2020 chrysler pacifica touring(US $16,264.50)

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Ferrari officially files SEC paperwork to register future IPO

Thu, Jul 23 2015Late last year FCA announced plans to spin off Ferrari into a separate company, and after a long wait that process has finally become official. The Prancing Horse has now filed the necessary prospectus and other documents with the Securities and Exchange Commission to hold an initial public offering on The New York Stock Exchange. The paperwork doesn't mention a specific date for the Italian sportscar maker's IPO, but it's expected sometime in October. At this point, the documents also don't include some other vital data about the IPO. Ferrari lists neither the number of shares being offered nor their price. The company also doesn't have a stock symbol yet. UBS, BofA Merrill Lynch and Santander are acting as joint book runners for the deal. As part of the IPO, FCA initially intends to sell 10 percent of Ferrari's shares on the stock market. Another 10 percent of the company still belongs to Piero Ferrari. FCA is holding onto the remaining 80 percent in the short term for financial reasons but intends to distribute them to shareholders in early 2016. After the spin-off, about 24 percent of Ferrari would be owned by Exor, 10 percent by Piero Ferrari, and 66 percent by public shareholders, according to the SEC documents. FCA boss Sergio Marchionne believes that Ferrari could be worth over $11 billion. Although, his estimate might be slightly high. According to Reuters, Wall Street is actually putting the value somewhere between $5.5 billion and $11 billion. If you're thinking about investing in the company or just want to read the nitty-gritty about the brand's financial health, the entire SEC filing can be read here. Ferrari Files for Initial Public Offering LONDON, July 23, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") announced today that its subsidiary, New Business Netherlands N.V. (to be renamed Ferrari N.V.), has filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission ("SEC") for a proposed initial public offering of common shares currently held by FCA. The number of common shares to be offered and the price range for the proposed offering have not yet been determined, although the proposed offering is not expected to exceed 10% of the outstanding common shares. In connection with the initial public offering, Ferrari intends to apply to list its common shares on the New York Stock Exchange.

Bring back the Bronco! Trademarks we hope are actually (someday) future car names

Tue, Mar 17 2015Trademark filings are the tea leaves of the auto industry. Read them carefully – and interpret them correctly – and you might be previewing an automaker's future product plans. Yes, they're routinely filed to maintain the rights to an iconic name. And sometimes they're only for toys and clothing. But not always. Sometimes, the truth is right in front of us. The trademark is required because a company actually wants to use the name on a new car. With that in mind, here's a list of intriguing trademark filings we want to see go from paperwork to production reality. Trademark: Bronco Company: Ford Previous Use: The Bronco was a long-running SUV that lived from 1966-1996. It's one of America's original SUVs and was responsible for the increased popularity of the segment. Still, it's best known as O.J. Simpson's would-be getaway car. We think: The Bronco was an icon. Everyone seems to want a Wrangler-fighter – Ford used to have a good one. Enough time has passed that the O.J. police chase isn't the immediate image conjured by the Bronco anymore. Even if we're doing a wish list in no particular order, the Bronco still finds its way to the top. For now (unfortunately), it's just federal paperwork. Rumors on this one can get especially heated. The official word from a Ford spokesman is: "Companies renew trademark filings to maintain ownership and control of the mark, even if it is not currently used. Ford values the iconic Bronco name and history." Trademarks: Aviator, AV8R Company: Ford Previous Use: The Aviator was one of the shortest-run Lincolns ever, lasting for the 2003-2005 model years. It never found the sales success of the Ford Explorer, with which it shared a platform. We Think: The Aviator name no longer fits with Lincoln's naming nomenclature. Too bad, it's better than any other name Lincoln currently uses, save for its former big brother, the Navigator. Perhaps we're barking up the wrong tree, though. Ford has made several customized, aviation themed-Mustangs in the past, including one called the Mustang AV8R in 2008, which had cues from the US Air Force's F-22 Raptor fighter jet. It sold for $500,000 at auction, and the glass roof – which is reminiscent of a fighter jet cockpit – helped Ford popularize the feature. Trademark: EcoBeast Company: Ford Previous Use: None by major carmakers.

FCA-Renault revival may hinge on willingness to cut Nissan stake

Mon, Jun 10 2019Fiat Chrysler Automobiles and Renault are looking for ways to resuscitate their collapsed merger plan and secure the approval of the French carmaker's alliance partner Nissan, according to several sources close to the companies. Nissan is poised to urge Renault to significantly reduce its 43.4% stake in the Japanese company in return for supporting a FCA-Renault tie-up, two people with knowledge of its thinking also told Reuters. It is still far from clear whether any concerted effort to revive the complex and politically fraught deal can succeed. FCA Chairman John Elkann abruptly withdrew his $35 billion merger offer in the early hours of June 6 after the French government, Renault's biggest shareholder, blocked a vote by its board and demanded more time to win Nissan's backing. Nissan representatives had said they would abstain. The failure, which FCA and Renault blamed squarely on the French government, deprived both companies of an opportunity to create the world's third-biggest carmaker with 5 billion euros ($5.6 billion) in promised annual synergies. It also shone a harsh light on Renault's relations with Nissan, which have gone from frayed to fried since the November arrest of former alliance Chairman Carlos Ghosn, now awaiting trial in Japan on financial misconduct charges he denies. REVIVAL TALKS Italian-American FCA — whose brand stable encompasses Fiat runabouts, Jeep SUVs, RAM pickups, Alfa Romeo luxury cars and Maserati sports cars — has so far turned a deaf ear to suggestions by French officials that its merger proposal could be revisited. But since the breakdown, Elkann and his French counterpart Jean-Dominique Senard have had talks about reviving the plan that left the Renault chairman and his Chief Executive Thierry Bollore upbeat about that prospect, three alliance sources said. Renault and a spokesman for FCA declined to comment. One of Elkann's senior advisors on the Renault merger bid, Toby Myerson, was expected at Nissan headquarters in Yokohama on Monday for exploratory discussions with top management, two people with knowledge of the matter said. Nissan CEO Hiroto Saikawa is likely to attend. Myerson did not respond to a message from Reuters seeking comment. The meeting comes amid mounting strains that may preclude compromise, after Senard warned Saikawa that Renault was prepared to block key Nissan governance reforms in a dispute over board committees.