We Finance 2007 Chrysler Pt Cruiser Auto Clean Carfax Warranty A/c Cd Kylssentry on 2040-cars

Cleveland, Ohio, United States

Body Type:Wagon

Vehicle Title:Clear

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Make: Chrysler

Model: PT Cruiser

Warranty: Vehicle has an existing warranty

Trim: Base Wagon 4-Door

Drive Type: FWD

Mileage: 92,692

Disability Equipped: No

Sub Model: Auto w/CLEAN

Doors: 4

Exterior Color: White

Drive Train: Front Wheel Drive

Interior Color: Gray

Number of Doors: 4

Number of Cylinders: 4

Inspection: Vehicle has been inspected

Chrysler PT Cruiser for Sale

2005 chrysler pt cruiser gt convertible ho 2.4l turbo - mint - 11,200 miles!

2005 chrysler pt cruiser gt convertible ho 2.4l turbo - mint - 11,200 miles! 2001 pt cruiser sedan delivery custom built all steel head turner

2001 pt cruiser sedan delivery custom built all steel head turner 2007 chrysler pt cruiser touring wagon 4-door 2.4l(US $6,800.00)

2007 chrysler pt cruiser touring wagon 4-door 2.4l(US $6,800.00) 2001 chrysler pt cruiser base wagon 4-door 2.4l(US $5,497.00)

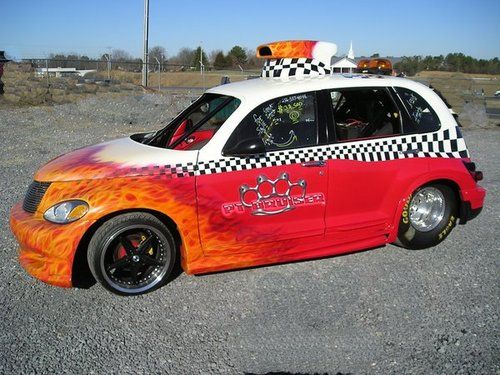

2001 chrysler pt cruiser base wagon 4-door 2.4l(US $5,497.00) Dodge plymouth hot rod,pro street,race car,drag racing

Dodge plymouth hot rod,pro street,race car,drag racing Best color combo cream & black leather , factory wheels .. super clean !!!

Best color combo cream & black leather , factory wheels .. super clean !!!

Auto Services in Ohio

Westside Auto Service ★★★★★

Van`s Tire ★★★★★

Used 2 B New ★★★★★

T D Performance ★★★★★

T & J`s Auto Body & Collision ★★★★★

Skipco Financial ★★★★★

Auto blog

FCA and Peugeot reportedly agree on merger

Wed, Oct 30 2019Citing a Wall Street Journal report, the Detroit Free Press says "Fiat Chrysler and PSA Groupe have agreed to merge." The Journal reported on talks between the two car companies only yesterday. It's said that Peugeot's board met yesterday to approve the deal, FCA's board met today, and an announcement could come as soon as tomorrow, Thursday. Both automakers have released statements, but neither company has released any information beyond admitting to ongoing talks. If the merger happens, the combined entity would become the world's fourth-largest carmaker with a $50 billion valuation, slotting in behind Toyota, the Volkswagen Group, and the Renault Nissan Mitsubishi alliance. Among the merger options possible, "an all-stock merger of equals" is the one analysts and Moody's seem to give the best grade. The reported merger would come about four months after FCA walked away from merger talks with Renault. FCA said the French government scuppered those talks over the role of Nissan in a reformed entity, but there were also brewing issues with French unions, and ongoing turmoil among Renault and Nissan leadership thanks to continuing fallout from ex-CEO Carlos Ghosn's arrest last year. FCA makes most of its revenue in the U.S. and rules Italy, while Peugeot is the second-best-selling automaker in Europe with its own brand in France and Opel in Germany. The two companies already have a partnership in Europe making vans, one that FCA CEO Mike Manley has spoken highly of. Among the list of obvious benefits in a potential merger, FCA would get access to Peugeot's small, modern platforms, $10.2 billion in cash, and electrified and hybrid architecture developments, the latter especially important to FCA as those are fields where it lags. Peugeot would get much easier access to the U.S. market, and the money-printing brands Jeep and Ram. A merged carmaker would have combined sales of nearly 9 million a year, based on 2018 results. By comparison, both Volkswagen and Toyota sell over 10 million cars a year, while the Renault-Nissan-Mitsubishi alliance almost 11 million. Peugeot CEO Carlos Tavares has proved he knows how to do turnarounds and mergers. After leaving a position as Carlos Ghosn's right-hand man in 2012, Tavares took over Peugeot in 2014, navigated a bailout from the French government and China's Dongfeng Motors in 2015, and turned PSA into a regional powerhouse.

FCA may sell off Magneti Marelli

Mon, Jul 20 2015FCA is reportedly just days away from filing the official prospectus for the Ferrari initial public offering, and it could put the Italian sportscar maker's value at $11 billion. Although, Sergio Marchionne always seems to have another iron in the fire, and his next big deal could shed the automotive giant's Magneti Marelli parts business to the tune of $3.3 billion. According to Reuters citing anonymous insider sources, at least two private equity firms are considering joint submitting bids with firms already in the industry. This deal has reportedly been in the works for at least the last few weeks. According to Reuters, FCA already rejected a roughly $2.7-billion offer in June. Marchionne apparently wants at least the equivalent of $3.3 billion for the company. Publicly, FCA isn't talking, though. Company spokesperson Gualberto Ranieri told Reuters and reiterated to Autoblog simply that Magneti Marelli wasn't for sale. However, a move to get rid of the parts company has been discussed in the past. In 2013, the business was rumored to be part of a purported arrangement to sell Alfa Romeo to Audi. While there's no final decision yet, according to Reuters, if the Magneti Marelli sale does move forward the decision would likely come sometime after the Ferrari IPO. The company would likely be split up among the various divisions. "Everyone will take a fair share of it," one of the anonymous sources to Reuters. News Source: ReutersImage Credit: Jeff Kowalsky / Bloomberg via Getty Images Earnings/Financials Chrysler Fiat Sergio Marchionne FCA fca us magneti marelli

Fiat Chrysler's third-quarter operating profit exceeds expectations

Thu, Oct 31 2019MILAN — Fiat Chrysler on Thursday posted higher than expected operating earnings in the third quarter, lifted by record profitability in North America, as the carmaker heads to a merger with French rival PSA. The strong results led Fiat Chrysler (FCA) to reiterate its full-year guidance of adjusted earnings before interest and tax (EBIT) over 6.7 billion euros ($7.5 billion). It also expects a further improvement of its financial performance in 2020. FCA and PSA said earlier on Thursday they planned to join forces through a 50-50 share swap to create the worldÂ’s fourth-largest automaker, triggering a new wave of consolidation in the car industry. Earnings/Financials Chrysler Fiat