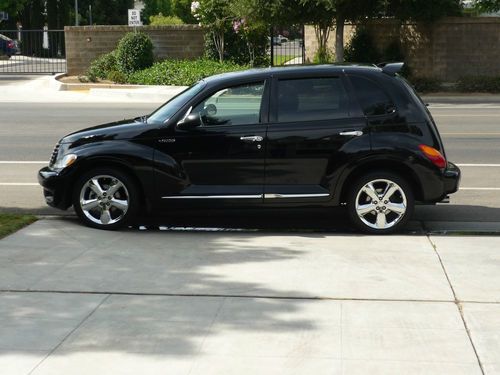

2007 Pt Cruiser Touring $25,000 on 2040-cars

Ronald, Washington, United States

Vehicle Title:Clear

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: blue/grey

Make: Chrysler

Number of Cylinders: 4

Model: PT Cruiser

Trim: Touring Wagon 4-Door

Options: Cassette Player, CD Player

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 75,640

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Sub Model: touring

Exterior Color: Blue

This is a clean car, has low miles and it came from Arizona so it has no rust and no cracked dash cold a/c factory stereo c/d player. It is currently registered in Washington state. Tire are in great shape alloy wheels. Also gets great gas mileage and fun to drive.

Chrysler PT Cruiser for Sale

2005 chrysler pt cruiser convertible touring 83k miles chrome wheels low reserve

2005 chrysler pt cruiser convertible touring 83k miles chrome wheels low reserve 05 chrysler pt cruiser touring turbo convertible(US $5,999.00)

05 chrysler pt cruiser touring turbo convertible(US $5,999.00) 2006 chrysler pt cruiser touring wagon 4-door 2.4l

2006 chrysler pt cruiser touring wagon 4-door 2.4l Chrysler pt cruiser 2004 88300 mi(US $3,800.00)

Chrysler pt cruiser 2004 88300 mi(US $3,800.00) 2006 chrysler pt cruiser touring wagon 4-door 2.4l(US $4,500.00)

2006 chrysler pt cruiser touring wagon 4-door 2.4l(US $4,500.00) Pt cruiser - 2004 - turbo - 1 owner - 59,400 miles(US $9,500.00)

Pt cruiser - 2004 - turbo - 1 owner - 59,400 miles(US $9,500.00)

Auto Services in Washington

Werner`s Crash Shop ★★★★★

Wayne`s Auto Repair ★★★★★

Washington Auto Credit ★★★★★

Universal Auto Body & Service ★★★★★

Tri-Cities Battery-Auto Repair ★★★★★

The Audio Experts with Discount Car Stereo ★★★★★

Auto blog

Stellantis won't race to split electric vehicles from fossil fuel cars

Fri, May 6 2022MILAN - Stellantis is not considering splitting its electric vehicle (EV) business from its legacy combustion engine operation, its finance chief said on Thursday, as the carmaker presented above-expectation revenue data for the first quarter. Chief Financial Officer Richard Palmer told analysts he did not see huge benefits in the kind of separations pursued by rivals such as France's Renault and U.S. Ford. "We need to manage the company and the assets we have through this transition," he said. "There are benefits to having the cash flow being generated by the internal combustion business for the investments we need to make." Palmer said the group, formed by a merger last year of Fiat Chrysler and Peugeot maker PSA, was not averse to considering adjusting its structure "but we aren't anticipating any big changes." Palmer's comments came after the world's fourth largest carmaker said its net revenue rose 12% to 41.5 billion euros ($44.1 billion) in the January-March period, as strong pricing and the type of vehicles sold helped offset the impact of the semiconductor shortage on volumes. That topped analyst expectations of 36.9 billion euros, according to a Reuters poll. Milan-listed shares were up 0.5% by 1415 GMT, in line with Italy's blue-chip index. The impact of the chip crunch was evident in the decline in shipment figures which fell 12% in the quarter to 1.374 million vehicles. It was a similar story for Germany's BMW which posted higher revenues on Thursday and a decline in car sales. Riding the Recovery Stellantis, whose brands also include Citroen, Jeep and Maserati, confirmed its 2022 forecasts for a double-digit adjusted operating income margin, after 11.8% last year, and a positive cash-flow despite supply and inflationary headwinds. Morgan Stanley analysts said after the results that Stellantis had better management than many peers and benefited from its significant exposure to a stronger U.S. economy and a European recovery from the COVID-19 pandemic. They also said it was less affected by a slowing Chinese economy. Palmer said it was important for the group to maintain double-digit margins and keep delivering positive cash flows. "A 12% increase in revenue with a 12% decrease in volumes indicates a very strong performance on price and mix, which augurs well for our margin performance," he said. He said semiconductor supply problems were expected to ease this year with continued improvements in 2023.

Peugeot maker PSA posts record profits ahead of FCA merger

Wed, Feb 26 2020PARIS — Peugeot maker PSA Group said its profitability reached a record high in 2019 but the French carmaker forecast falling industry sales in Europe this year as it pursues its merger with Fiat Chrysler, which is strong in North America. PSA has trimmed costs in areas such as the procurement of components as it has integrated its acquisition of Opel and Vauxhall, boosting operating margins to 8.5% last year. The group, which also produces cars under the Citroen and DS brands, offset a slump in vehicle sales by selling pricier SUV models, with launches including the Citroen C5 Aircross helping to lift revenues by a higher-than-expected 1% to $81.2 billion (74.7 billion euros). That helped it stand out in a car market where some rivals including France's Renault have struggled with sliding revenues and profits, amid a broader downturn in demand. PSA's group net profit increased 13.2% to a record 3.2 billion euros, and the company increased its dividend against 2019 results to 1.23 euros per share, up 58% from 2018 levels. The carmaker was "once again very solid", analysts at brokerage Oddo-BHF said in a note, adding the results confirmed the company's "best-in-class status." However PSA forecast a 3% contraction in Europe's car market this year, by far its biggest market. The tie-up with Fiat Chrysler will help it gain exposure to that group's strong presence in North America with brands like Jeep. The two companies struck a deal in December to create the world's No.4 carmaker, to better cope with market turmoil and the cost of making less-polluting vehicles. Fiat also posted more upbeat results than most rivals this year. CORONAVIRUS WEIGHS PSA boss Carlos Tavares told a news conference that the two groups were both in good shape and well placed to face market challenges together. He said he did not expect any major regulatory hurdles to the merger, adding it had so far submitted 14 approval requests to competition authorities out of the 24 it needs. There are no immediate plans to change anything in the large portfolio of brands within the combined group, he added. However the companies still face problems this year, including the coronavirus outbreak which has paralyzed production in China and hits carmakers' supply chain. PSA said the coronavirus impact was still difficult to assess. It factories in Wuhan, at the epicenter of the outbreak, are due to reopen in the second week of March.

Fiat seeking autonomous partnerships with Uber and Amazon

Fri, Jun 10 2016If Fiat Chrysler Automobiles CEO Sergio Marchionne can't find another automaker to partner with, he'll have to look elsewhere. Like, outside the traditional automotive industry entirely, if recent reports are to be believed. According to Bloomberg and Business Insider, Fiat is pursuing relationships with Uber and Amazon for self-driving vehicles. This news comes shortly after FCA announced an official tie-up with Google to turn 100 Chrysler Pacifica minivans into autonomobiles. Uber might want to venture into self-driven vehicles for its ride-hailing service, cutting out the expense of human drivers. For its part, Amazon could use autonomous vehicles for deliveries from its online shopping destinations. FCA's interest in these endeavors seems to revolve around their vehicles being used as platforms for software and bespoke hardware setups created by the tech companies. There's no indication of what vehicles FCA would provide to either Uber or Amazon, but something minivan shaped could capably serve both the ride-sharing and package delivery service industries. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. News Source: Bloomberg, Business InsiderImage Credit: Jeff Kowalsky/Bloomberg via Getty Green Chrysler Fiat Transportation Alternatives Technology Emerging Technologies Autonomous Vehicles Uber Sergio Marchionne FCA Amazon