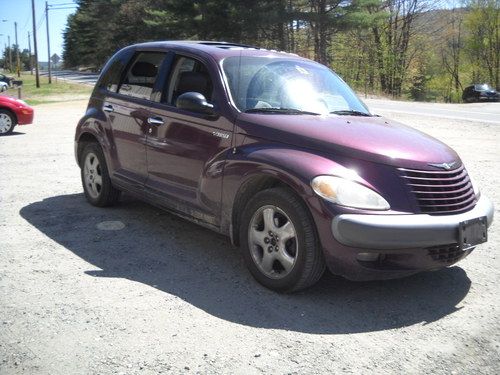

2005 Chrysler Pt Cruiser Gt Convertible 2-door 2.4l on 2040-cars

Wisconsin Rapids, Wisconsin, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Turbocharged

Fuel Type:GAS

For Sale By:Private Seller

Make: Chrysler

Model: PT Cruiser

Warranty: Vehicle does NOT have an existing warranty

Trim: GT Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 23,198

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Sub Model: GT

Exterior Color: Blue

Number of Cylinders: 4

Chrysler PT Cruiser GT Convertible. Excellent condition with super low 23,198 miles. I bought this car for my wife as an anniversary present and she only drove it on very special occasions. Car is electric blue and has every available option. I just had the car serviced and installed all new Goodyear Eagle F1 tires on it so it is literally like new. Convertible "boot" cover is included. Phone 715-213-7008.

Chrysler PT Cruiser for Sale

Auto Services in Wisconsin

Versus Paint & Collision ★★★★★

U S Speed Research ★★★★★

Topel`s Towing & Repair Inc ★★★★★

Tj`s Auto Body ★★★★★

Swant Graber Ford ★★★★★

Sebring Garage ★★★★★

Auto blog

China-FCA merger could be a win-win for everyone but politicians

Tue, Aug 15 2017NEW YORK — Fiat Chrysler boss Sergio Marchionne has said the car industry needs to come together, cut costs and stop incinerating capital. So far, his words have mostly fallen on deaf ears among competitors in Europe and North America. But it appears Marchionne has finally found a receptive audience — in China. FCA shares soared Monday after trade publication Automotive News reported the $18 billion Italian-American conglomerate controlled by the Agnelli family rebuffed a takeover from an unidentified carmaker from the Chinese mainland. As ugly as the politics of such a combination may appear at first blush, a transaction could stack up industrially, and perhaps even financially. A Sino-U.S.-European merger would create the first truly global auto group. That could push consolidation to the next level elsewhere. Moreover, China is the world's top market for the SUVs that Jeep effectively invented, so it might benefit FCA financially. A combo would certainly help upgrade the domestic manufacturer; Chinese carmakers have gotten better at making cars, but struggle to build global brands, and they need to develop export markets. Though frivolous overseas shopping excursions by Chinese enterprises are being reined in by Beijing, acquisitions that support the modernization and transformation of strategic industries still receive support, and the government considers the automotive industry to be strategic. A purchase of FCA by Guangzhou Automobile, Great Wall or Dongfeng Motors would probably get the same stamp of approval ChemChina was given for its $43 billion takeover of Syngenta. What's standing in the way? Apart from price (Automotive News said FCA's board deemed the offer insufficient) there's the not-insignificant matter of politics. Even as FCA shares soared, President Donald Trump interrupted his vacation to instruct the U.S. Trade Representative to look into whether to investigate China's trade policies on intellectual property. Seeing storied Detroit brands like Jeep, Chrysler, Ram and Dodge handed off to a Chinese company would provoke howls among Trump's economic-nationalist supporters. It might not play well in Italy, either, to see Alfa Romeo and Maserati answering to Wuhan instead of Turin — though Automotive News said they might be spun off separately. Yet, as Morgan Stanley observes, "cars don't ship across oceans easily," and political considerations increasingly demand local manufacture of valuable products.

FCA under investigation for fraud by FBI, SEC, and DOJ

Tue, Jul 19 2016The US Justice Department is currently in the initial stages of investigating Fiat Chrysler Automobiles for fraud, according to two anonymous sources that spoke with Bloomberg. According to the unnamed sources, prosecutors are examining whether FCA violated US securities laws. As part of a coordinated investigation into FCA's sales reporting practices, investigators from the Federal Bureau of Investigation and the Securities and Exchange Commission visited the automaker's field staff in their offices and homes earlier this month, reports Automotive News. According to an anonymous source that spoke to Automotive News, federal staff attorneys visited FCA's US headquarters in Auburn Hills, MI on July 11. The unnamed source told the outlet that employees were advised to seek counsel before speaking with investigators. Investigators also visited the automaker's offices in Dallas, California, and Orlando, the unnamed source told Automotive News. The investigation comes after FCA claimed it had recorded the best month of sales in the US in the automaker's history in December with a total of 217,527 vehicles sold, reports Bloomberg. The claim now seems untrustworthy. According to a previous report from Automotive News, a Chicago-based dealership group filed a lawsuit against FCA earlier this year. The suit accused the automaker of paying dealers to fake new-vehicle sales. At the time, the automaker claimed the allegations were baseless and had no merit. After the lawsuit, FCA started to add an extended disclaimed at the end of its monthly sales reports, according to Automotive News. In a statement, FCA claimed that the automaker is cooperating with the SEC investigation and pointed out that it records "revenues based on shipments to dealers and customers, not on reported vehicle unit sales to end customers." We'll have more on the investigation as it unfolds. Related Video: News Source: Automotive News-sub.req., Automotive News-sub.req, Bloomberg, GIUSEPPE CACACE/AFP/Getty Images Government/Legal Chrysler Fiat FCA USDOJ investigation

I sold my Viper, but the memories I'll keep

Thu, 30 May 2013The following is written by auto industry veteran Tow Kowaleski. The words are his own, but the memories now belong to everyone thanks to his willingness to share. If you're an industry veteran with a story to share, contact us at tipsATautoblogDOTcom.

It became the flame that started the fire of belief in the next life of Chrysler.

I just sold a car. Nothing new. Millions do it every day. But my car was a 1995 Dodge Viper, so maybe it was a bit more unique since just 12,000 were built. And like others selling a car that's been a part of the family for close to 20 years, this was a confluence of emotions for me. I was sad to see it go, but happy to have the cash and one less big, shiny, under-utilized object in my life.

2001 chrysler pt cruiser, no reserve

2001 chrysler pt cruiser, no reserve 2006 chrysler pt cruiser touring wagon 4-door 2.4l

2006 chrysler pt cruiser touring wagon 4-door 2.4l 2002 chrysler pt cruiser base wagon 4-door 2.4l

2002 chrysler pt cruiser base wagon 4-door 2.4l 2002 chrysler pt cruiser base wagon 4-door 2.4l

2002 chrysler pt cruiser base wagon 4-door 2.4l 2001 chrysler pt cruiser

2001 chrysler pt cruiser 2001 chrysler pt cruiser

2001 chrysler pt cruiser