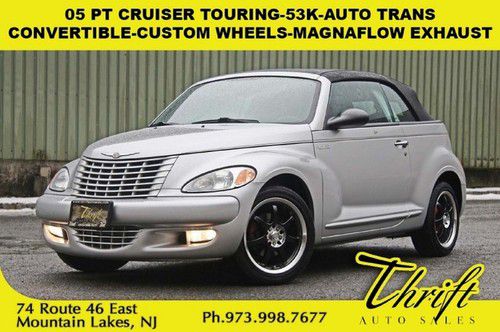

05 Pt Cruiser Touring-53k-auto Trans-convertible-custom Wheels-magnaflow Exhaust on 2040-cars

Mountain Lakes, New Jersey, United States

For Sale By:Dealer

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Turbocharged

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Cab Type (For Trucks Only): Other

Make: Chrysler

Warranty: Vehicle does NOT have an existing warranty

Model: PT Cruiser

Trim: Touring Convertible 2-Door

Disability Equipped: No

Drive Type: FWD

Doors: 2

Mileage: 53,435

Drive Train: Front Wheel Drive

Sub Model: Touring

Exterior Color: Silver

Number of Cylinders: 4

Interior Color: Gray

Chrysler PT Cruiser for Sale

2005 chrysler pt cruiser gt convertible 2.4l ho turbo

2005 chrysler pt cruiser gt convertible 2.4l ho turbo 2007 chrysler pt cruiser 5speed sunroof cd audio 62k mi texas direct auto(US $6,980.00)

2007 chrysler pt cruiser 5speed sunroof cd audio 62k mi texas direct auto(US $6,980.00) 2009 chrysler pt cruiser 2.4l automatic cd audio 73k mi texas direct auto(US $7,980.00)

2009 chrysler pt cruiser 2.4l automatic cd audio 73k mi texas direct auto(US $7,980.00) 2008 chrysler pt cruiser convertible cruise ctrl 64k mi texas direct auto(US $10,980.00)

2008 chrysler pt cruiser convertible cruise ctrl 64k mi texas direct auto(US $10,980.00) We finance!!! 2005 chrysler pt cruiser limited turbo auto leather roof 1 owner(US $7,888.00)

We finance!!! 2005 chrysler pt cruiser limited turbo auto leather roof 1 owner(US $7,888.00) Used chrylser pt cruiser automatic crossover 4dr sedan we finance auto gas saver

Used chrylser pt cruiser automatic crossover 4dr sedan we finance auto gas saver

Auto Services in New Jersey

Woodstock Automotive Inc ★★★★★

Windrim Autobody ★★★★★

We Buy Cars NJ ★★★★★

Unique Scrap & Auto - USA ★★★★★

Turnersville Pre-Owned ★★★★★

Trilenium Auto Recyclers ★★★★★

Auto blog

Fiat Chrysler's UAW members ratify new four-year contract

Thu, Dec 12 2019DETROIT — The United Auto Workers union said on Wednesday that rank-and-file members at Fiat Chrysler Automobiles NV have voted in favor of a new four-year labor contract with the automaker, helping the Italian-American firm avoid a strike as it works to merge with France's Groupe PSA. FCA and PSA, the maker of Peugeot and Citroen, in October announced a planned $50 billion merger to create the world's fourth-largest automaker. FCA's 47,200 rank-and-file UAW members voted 71% in favor of the new contract. The deal follows contracts the UAW already concluded with larger rivals General Motors and Ford. “Every full-time production employee currently at FCA will be at top rate by the end of this four-year agreement,” Cindy Estrada, UAW vice president and director of the union's FCA department, said in a statement. She added that all temporary workers also have a path to full employment. “We are pleased to have reached a new agreement that allows us to continue our record of adding good-paying UAW-represented jobs,” FCA North America Chief Operating Officer Mark Stewart said in a statement. Ratification of the contract had not been viewed as a sure thing, as union members at FCA in 2015 rejected the first version of a contract. In addition, a federal corruption probe related to embezzlement at the union drew attention. The federal corruption probe led GM to file a racketeering lawsuit against FCA, alleging its rival bribed union officials over many years to corrupt the bargaining process and gain advantages, costing GM billions of dollars. FCA has brushed off the lawsuit as groundless. The contract with GM that was ratified by workers in October followed a 40-day strike in the United States that virtually shuttered GM's North American operations and cost the automaker $3 billion. The UAW has said the contract with FCA included a commitment by the automaker to invest $9 billion, creating 7,900 new jobs over the course of the contract. Of the $9 billion, $4.5 billion was announced earlier this year, to be invested in five plants and creating 6,500 jobs. The investments include $2.8 billion at Warren Truck Assembly plant in Michigan to build a new a plug-in hybrid SUV in 2021 and a potential increase of 1,500 jobs.

Jeep follows up Super Bowl spot with call to help the USO

Tue, 05 Feb 2013Once again, Chrysler had one of the most talked about Super Bowl commercials with its two-minute Whole Again Jeep spot, which was used to highlight its Operation SAFE Return program for US military personnel returning home from active duty. As part of this campaign, Jeep announced today that it will be donating up to $300,000 to the United Services Organizations (USO), and you can help.

Simply tweet using the #joinOSR hashtag on Twitter, visit the Yahoo! homepage or go to the Jeep Operation SAFE Return website, and Jeep will donate $1 to a fund that provides returning troops things like employment assistance and incentives to buy new vehicles. Jeep is also donating to this charity to the tune of $250 for each Jeep Wrangler and Wrangler Unlimited (including the Freedom Edition model) and Jeep Patriot Freedom Edition model sold.

Stellantis is official: FCA and PSA merger finally sealed

Sat, Jan 16 2021MILAN — Fiat Chrysler and PSA sealed their long-awaited merger on Saturday to create Stellantis, the world's fourth-largest auto group with deep enough pockets to fund the shift to electric driving and take on bigger rivals Toyota and Volkswagen. It took over a year for the Italian-American and French automakers to finalize the $52 billion deal, during which the global economy was upended by the COVID-19 pandemic. They first announced plans to merge in October 2019, to create a group with annual sales of around 8.1 million vehicles. "The merger between Peugeot S.A. and Fiat Chrysler Automobiles N.V. that will lead the path to the creation of Stellantis N.V. became effective today," the two automakers said in a statement. Shares in Stellantis, which will be headed by current PSA Chief Executive Carlos Tavares, will start trading in Milan and Paris on Monday, and in New York on Tuesday. Now analysts and investors are turning their focus to how Tavares plans to address the huge challenges facing the group – from excess production capacity to a woeful performance in China. Tavares will hold his first press conference as Stellantis CEO on Tuesday, after ringing NYSE's bell with Chairman John Elkann. FCA and PSA have said Stellantis can cut annual costs by over 5 billion euros ($6.1 billion) without plant closures, and investors will be keen for more details on how it will do this. Marco Santino, a partner at consultants Oliver Wyman, said he expected Tavares to disclose the outlines of his action plan soon, but without divulging too many details at first. "He has proven to be the kind of person who prefers action to words, so I don't think he will make loud statements or try to over-sell targets," he said. Like all global automakers, Stellantis needs to invest billions in the years ahead to transform its vehicle range for the electric era. But other pressing tasks loom, including reviving the group's lagging fortunes in China, rationalizing its huge global empire and addressing massive overcapacity. "It will be a step by step process, also to allow the market to better appreciate every single move. I don't think we will have all the details before one year," Santino said.