1965 Chrysler Newport Chrome on 2040-cars

Glendale, Arizona, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:383

VIN (Vehicle Identification Number): 5R9185301

Mileage: 78000

Trim: chrome

Number of Cylinders: 8

Make: Chrysler

Drive Type: RWD

Model: Newport

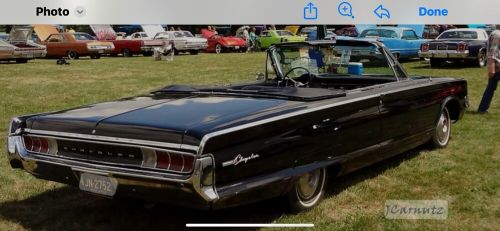

Exterior Color: Black

Chrysler Newport for Sale

1968 chrysler newport convertible(US $20,968.00)

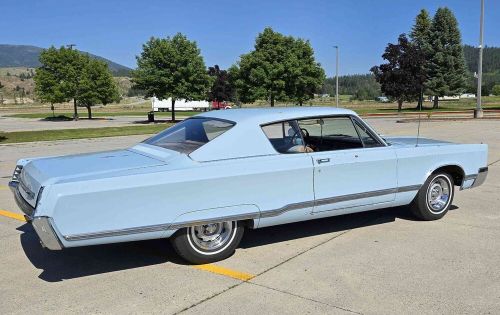

1968 chrysler newport convertible(US $20,968.00) 1966 chrysler newport(US $17,500.00)

1966 chrysler newport(US $17,500.00) 1966 chrysler newport(US $24,995.00)

1966 chrysler newport(US $24,995.00) 1955 chrysler newport windsor deluxe(US $16,500.00)

1955 chrysler newport windsor deluxe(US $16,500.00) 1967 chrysler newport custom(US $3,000.00)

1967 chrysler newport custom(US $3,000.00) 1968 chrysler newport(US $3,000.00)

1968 chrysler newport(US $3,000.00)

Auto Services in Arizona

Wright Cars ★★★★★

World Class Automotive Repair ★★★★★

Walt`s Body & Paint, LLC ★★★★★

Upark We Sell IT ★★★★★

Tristan Express Auto Sales ★★★★★

Superstition Springs Lexus ★★★★★

Auto blog

Trump wants a trade deal, but South Korea doesn't want US cars

Thu, Jul 6 2017SEOUL - US auto imports from the likes of General Motors and Ford must become more chic, affordable or fuel-efficient to reap the rewards of President Donald Trump's attempts to renegotiate a trade deal with key ally South Korea, officials and industry experts in Seoul say. Meeting South Korean President Moon Jae-in last week in Washington, Trump said the United States would do more to address trade imbalances with South Korea and create "a fair shake" to sell more cars there, the world's 11th largest auto market. "What we really want to say to the United States is: Make good cars, make cars that Korean consumers like." While imports from automakers including Ford, Chrysler and GM more than doubled last year largely thanks to free trade deal which took effect in 2012, sales account for just 1 percent of a market dominated by more affordable models from local giants Hyundai and affiliate Kia. Imports make up just 15 percent of the overall Korean auto market, and are mainly more luxurious models from German automakers BMW and Daimler AG's Mercedes-Benz, which also benefit from a trade deal with the European Union. "Addressing non-tariff barriers would not fundamentally raise the competitiveness of US cars," a senior Korean government official told Reuters, declining to be identified because of the sensitivity of the subject. "What we really want to say to the United States is: Make good cars, make cars that Korean consumers like." TASTE BARRIER In Korea, US imports are seen as lagging German brands in brand image, sophistication and fuel economy, industry experts say. US imports do have a competitive advantage in electric cars: Tesla Motors' electric vehicles are seen as both environmentally friendly and trendy, while GM has launched a long-range Bolt EV. US Commerce Secretary Wilbur Ross had cited a quota in the current trade deal as an obstacle to boosting imports. The quota allows US automakers to bring in each year 25,000 vehicles that meet US, not necessarily Korean, safety standards. Should GM, for example, decide to bring in more than its quota of one model - the Impala sedans - it would cost up to $75 million to modify the cars to meet Korean safety standards, the company told its local labor union. Asked about non-tariff barriers, a spokesman at GM's Korean unit said removing them could expand the range of models the company can bring in from the United States. No US company, however, has yet to make full use of the quota, industry data shows.

Hot sales have Detroit automakers shortening summer shutdowns

Tue, 08 Jul 2014Back in May, there was speculation that the Detroit Three automakers would maintain or perhaps even extend their traditional summer shutdowns, mostly due to a bitingly cold winter that saw below-freezing temperatures infiltrate the southernmost reaches of the US, putting a chill on auto sales. Now, though, the numbers are in, and thanks to some promising sales figures, it looks like some domestic line workers are going to be working clear through July, in some cases.

According to Automotive News, Ford has slashed its traditional two-week hiatus for factory workers in half at four of its plants, while both Chrysler and General Motors will keep factories running nonstop (two plants in Chrysler's case and a third of GM's factories).

This is, as we said, thanks to some positive numbers. Chief among those is the Seasonal Adjusted Annual Rate, which was at an eight-year high of 17 million units. Individual figures were less promising. GM, embroiled in its recall scandal, still saw a one-percent increase while Ford dropped six percent in year-over-year sales. Chrysler was the big winner, though, with a nine-percent jump in June.

Plug-in BMWs, long-term updates and the best of SEMA 2018 | Autoblog Podcast #560

Thu, Nov 1 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Associate Editor Reese Counts. The pair discuss the BMW 740e xDrive iPerformance plug-in hybrid as well as our long-term Chrysler Pacifica Hybrid and Honda Ridgeline. They also discuss the best of SEMA Show 2018, including some pretty wild cars from Dodge and Chevy. Finally, we spend your money. This week, rather than pulling questions in from our email, we head to Reddit to answer some questions on r/cars.Autoblog Podcast #560 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2018 BMW 740e xDrive iPerformance 2018 Chrysler Pacifica Hybrid long-term 2018 Honda Ridgeline RTL-E long-term SEMA Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Green Podcasts BMW Chrysler Dodge Honda chrysler pacifica