1991 Chrysler New Yorker Fifth Avenue 4dr 3.8l V6 Automatic 1-owner Car Low Mile on 2040-cars

Tremont, Pennsylvania, United States

|

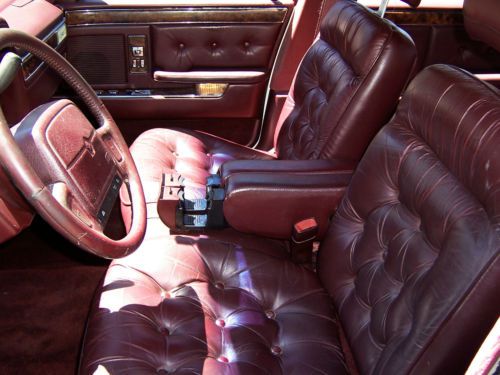

'91 Chrysler New Yorker Fifth Avenue 4 door luxury sedan with 3.8L V6 engine and automatic transmission. car is in driveable condition, all electrical power and air conditioning work great.. has leather burgundy button seats(no rips), interior carpeting all clean with only headliner drooping down(see photos).. body straight, no dents with only small areas of rust and areas of paint peels, frame has no rust and well kept for its age. glass is all good (no cracks) all electrical works(see list below)... cooling system just flushed & filled, also new oil change and full tune-up including spark plugs. car is safe, road worthy and good to go driving, with over 50% tread tires and spare included... please ask questions, additional photos are available on request.... car is located in PA. zip code 17981 and am willing to help winning bidder to coordinate their choice of carrier transport service or just come on over and drive it home... I am the 2nd owner with low low miles for its age ....take a look through all the photos provided showing car,ask

questions for anything we may have missed and have fun bidding.

the goodies are: power adjustment reclining seats(driver and passenger)-working power windows-working power locks-working armrests with built-in slide out cup holders-working factory stereo AM/FM/CD player-working power antenna-working air conditioning-working brrrrrr cruise control-working tilt steering wheel with(cruise controls)-working sunvisors lighted mirrors-working 141000 original miles-working digital instrument cluster-working flip cover headlights-working automatic transmission-working 3.8L V6 power engine-working large comfortable seats-working large trunk space plenty of leg room driverside airbag no reserve auction more goodies are: body straight tires good engine strong chassis/frame no rust comfy seats smooth ride the baddies are: drooping headliner two speakers may need replaced and the uglies are: minimal areas of paint faded/peeled minimal areas of rust |

Chrysler New Yorker for Sale

1984 new yorker one owner 26k miles org.

1984 new yorker one owner 26k miles org. 1953 chrysler new yorker **rare** hemi firepower 331ci v8

1953 chrysler new yorker **rare** hemi firepower 331ci v8 1950 green runsdrive nice bodyinterior vgood all original!

1950 green runsdrive nice bodyinterior vgood all original! 1956 chrysler new yorker with hemi engine!

1956 chrysler new yorker with hemi engine! Survivor car 1990 chrysler new yorker landau 161k miles 4 dr runs great(US $2,100.00)

Survivor car 1990 chrysler new yorker landau 161k miles 4 dr runs great(US $2,100.00) 1968 chrysler new yorker 4 dr hardtop .....california car(US $6,500.00)

1968 chrysler new yorker 4 dr hardtop .....california car(US $6,500.00)

Auto Services in Pennsylvania

YBJ Auto Sales ★★★★★

West View Auto Body ★★★★★

Wengert`s Automotive ★★★★★

University Collision Center ★★★★★

Ultimate Auto Body Inc ★★★★★

Stewart Collision Service ★★★★★

Auto blog

FCA explains, updates sales reporting in wake of investigation

Tue, Jul 26 2016Fiat Chrysler Automobiles (FCA) is currently under investigation by the Department of Justice (DoJ) and Securities and Exchange Commission (SEC) for possible misappropriation of monthly sales. Not only that but a dealer group filed a lawsuit against the auto company for allegedly bribing dealers to falsify sales reports. In the wake of these mounting pressures, FCA released a report explaining their old sales reporting methods, as well as introducing the method they will use now. The report explains that sales will break down into three main categories. The first category is simply sales made by dealers in the United States that were purchased by your typical consumer. The second group is fleet sales that were purchased directly from FCA. The final group is a mix of various sales including sales by Puerto Rican dealers, cars used for marketing, and vehicles delivered to FCA employees and retirees. The original method of recording these sales relied mainly on the New Vehicle Delivery Report (NVDR). This system allowed dealers to report new car sales at the time of sale. These sales were used to create and report a total at the end of each month. Dealers also had the ability to "unwind" sales. What this means is that a dealer could cancel the sale of a car that was reported as sold in the event that a customer couldn't purchase the car or wanted a different vehicle. This would also return factory incentives to Chrysler and end the warranty period. Fleet and other sales were not recorded through this system, and were rather included in a separate "reserve" of vehicles. FCA explained that it did not know why this was the case, but the company speculated the reason may have been to avoid reporting vehicles that hadn't made it to road use yet. FCA also emphasized that their retail sales reports do not reflect quarterly earnings. The company explained that those earnings are based on vehicles purchased from FCA, which includes sales like the cars dealers buy for their local inventories. The new method also shows FCA's long run of sales increases wasn't as long as first thought. FCA has adopted a new system for calculating sales in light of concerns and confusion. This system retains the categories listed above, but changes how it counts them. The dealer reported numbers will now only include sold vehicles and will deduct sales of unwound vehicles that month.

FCA US under-reported death and injury claims to NHTSA

Tue, Sep 29 2015The National Highway Traffic Safety Administration says FCA US significantly under-reported death and injury claims due to flaws in its early warning system. The government first discovered a potential problem with the automaker's reporting in late July, and FCA US has been investigating the issue since. NHTSA claims that the problem appears linked to the way the company gathers and reports safety information. The agency is still investigating how serious the flaws are and their causes. "This represents a significant failure to meet a manufacturer's safety responsibilities," NHTSA Administrator Mark Rosekind.Rosekind said in a statement. FCA US admits that it "identified deficiencies" in the reporting, but in a statement the company said that it notified NHTSA of the issue immediately. The company promised that it is taking this problem "extremely seriously" and pledged to remedy the situation. In late July, FCA US was hit with a potential $105-million fine by NHTSA for the way the automaker conducted some recalls. As part of that agreement, the company also consented to more rigorous oversight by safety regulators in the future and a buy-back of some affected vehicles. Other automakers have been punished for failing to submit EWR data. Honda incurred a $70 million fine in January from NHTSA for missing 1,729 incidents over 11 years. Ferrari had to pay $3.5 million in 2014 for not sending them in for three years. Statement from NHTSA Administrator, Mark Rosekind, on Fiat Chrysler Automobiles' under-reported discrepancy in FCA's Early Warning Report data September 29, 2015 "In late July, NHTSA notified Fiat Chrysler Automobiles of an apparent discrepancy in FCA's Early Warning Report data. FCA has informed NHTSA that in investigating that discrepancy, it has found significant under-reported notices and claims of deaths, injuries and other information required as part of the Early Warning Reporting system. Preliminary information suggests that this under-reporting is the result of a number of problems with FCA's systems for gathering and reporting EWR data. This represents a significant failure to meet a manufacturer's safety responsibilities. NHTSA will take appropriate action after gathering additional information on the scope and causes of this failure." – Mark Rosekind, NHTSA Administrator. Statement: TREAD Reporting September 29, 2015 , Auburn Hills, Mich.

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.