1956 Chrysler New Yorker Base 5.8l on 2040-cars

Dixon, Illinois, United States

Body Type:U/K

Engine:5.8L 5802CC 354Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Interior Color: Turquoise & white

Make: Chrysler

Number of Cylinders: 8

Model: New Yorker

Trim: Base

Warranty: Vehicle does NOT have an existing warranty

Drive Type: U/K

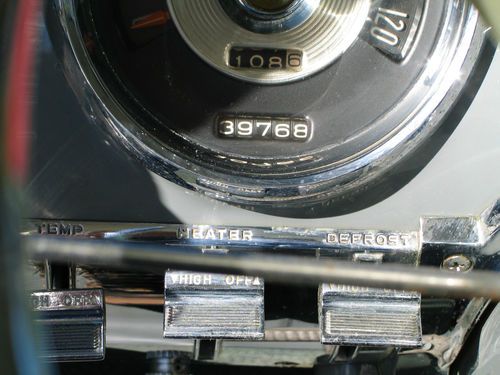

Mileage: 39,768

Exterior Color: Turquoise & white

Chrysler New Yorker for Sale

Chrysler new yorker 1971 hard top

Chrysler new yorker 1971 hard top 1958 chrysler new yorker

1958 chrysler new yorker 1977 chrysler new yorker brougham 4 door hardtop 440 engine

1977 chrysler new yorker brougham 4 door hardtop 440 engine 1972 chrysler new yorker all original numbers matching 440 ci v8 missouri car

1972 chrysler new yorker all original numbers matching 440 ci v8 missouri car Fifth avenue loaded white blue rare like diplomat gran fury caravelle no reserve

Fifth avenue loaded white blue rare like diplomat gran fury caravelle no reserve 1955 chrysler new yorker st regis 2dr ht hemi motor very rare car(US $10,995.00)

1955 chrysler new yorker st regis 2dr ht hemi motor very rare car(US $10,995.00)

Auto Services in Illinois

World Class Motor Cars ★★★★★

Wilkins Hyundai-Mazda ★★★★★

Unibody ★★★★★

Turpin Chevrolet Inc ★★★★★

Tuffy Auto Service Centers ★★★★★

Triple T Car Wash Lube & Detail Center ★★★★★

Auto blog

Move over Audi, now Chrysler has a beef with Tesla's claims

Thu, 23 May 2013In the same week that Audi said "not so fast" to some claims from Tesla, Chrysler has responded to a new press release from the California-based EV-maker by saying "not exactly, Tesla." The statement, released through the company's blog, comes in response to Tesla claiming it was "the only American car company to have fully repaid the government." Chrysler notes that it, too, recently paid back Uncle Sam from its 2008 bailout. Similar to Audi's recent press release, which was eventually and mysteriously deleted from the German automaker's site, Chrysler is both right and wrong in its statement.

Tesla specifically said that it had paid back the Department of Energy loans that many automakers received - including Fisker and VPG Autos - while Chrysler's retort argues Tesla is "unmistakably incorrect" since it repaid the government in 2011 a full six years early. Technically, the statements from both automakers are correct, but Tesla's startup loan originated from the DoE, while Chrysler's loan came in bailout form from the Troubled Asset Relief Program (TARP). Further, as The Detroit News notes, Chrysler's loan still cost taxpayers well over a billion dollars after all was said and done - those negative assets tied to "old Chrysler" in the bankruptcy did not require repayment.

Fiat Chrysler joins open pool with Tesla to avoid paying EU emissions fines

Sun, Apr 7 2019According to a report from the Financial Times, Fiat Chrysler has agreed to pay Tesla "hundreds of millions of euros" in order to pool their fleets together in Europe. This move will reportedly allow FCA to use Tesla's zero-emission vehicle sales to offset fines it would have to pay for failing to meet European Union carbon emissions rules, which fall to 95 grams per kilometer starting next year. According to the report, FCA joined a so-called open pool with Tesla on February 25. The electric car company created the pool and gave other automakers "the chance to join" three days prior. The pool will be valid "for several years," according to Julia Poliscanova, a senior director at the Transport & Environment lobbying group. Toyota and Mazda apparently created a similar pool on the same day, but that agreement doesn't elicit quite the same eyebrow raise since Toyota owns a five-percent stake in Mazda. It's not clear exactly how much money FCA will pay Tesla through this arrangement, but similar deals have been part of Tesla's financial strategy for years. FT reports Tesla earned more than $100 million by selling electric vehicle credits in the United States last year and close to $300 million the prior year.

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.