Restored St Regis Numbers Matching on 2040-cars

Gilroy, California, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:331 Hemi

For Sale By:Dealer

Interior Color: Orange/Sand

Make: Chrysler

Model: New Yorker

Trim: St Regis

Options: Leather Seats

Drive Type: R W D

Power Options: Power Seats

Mileage: 96,967

Exterior Color: Orange/Sand

|

1955 Chrysler New Yorker Hardtop St. Regis was created by Virgil Exner. The 1955's had that Hundred Million Dollar Look with its split eggcrate grille and tall, chrome-encased Twin Tower taillights and more. The chrome and stainless are almost perfect. It is equipped with factory power steering, original brakes, and a 6 volt system. All dash gauges work including lights and horn. Period correct White walls with original Chrysler wire wheels. Finished in near perfect Navajo Orange/ Desert Sand with matching two tone new leather interior. Original air cleaner in the trunk. This Icon is powered by the ever-potent original 331 Hemi V8 which produces 250 hp and driven by the Power Flite two-speed automatic. The odometer reads 96, 967 original miles. The total production of the plushly trimmed St. Regis was only 11,076. This stunning example is very rare and highly collectible. There is ZERO RUST and the lines and gaps line up great. This car is a pleasure to drive smooth, powerful and true luxury. #525238. Now on display at the home of “over the top cars”CHECKERED FLAG CLASSICS 7743 MONTEREY ST GILROY 408-847-8788, sold as-is, California buyers are responsible for sales tax and license. Bid with confidence I am a licensed bonded California dealer. This car is for sale locally therefore the auction can end at any time.

|

Chrysler New Yorker for Sale

Auto Services in California

Zoll Inc ★★★★★

Zeller`s Auto Repair ★★★★★

Your Choice Car ★★★★★

Young`s Automotive ★★★★★

Xact Window Tinting ★★★★★

Whitaker Brake & Chassis Specialists ★★★★★

Auto blog

FCA and PSA sign merger agreement

Wed, Dec 18 2019Confirming an earlier rumor, PSA Group and Fiat-Chrysler Automobiles (FCA) signed a binding merger agreement to create the world's fourth-largest automaker. The partners hope to leverage the benefits of economies of scale as they develop new technologies and expand their global presence. The announcement ends FCA's years-long search for a partner, which nearly ended earlier in 2019 when it came close to merging with Renault, PSA's rival. It brings Fiat, Chrysler, Dodge, Ram, Jeep, Alfa Romeo, Maserati, Lancia, Peugeot, Citroen, DS, and Opel/Vauxhall under the same roof. That's a huge portfolio of brands that often overlap, but executives pledged to keep them all open, as well as all their respective factories as a result of the transaction. They're committed to making this big family of automakers work by building on each one's strengths, whether they're technical or regional. FCA and PSA jointly predicted they'll sell about 8.7 million cars annually around the globe, while posting an ˆ11 billion (about $12.2 million) profit. North America, a strong market for FCA, will provide 43% of its revenues, and 46% will be generated in Europe, where Peugeot's brands are doing better than ever. Together, they plan to achieve ˆ3.7 billion (about $4.1 million) in annual run-rate synergies. They'll notably have the purchasing power to negotiate a better price with suppliers, and they'll merge their research and development efforts where it makes sense to do so. Over two thirds of the group's annual volume will be built on two shared platforms. One will underpin about three million small cars annually, and the other will serve as the foundation for approximately three million compact and mid-sized cars. Details about these architectures haven't been made public yet, but a quick look at both companies' product portfolios reveals the small car will very likely come from Peugeot. Recent additions to its range, like the second-generation 208, are built on a new architecture named Common Modular Platform (CMP) developed with electric powertrains in mind. Meanwhile, Fiat is still making the cheeky 500 on an evolution of the platform found under the second-generation Panda released in 2003. The bigger architecture could come from FCA, however. The group's brands will share engines, transmissions, electric powertrains, infotainment systems, various sensors used to power electronic driving aids, and other components like wiring looms, but each one will retain its own identity.

Appeals court delays 'sensible resolution' meeting between GM, Fiat Chrysler CEOs

Tue, Jun 30 2020DETROIT — Three federal appeals judges have delayed a court-ordered meeting between the CEOs of General Motors and Fiat Chrysler to try to settle a lawsuit over corruption by union leaders. U.S. District Court Judge Paul Borman last week ordered GM CEO Mary Barra and FCA CEO Mike Manley to meet before July 1. But GM on Friday asked the federal appeals court in Cincinnati to overturn the order and remove Borman from the case. In an order issued Monday, three appellate judges delayed Borman's order to provide time to consider legal points raised by GM. GM is suing crosstown rival FCA alleging that it got an advantage by paying off United Auto Workers union leaders to reduce labor costs during contract talks. FCAÂ’s former labor chief, Al Iacobelli, is in prison, although the company denies that it directed any prohibited payments. In his order last week, Borman described the lawsuit as a “nuclear option” that would be a “waste of time and resources” for years if he allows the case to move forward. The judge ordered Barra and Manley to sit down without lawyers by July 1 and reach a “sensible resolution of this huge legal distraction.” Borman wants an update from them on a public video conference that same day. Over the weekend he modified the order to allow lawyers to attend the meeting. In a court filing, GM called BormanÂ’s order a “profound abuse” of power. “The court possesses no authority to order the CEOs of GM and FCA to engage in settlement discussions, reach a resolution and then appear alone at a pretrial conference eight days later, without counsel,” GMÂ’s attorneys said. “Second, the court has no business labeling a properly filed federal lawsuit assigned to the court for impartial adjudication ‘a distractionÂ’ or a ‘nuclear option,’” GM said. Borman canÂ’t be viewed as impartial, company lawyers said. The judge declined to comment. In a court filing Monday, Fiat Chrysler lawyers wrote that GM didn't make a good case to remove Borman because judges routinely direct lawsuit parties to talk about settling. The lawyers wrote that GM originally wanted the case assigned to Borman but now apparently is worried that his tough questions mean he will dismiss GM's claims. “GM should not be permitted now to complain that that judge has turned out to be less hospitable to GMÂ’s claims than GM anticipated. Parties are not permitted to engage in such judge shopping," the filing said.

Hybrid, Plug-in Hybrid and EV Buyer's Guide: Which one do you want?

Fri, Nov 10 2017If you're shopping for a new vehicle these days, there's a litany of acronyms, buzzwords, and technobabble to further complicate an already difficult decision. But if you're looking at a green powertrain, you have three basic choices to compare: hybrid, plug-in hybrid and "EV" or, electric vehicle. So what are they and which one — if any — is right for you? Research your next new vehicle using Autoblog's Car Finder. Gasoline-Electric Hybrids By now, most people are familiar with the concept of a hybrid car. Thank Toyota's Prius for that. At its most basic, a hybrid vehicle has two powertrains, one gasoline and one electric, which work together for maximum efficiency. At low speeds, the engine can shut off entirely, relying solely on the battery for propulsion. The battery is either charged as you drive by converting kinetic energy into potential energy via a complex regenerative braking system, or directly off of the gas motor. This is a very hands-off, behind-the-scenes system as all the driver has to is put in gas and drive as normal. Hybrids come in all shapes and sizes and, according to the EPA, range in fuel economy from 58 mpg for the Hyundai Ioniq Blue all the way down to 13 mpg for the Ferrari LaFerrari Aperta. Best For: Anyone who want to see their fuel consumption go down without many sacrifices. You can easily find a hybrid sedan, hatchback, crossover, SUV or even a pickup truck (i f you can find one). Best of all, a hybrid requires no special equipment to be installed at home, or added work for the driver. Hybrids do cost more than traditionally-powered competitors, so make sure to compare projected fuel savings with how much extra a hybrid will cost – it may take a surprisingly long time to break even. The EPA provides a handy calculator for this very purpose. Our Favorite Hybrids: 2017 Toyota Prius 2018 Hyundai Ioniq Hybrid 2017 Ford Fusion Hybrid Plug-In Hybrids Sometimes referred to as a PHEV, or plug-in hybrid electric vehicle, this is a baby-step towards full electrification. Armed with a much larger battery pack than a hybrid, PHEVs can go between 12 ( Mercedes-Benz GLE550e) and 97 ( BMW i3 w/Range Extender) miles on electricity alone depending on the model and your driving style. Like a normal hybrid, the driver is largely unaware of which power source is currently in use, even as they switch over — either because the battery is drained, or the driving circumstances require more power.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.04 s, 7971 u

1974 chrysler new yorker brougham hardtop 4-door 7.2l 440 v8,

1974 chrysler new yorker brougham hardtop 4-door 7.2l 440 v8, No reserve auction 1993 chrysler 5th ave

No reserve auction 1993 chrysler 5th ave 1951 chrysler new yorker base 5.4l

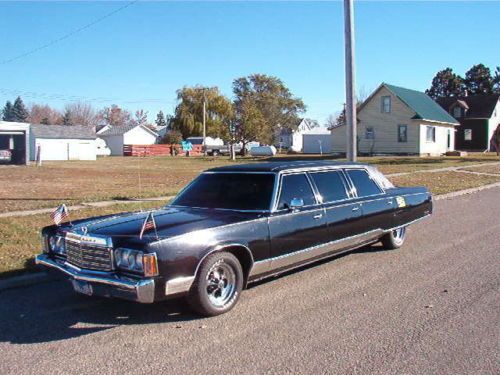

1951 chrysler new yorker base 5.4l Rare vintage 1974 6 door chrysler new yorker

Rare vintage 1974 6 door chrysler new yorker 1963 chrysler

1963 chrysler 1978 chrysler new yorker brougham hardtop 4-door 7.2l

1978 chrysler new yorker brougham hardtop 4-door 7.2l