1979 Chrysler New Yorker Base Hardtop 4-door 5.9l on 2040-cars

Cedar Springs, Michigan, United States

Chrysler New Yorker for Sale

1962 chrysler new yorker..very rare barn find and priced to sell!

1962 chrysler new yorker..very rare barn find and priced to sell! 1962 chrysler new yorker wagon original car see video 61 63 64 dodge plymouth

1962 chrysler new yorker wagon original car see video 61 63 64 dodge plymouth 1977 chrysler new yorker brougham

1977 chrysler new yorker brougham 1970 jesus chrysler new yorker! 36k original yikes! minty!(US $7,999.00)

1970 jesus chrysler new yorker! 36k original yikes! minty!(US $7,999.00) 1954 chrysler new yorker deluxe 2 door hardtop w/matching #s 331 hemi

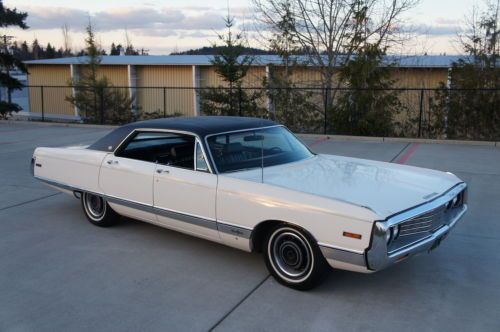

1954 chrysler new yorker deluxe 2 door hardtop w/matching #s 331 hemi 1973 chrysler new yorker brougham 2 door rare(US $13,000.00)

1973 chrysler new yorker brougham 2 door rare(US $13,000.00)

Auto Services in Michigan

Xpert Automotive Repair ★★★★★

White`s Muffler & Brakes ★★★★★

Westwood Auto Parts ★★★★★

West Michigan Collision ★★★★★

Wells-Car-Go ★★★★★

Ward Eaton Towing ★★★★★

Auto blog

Mopar opening Custom Shop at Cobo

Thu, 09 Jan 2014While other automakers have been streamlining their brand portfolio, the Chrysler Group has shown no such signs. It's got the Dodge, Chrysler and Jeep brands, plus Fiat, and it recently broke out its SRT and Ram nameplates into their own brands. And you can bet each will have its own presence at the Detroit Auto Show this year. But don't forget Mopar. The company's performance parts division is getting its own display at Cobo this year, and it'll be the largest in the brand's history.

The Mopar Custom Shop is poised to take up 5,500 square-feet of Cobo floor space, further expanding on last year's Mopar Garage. If the image above offers any indication, the show stand will include a Dodge Challenger, SRT Viper, Fiat 500L, Jeep Wrangler, Jeep Cherokee, Ram 3500 and what looks like (but isn't identified in the press release below as) a Chrysler 200 (which may be replaced by a 2014 model), all augmented with Mopar parts and accessories.

Visitors will also be able to use pre-programmed iPads to configure Chrysler Group vehicles with a wide range of accessories - a portfolio that grows by 1,500 new parts every year and tops over 100 add-ons for every new vehicle Chrysler launches.

Chrysler IPO to be filed as early as this week

Mon, 16 Sep 2013An initial public offering for the Chrysler Group could happen this week, following Sergio Marchionne's comments to Financial Times in London, according to a report from The Detroit News. Fiat, which owns 58.5 percent of Chrysler, has been in a battle with the UAW retiree healthcare trust over its minority stake in the company. While the automotive union recognizes its role as a temporary shareholder, the two couldn't come to an agreement on how the shares should be priced.

As Marchionne explained to FT, a Chrysler IPO allows the market, rather than the two competing sides, to determine the value of the shares. The public offering is a risky move, which could potentially hang one side out to dry - if the shares go high, it's bad news for Fiat, but if they go low, the UAW stands to lose. Regardless of where the stock prices go in an IPO, though, it's a move that's being supported by analysts, who are quick to cite Chrysler's near-constant growth and a product lineup that is getting healthier with each new introduction.

FCA-Renault merger faces tall odds delivering on cost-cutting promises

Thu, May 30 2019FRANKFURT/DETROIT — Fiat Chrysler Automobiles and Renault promise huge savings from a mega-merger, but such combinations face tall odds because of the industry's long product cycles and problems translating deal blueprints into real world success, industry veterans told Reuters. BMW's 1994 purchase of Rover, and Daimler's 1998 merger with Chrysler both made sense on paper. The companies promised to hike profits by combining vehicle platforms and engine families. Both combinations proved unworkable in reality, and were unwound. Renault and Nissan, which have been in an alliance since 1999 designed to share vehicle components, have only managed to use common vehicle platforms in 35% of Nissan's products despite an original target of 70%, according to Morgan Stanley. FCA and Renault have raised the stakes for themselves by ruling out plant closures. That increases the pressure to achieve more than $5 billion in promised annual savings from pooling procurement and research investments. The two companies have yet to fill in many of the blanks in the merger plan put forward by Fiat Chrysler. Renault's board is expected to act soon to accept the proposal, but that would lead only to a memorandum of understanding to pursue detailed operational and financial plans. A final deal and the legal combination of the two companies could take months to complete if all goes well. Pressure to cut automotive pollution is driving the latest round of consolidation. Automakers are looking at multibillion-dollar bills to develop electric and hybrid cars and cleaner internal combustion engines. Fiat Chrysler and Renault are betting they can design common electric vehicle systems, then sell more of them through their respective brands and dealer networks, cutting the cost per car. Developing all-new electric vehicles can bring more opportunities to share costs from the outset, industry experts said. "With the emergence of connected, autonomous, electric and shared vehicles, carmakers face immediate investments, so new opportunities for sharing costs have emerged," said Elmar Kades, managing director at Alix Partners. However, most electric vehicles lose money. This is a challenge for city car brands in Europe in particular. Both Renault and Fiat rely heavily on this segment for sales.