Auto Services in California

New Car Dealers, Used Car Dealers, Wholesale Used Car Dealers

Address: 225 Tank Farm Rd Ste B2, Shell-Beach

Phone: (805) 541-9823

Auto Repair & Service, Automobile Machine Shop, Engine Rebuilding & Exchange

Address: 229 Empire Ave, Ceres

Phone: (209) 578-5654

Auto Repair & Service, Automobile Inspection Stations & Services, Gas Stations

Address: 208 Main St, Knights-Landing

Phone: (530) 662-5253

Auto Repair & Service, New Car Dealers, Automobile Parts & Supplies

Address: 1680 E Main St, North-Highlands

Phone: (888) 969-7133

Auto Repair & Service, Automobile Body Repairing & Painting

Address: 7542 Warner Ave # 104, Midway-City

Phone: (714) 842-3161

Auto Repair & Service, Brake Repair, Tire Dealers

Address: 801 E Ball Rd, Rowland-Heights

Phone: (714) 533-1152

Auto blog

Tue, 12 Feb 2013

In December, the US Treasury announced that it was going to sell all of its shares in General Motors within 12 to 15 months. The first tranche of the 500-million total shares was purchased by GM, which took 200 million of them at $27.50 per share. That price represents an eight-percent premium over the market price at the time. The remaining 300 million shares will be sold "through various means in an orderly fashion."

Of the $418 billion disbursed through the Troubled Asset Relief Program (TARP), a report in Automotive News indicates that "about 93 percent" has been paid back, and the latest figures put Treasury's loss from the program overall at $55.58 billion. That's a $4.1 billion improvement on the last figure, when the expected red ink added up to $59.68 billion. The auto industry's portion of that loss is estimated to be $20.3 billion, a 16-percent drop from the earlier estimate of $24.3 billion.

The Treasury now owns 19 percent of GM, but if all goes well, there will be no more cause for anyone to utter "Government Motors" by the end of Q1 next year. A loss of some kind is still expected, however. Although GM's stock price is close to $29 at the time of this writing, that's still $4 below its IPO price and well below the $72 share price necessary for the government to come out even on its GM investment. On second thought, maybe the ribbing will continue.

Fri, Jun 5 2015

The automotive industry is expected to keep booming in the US over the next several years, but the train might start running out of steam in the long term, according to 2015's Car Wars report from Bank of America Merrill Lynch analyst John Murphy. The forecast focuses on changes between the 2016 and 2019 model years, and the latest trends appear similar in some cases to the past predictions. Sales are expected to keep growing and reach a peak of 20 million in 2018, according to the Detroit Free Press. The expansion is projected to come from a quick pace of vehicle launches, with an average of 48 introductions a year – 26 percent more than in 1996. Crossovers are expected to make up a third of these, maintaining their strong popularity. However, Murphy predicts a decline, as well. By 2025, total sales could fall to around 15 million units. As of May 2015, the seasonally adjusted annual rate for this year stands at 17.71 million. Like last year, Honda is predicted to be a big winner in the future thanks to products like the next-gen Civic. "Honda should be the biggest market share gainer," Murphy said when presenting the report, according to Free Press. Meanwhile, in a situation similar to Car Wars from 2012, a lack of many new vehicles is expected to cause a drop for Hyundai, Kia, and Nissan. Based on this forecast, Ford, General Motors, and FCA US will all generally maintain market share for the coming years. The report does make some future product predictions, though. The next Chevrolet Silverado and GMC Sierra might come in 2019, which is earlier than expected. Also, Lincoln could get a Mustang-based coupe for 2017, a compact sedan for 2018 and an Explorer-based model in 2019, according to the Free Press. Related Video: News Source: The Detroit Free PressImage Credit: Nam Y. Huh / AP Photo Earnings/Financials Chrysler Fiat Ford GM Honda Lincoln Car Buying fca us

Thu, Jan 2 2014

Italian automaker Fiat SpA announced Wednesday that it reached an agreement to acquire the remaining shares of Chrysler for $3.65 billion in payments to a union-controlled trust fund. Fiat already owns 58.5 percent of Chrysler's shares, with the remaining 41.5 percent held by a United Auto Workers union trust fund that pays health care bills for retirees. Under the deal, Fiat will make an initial payment of $1.9 billion to the fund, plus an additional $1.75 billion upon closing the deal. Chrysler will also make additional payments totaling $700 million to the fund as part of an agreement with the UAW. The deal is expected to close on or before Jan. 20, according to a statement from Chrysler. Sergio Marchionne, CEO of both Fiat and Chrysler, has long sought to acquire the union's shares in order to combine the two companies. "The unified ownership structure will now allow us to fully execute our vision of creating a global automaker that is truly unique in terms of mix of experience, perspective and know-how, a solid and open organization," Marchionne said in a statement issued by Turin, Italy-based Fiat. The deal eliminates the need for an initial public offering of the union fund's stake, which analysts had previously valued at $5.6 billion. Fiat went to court last year seeking a judgment on the price, but the trial date was set for next September. Marchionne can't spend Chrysler's cash on Fiat's operations unless the companies merge. In recent months he made it clear that he preferred to settle the dispute without an IPO, but filed the paperwork for the offering in September at the trust's request. Chrysler's profits have helped prop up Fiat on the balance sheet as the Italian automaker struggles in a down European market. The Auburn Hills, Mich., automaker earned $464 million in the third quarter on U.S. sales of the Ram pickup and Jeep Grand Cherokee, its ninth-straight profitable quarter. The results boosted Fiat, which earned $260 million in the quarter. Without Chrysler's contribution, Fiat would have lost $340 million. UAW/Unions Chrysler Fiat

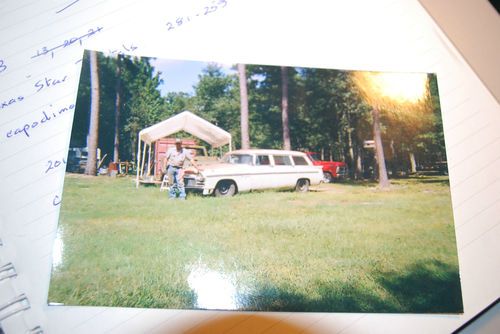

1956 chrysler new yorker wagon * antique * classic *

1956 chrysler new yorker wagon * antique * classic * 1971 chrysler new yorker base 7.2l

1971 chrysler new yorker base 7.2l 1951 chrysler new yorker convertible plus 1951 chyrsler new yorker sedan

1951 chrysler new yorker convertible plus 1951 chyrsler new yorker sedan 1989 chrysler new yorker landau sedan 4-door 3.0l

1989 chrysler new yorker landau sedan 4-door 3.0l 1956 chrysler new yorker wagon * antique * classic *

1956 chrysler new yorker wagon * antique * classic * 1955 chrysler new yorker deluxe 331 hemi

1955 chrysler new yorker deluxe 331 hemi