1953 Chyrsler New Yorker on 2040-cars

Orangevale, California, United States

|

1953 Hemi coupe. Nice condition no rust to speak of. Car is complete and runs. Has original everything including the Hemi motor. Car has lots of extra parts and is perfect for restoration or custom. Car has been in storage for over ten years and was a barn find. Everything you need comes with this car.

|

Chrysler New Yorker for Sale

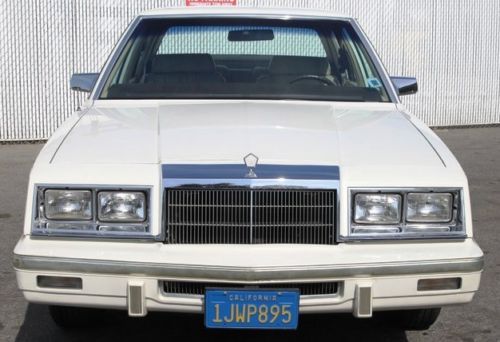

Chrysler new yorker landau

Chrysler new yorker landau One owner~leather~only 30k miles~power everything~(US $10,995.00)

One owner~leather~only 30k miles~power everything~(US $10,995.00) 1949 chrysler new yorker highlander restorable(US $3,000.00)

1949 chrysler new yorker highlander restorable(US $3,000.00) 1992 new yorker fifth avenue with remote start(US $1,500.00)

1992 new yorker fifth avenue with remote start(US $1,500.00) 1991 chrysler new yorker fifth avenue 4dr 3.8l v6 automatic 1-owner car low mile

1991 chrysler new yorker fifth avenue 4dr 3.8l v6 automatic 1-owner car low mile 1984 new yorker one owner 26k miles org.

1984 new yorker one owner 26k miles org.

Auto Services in California

Z Auto Sales & Leasing ★★★★★

X-treme Auto Care ★★★★★

Wrona`s Quality Auto Repair ★★★★★

Woody`s Truck & Auto Body ★★★★★

Winter Chevrolet - Honda ★★★★★

Western Towing ★★★★★

Auto blog

10 years later, a look back at U.S. auto industry’s near-death experience

Wed, Apr 3 2019The U.S. auto industry this month marks a grim and harrowing milestone: A decade ago, the entire industry was staring into the abyss of total collapse. By 2009, of course, the broader economy was teetering on the brink, with mortgage default rates and foreclosures spiraling and the real estate market in the tank. Both Lehman Brothers and Bear Stearns had collapsed, President George W. Bush had signed the Troubled Asset Relief Program, or TARP, infusing $700 billion of taxpayer money to stabilize Wall Street, and Insurer AIG, stung by huge losses on subprime mortgages, won a federal bailout. Virtually the entire decade had been particularly unkind to the Detroit Three automakers, which were over-reliant on gas-guzzling trucks and SUVs as gasoline prices crept toward the $4 mark, and whose labor costs — especially for health care and retiree pension obligations — were dragging them billions into the red. It was a dreadful, frightening time in Detroit, especially, with reports of plant closures and mass layoffs appearing with alarming regularity. Seeing the federal government's largess with Wall Street, General Motors and Chrysler both went calling for government assistance for themselves. (Ford managed to avoid following suit only by mortgaging all of its assets, including its very brand, years earlier in exchange for billions of dollars in loans.) Yet instead of giving them the "bridge loans" they sought, the incoming Obama administration instead pushed back against GM and Chrysler, eventually guiding them into bankruptcy protection, as the Detroit Free Press recalls in a multimedia story recounting the industry's tumultuous and perilous recent past. The piece uses images of the newspaper's front pages from those days, splashed with what former newsroom colleagues and I would often refer to as "Pearl Harbor font" headlines ("NO DEAL" read the Freep's Dec. 12, 2008, edition). There are also timelines, interactive graphics and snippets of video interviews with two insiders: freshman U.S. Rep. Haley Stevens of Michigan, who served as chief of staff for President Obama's auto task force; and U.S. Rep. Debbie Dingell, the wife of the late longtime U.S. Rep. and industry ally John Dingell, who was then an executive at GM.

Inline-6 Hemi replacement on the cusp of production from Stellantis

Thu, Dec 30 2021It appears that Stellantis is ready to put its long-rumored inline-six into production at its Saltillo, Mexico plant, possibly marking the beginning of the end of Chrysler's long-running 5.7L Hemi V8. But so far, the automaker's American brands have remained mum on where exactly the new turbocharged "Tornado" I6 may land. Stellantis powertrain blog Stellpower (by way of Muscle Cars & Trucks) spotted an entry for a new "GME T6" inline-six engine on the Saltillo facility's web site, suggesting that it was either in production or close to it. That entry has since been removed, but the mystery remains. We've been hearing tidbits here and there about this new inline engine for years, but this is the first time we've seen anything suggesting its arrival is imminent. Usually, such a significant powertrain update would coincide with the launch of a new product to showcase it. So far, Stellantis has remained mum, even overseas, about where this engine is destined to reside. 2022 model year vehicles are likely off the table entirely. But while it's common for new engines to debut with new cars and trucks, it's not a universal truth. Ford's Coyote V8 missed the corresponding Mustang refresh by a year, for example, orphaning the 2010 model and its much-needed styling updates with the old 4.6L V8 (and the 3.8L V6, for that matter; the 3.7L Duratec was also late to that party). Even sticking just to Stellantis, the JL Wrangler's powertrains have been a work in progress since it arrived back in 2018. The standard V6 and 2.0-liter turbo-4 debuted at launch; the EcoDiesel, 392 and 4xe all came later. And 4xe may be the model by which to measure our expectations. Its introduction didn't come completely out of nowhere, but it was rather sudden for what turned out to be such a solid offering. That bodes well for the company's existing Hemi-powered trucks and SUVs. The Ram 1500, Jeep Grand Cherokee and Wagoneer are all strong candidates to receive the new Hemi replacement, as all would greatly benefit from even small improvements in fuel economy. If there's to be a future for the Dodge Charger and Challenger and Chrysler 300, they'd benefit too. And how about a Gladiator with the wick turned up, positioned as its equivalent to the Wrangler 392. Turn that Tornado into a Dust Devil. Don't worry; we've got plenty more where that came from. Related Video This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Auto bailout cost the US goverment $9.26B

Tue, Dec 30 2014Depending on your outlook, the US Treasury's bailout of General Motors, Chrysler (now FCA) and their financing divisions under the Troubled Asset Relief Program was either a complete boondoggle or a savvy move to secure the future of some major employers. Regardless of where you fall, the auto industry bailout has officially ended, and the numbers have been tallied. Of the $79.69 billion that the Feds invested to keep the automakers afloat, it recouped $70.43 billion – a net loss of $9.26 billion. The final nail in the coffin for the auto bailout came in December 2014 when the Feds sold its shares in Ally Financial, formerly GMAC. The deal turned out pretty good for the government too because the investment turned a 2.4 billion profit. The actual automakers have long been out of the Treasury's hands, though. The current FCA paid back its loans six years early in 2011, the Treasury sold of the last shares of GM in late 2013. According to The Detroit News, the government's books actually show an official loss on the auto bailouts of $16.56 billion. The difference is because the larger figure does not include the interest or dividends paid by the borrowers on the amount lent. While it's easy to see fault in any red ink on the Feds' massive investment, the number is less than some earlier estimates. At one time, deficits around $44 billion were thought possible, and another put things at a $20.3 billion loss. Outside of just the government losing money, the bailouts might have helped the overall economy. A study from the Center for Automotive Research last year estimated that the program saved 2.6 million jobs and about $284.4 billion in personal wealth. It also indicated that the Feds' reduction in income tax revenue alone from Chrysler and GM going under could have been around $100 billion for just 2009 and 2010, significantly more than any loss in the bailout.