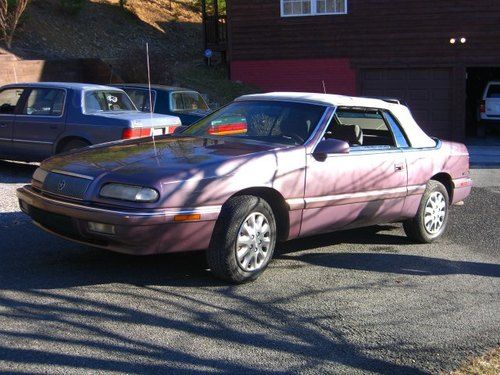

1995 Chrysler Lebaron Lx Convertible 2-door 3.0l on 2040-cars

Front Royal, Virginia, United States

Vehicle Title:Clear

Transmission:Automatic

Body Type:Convertible

Fuel Type:GAS

For Sale By:Private Seller

Mileage: 136,900

Make: Chrysler

Sub Model: LX

Model: LeBaron

Exterior Color: WILD ORCHID

Trim: GTC Convertible 2-Door

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Number of Cylinders: 6

Options: Cassette Player, Convertible

Safety Features: Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

JUST IN TIME FOR SPRING!! 1995 CHRYSLER LEBARON LX CONVERTIBLE. VERY RARE WILD ORCHID COLOR, WITH WHITE TOP. 3.0 V6 ENGINE, 4 SPEED AUTOMATIC. FULL POWER OPTIONS. ENGINE RUNS GREAT WITH RECENT TIMING BELT, WATER PUMP AND FULL TUNE UP. TRANSMISSION SHIFTS PERFECT. THIS CAR IS IN OVERALLL GREAT CONDITION, BUT DOES HAVE A FEW MINOR ISSUES, SUCH AS POWER DOOR LOCKS DO NOT WORK. CLEAN INTERIOR WITH NO RIPS OR TEARS. POWER TOP WORKS GOOD, TOP IS IN GOOD CONDITION WITH NO RIPS OR TEARS.

CAR IS AVAILABLE FOR INSPECTION IN FRONT ROYAL VIRGINIA. PLEASE ASK ANY AND ALL QUESTIONS BEFORE YOU BID. THIS CAR IS SOLD AS IS, WITH NO WARRANTIES WRITTEN OR IMPLIED. WINNING BIDDER MUST PAY $500.00 DEPOSIT THRU PAYPAL WITH IN 24 HOURS OF END OF AUCTION. BALANCE OF PURCHASE PRICE MUST BE PAID IN CASH ONLY, WITH IN 7 DAYS OF END OR AUCTION. CAR MUST BE PICKED UP IN FRONT ROYAL VIRGINIA. ANY SHIPPING MUST BE PAID FOR AND ARRANGED BY WINNING BIDDER. SELLING IN THE US ONLY.

Chrysler LeBaron for Sale

. barn find1989 chrysler le baron convertible

. barn find1989 chrysler le baron convertible No reserve! only 7300 made! 89 chrysler tc by maserati! lo miles no reserve!

No reserve! only 7300 made! 89 chrysler tc by maserati! lo miles no reserve! 1994 chrysler lebaron convertible gtc automatic v6 new top ...no reserve!

1994 chrysler lebaron convertible gtc automatic v6 new top ...no reserve! 1994 chrysler lebaron gtc convertible 2-door 3.0l car has a jovi kit on it

1994 chrysler lebaron gtc convertible 2-door 3.0l car has a jovi kit on it 1988 chrysler lebaron base convertible 2-door 2.2l

1988 chrysler lebaron base convertible 2-door 2.2l 1985 chrysler lebaron woody wagon(US $4,850.00)

1985 chrysler lebaron woody wagon(US $4,850.00)

Auto Services in Virginia

Whitten Brothers Mazda ★★★★★

West Broad Audi ★★★★★

Watkin`s Garage ★★★★★

Virginia Auto Ctr ★★★★★

Victory Lane Auto Sales ★★★★★

Van`s Garage ★★★★★

Auto blog

2015 Chrysler 200 production gets underway [w/videos]

Mon, 17 Mar 2014Chrysler announced recently that it has added some 800 new jobs at its Sterling Heights Assembly Plant (SHAP) to support the production of its all-new 2015 Chrysler 200 sedan. Total employment at the Sterling Heights, MI plant grows to almost 2,800 with the hires, an impressive figure for a plant that was slated for closure in 2010.

Speaking to a crowd of employees and community leaders, Fiat-Chrysler CEO Sergio Marchionne was on hand to celebrate the kick-off of 200 production last week. "We're making a big bet on its success," said Marchionne of the sedan, "we've invested nearly a billion dollars in this facility."

That billion-dollar bill has been used to construct a spanking new paint shop, install a new body shop and install "machinery, tooling and material-handling equipment" according to the Chrysler press release. The company says that SHAP now runs to nearly five million square feet of manufacturing space - loads of room for all the new employees to do their thing - and that the facility can handle multiple vehicles on two unique architectures.

Bob Lutz, UAW rep commend Chrysler for not bowing to NHTSA recall pressure [w/poll]

Mon, 10 Jun 2013Bob Lutz, the well-known executive with a range of automakers including both General Motors and Chrysler, says he supports Chrysler for not caving under federal pressure to issue a recall on 2.7 million Jeep vehicles. The National Highway Traffic Safety Administration is arguing that the plastic fuel tanks positioned behind the axles of certain 1993-2004 Grand Cherokee models and 2002-2007 Liberty models may become punctured in a collision and potentially catch fire, so it has called upon Chrysler to recall the vehicles. 15 deaths and 46 injuries have been attributed to the issue. For its part, Chrysler has maintained that its models "met and exceeded" all safety applicable mandates when they were manufactured, and furthermore, they argue that the government agency's own data proves that the vehicles are no more dangerous than similar SUVs produced by other automakers at the time. As a result, it is taking the unusual step of refusing to recall the vehicles.

According to The Detroit News, Lutz says Chrysler is right to push back when the government is out of line. Lutz also said that he wished he could have done the same when NHTSA urged Chrysler to issue a recall on certain minivans back when he was with the automaker 25 years ago.

Meanwhile, United Auto Workers Vice President General Holiefield also defended Chrysler by saying, "Our legendary Jeeps are crafted with pride by our dedicated UAW American workforce who work tirelessly to ensure the utmost quality of each Jeep that is produced for customers."

Chrysler, Nissan looking into claim that their cars are industry's most hackable

Sun, 10 Aug 2014A pair of cyber security experts have awarded the ignominious title of most hackable vehicles on American roads to the 2014 Jeep Cherokee, 2014 Infiniti Q50 and 2015 Cadillac Escalade.

Charlie Miller and Chris Valasek are set to release a report at the Black Hat hacking conference in Las Vegas, Automotive News reports. The two men found the Jeep, Caddy and Q50 were easiest to hack based not on actual tests with the vehicles, but a detailed analysis of systems like Bluetooth and wireless internet access - basically, anything that'd allow a hacker to remotely gain access to the vehicle's systems.

Considering this lack of hands-on testing, the pair acknowledge that "most hackable" could be a relative term - they point out that the vehicles may actually be quite secure.