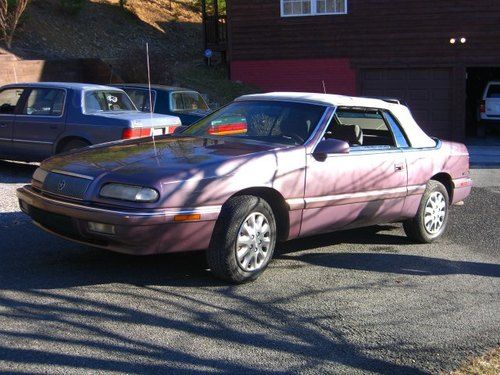

1987 Chrysler Lebaron Town & Country No Reserve!! on 2040-cars

Boonton, New Jersey, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Chrysler

Warranty: Vehicle does NOT have an existing warranty

Model: LeBaron

Mileage: 81,478

Options: Cassette Player

Exterior Color: Other

Power Options: Power Locks

Interior Color: Tan

Number of Cylinders: 4

Chrysler LeBaron for Sale

1990 chrysler lebaron gt convertible 2-door 3.0l -- very low miles(US $6,500.00)

1990 chrysler lebaron gt convertible 2-door 3.0l -- very low miles(US $6,500.00) 1989 chrysler labaron turbo gt convertible low miles beautiful car big pictures

1989 chrysler labaron turbo gt convertible low miles beautiful car big pictures Chrysler lebaron mark cross town&country convertible. extremely rare classic!!!(US $5,995.00)

Chrysler lebaron mark cross town&country convertible. extremely rare classic!!!(US $5,995.00) 1984 chrysler lebaron convertible classic

1984 chrysler lebaron convertible classic 1995 chrysler lebaron lx convertible 2-door 3.0l(US $3,850.00)

1995 chrysler lebaron lx convertible 2-door 3.0l(US $3,850.00) . barn find1989 chrysler le baron convertible

. barn find1989 chrysler le baron convertible

Auto Services in New Jersey

Yonkers Honda Corp ★★★★★

White Dotte ★★★★★

Vicari Motors Inc ★★★★★

Tronix Ii ★★★★★

Tire Connection & More ★★★★★

Three Star Auto Service Inc. ★★★★★

Auto blog

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

North America profit helps Fiat Chrysler limit its losses from coronavirus

Fri, Jul 31 2020MILAN — Italian-American automaker Fiat Chrysler Automobiles (FCA) posted a smaller-than-expected operating loss in the second quarter, as a small profit in North America helped to limit the damage wrought by the COVID-19 pandemic. FCA said on Friday it had an adjusted loss before interest and tax of 928 million euros ($1.1 billion) in April-June, versus a forecast 1.87 billion euro ($2.2 billion) loss in an analyst poll compiled by Reuters. The group also said it made adjusted earnings before interest and tax of 39 million euros ($46.2 million) in North America, the home market of its Jeep and Ram brands, in the quarter. Milan-listed FCA shares were up 1.2% at 1125 GMT, after being little changed before the results. Chief Executive Mike Manley said the group's plants were up and running and car dealers were selling in showrooms and online, following disruptions caused by the pandemic. "We have the flexibility and financial strength to push ahead with our plans," he said in a statement. FCA, which is set to tie-up with Peugeot maker PSA to create Stellantis, the world's fourth largest carmaker, said on ongoing probe launched by European Commission competition authorities was not expected to delay the merger timetable. Despite the pandemic, PSA earlier this week delivered a profit in the first half of the year and stuck to its medium-term margin goal. FCA said its industrial free cash flow was minus 4.9 billion euros in the second quarter, with a slightly lower cash burn compared with January-March. Â

Fiat Chrysler to pay $40 million fine for inflating sales numbers

Fri, Sep 27 2019DETROIT — Fiat Chrysler is paying $40 million to settle with U.S. securities regulators who say the automaker misled investors by overstating its monthly sales numbers over a five-year period. The Italian-American company inflated sales by paying dealers to report fake numbers from 2012 to 2016, the U.S. Securities and Exchange Commission alleged in a complaint. Fiat Chrysler agreed to pay the civil penalty and to stop violating anti-fraud, reporting and internal accounting control regulations, the SEC said Friday in a statement. The automaker did not admit or deny the agency's allegations, the statement said. "This case underscores the need for companies to truthfully disclose their key performance indicators," Antonia Chion, associate director in the SEC's Enforcement Division, said in the statement. She noted that the new vehicle sales figures give investors insight into the demand for an automaker's products, a key to assessing the company's performance. Fiat Chrysler said it has reviewed and refined its sales reporting procedures. It said the payment will not have a large impact on its financial statements. The agency said the automaker boasted about a streak of year-over-year sales increases into 2016, when the streak actually was broken in September of 2013. When the company disclosed the sales scheme in 2016, it said that it had a "reserve" stock of cars that had been shipped to big fleet buyers such as rental car companies but not recorded as sales. The SEC said employees called this database of actual but unreported sales the "cookie jar." The company dipped into those sales to stop the streak from ending, or when it would have missed other sales targets. Fiat Chrysler said it now records sales as soon as vehicles are shipped to customers. It has also take steps to ensure that a sale is immediately subtracted from its books when it finds out the deal was scuttled because the buyer backed out or couldn't get financing. The SEC probe is another in a long string of legal troubles for Fiat Chrysler. It also faces federal investigations into illegal payments to union officials through a training center, and a criminal probe into allegations that its diesel-powered trucks were programmed to cheat on emissions tests. The company has denied cheating, but federal prosecutors charged an engineer earlier this week and said he conspired with others. In June, Fiat Chrysler's U.S.