1986 Chrysler Lebaron Base Convertible 2-door 2.2l on 2040-cars

Eau Claire, Wisconsin, United States

Body Type:Convertible

Engine:2.2L 135Cu. In. l4 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

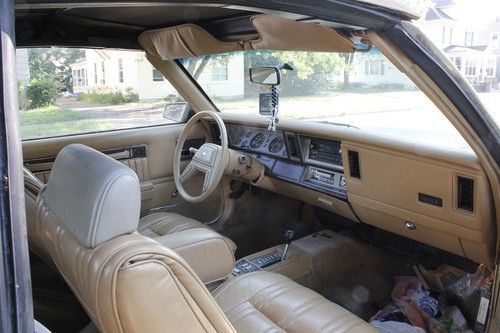

Interior Color: Tan

Make: Chrysler

Number of Cylinders: 4

Model: LeBaron

Trim: Base Convertible 2-Door

Drive Type: FWD

Options: Leather Seats, Convertible

Mileage: 133,000

Exterior Color: Tan

1986 LeBaron convertible, recently had head gasket replaced along with MAP sensor and ECM by battery. Runs rough partly due to fuel leak near filter. Tires are good, did run and drive before fuel leak.

Chrysler LeBaron for Sale

1992 chrysler lebaron convertible

1992 chrysler lebaron convertible 1995 chrysler le baron lx convertable

1995 chrysler le baron lx convertable Mark cross town and country 1986, convertible

Mark cross town and country 1986, convertible 1988 chrysler lebaron convertible only 4k original miles!! like new!!!(US $8,998.00)

1988 chrysler lebaron convertible only 4k original miles!! like new!!!(US $8,998.00) 1986 chrysler lebaron town & country convertible(US $16,000.00)

1986 chrysler lebaron town & country convertible(US $16,000.00) 1991 chrysler lebaron convertable one owner

1991 chrysler lebaron convertable one owner

Auto Services in Wisconsin

Van`s Auto Salvage ★★★★★

Trans-X-Press Transmissions ★★★★★

Sullivans Two Unlimited ★★★★★

Steve`s Service ★★★★★

South Milwaukee Automotive Service ★★★★★

Schmit Bros Chrysler Dodge Jeep RAM ★★★★★

Auto blog

Buick Wildcat and Electra concepts, Ford Maverick | Autoblog Podcast #732

Fri, Jun 3 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. They lead off with a discussion of the news. This section touches on the DeLorean Alpha5, Buick Wildcat EV Concept reveal, revival of the Buick Electra name, production reveal of the Mercedes-AMG One and some scuttle about Volkswagen's recently-bought Scout brand. After that, they move on to the cars they've been driving, including the Ford Maverick and Chrysler Pacifica Hybrid. After the pair finish with what they've been driving, the podcast transitions to an interview between Greg Migliore and former Car and Driver Editor-in-Chief Eddie Alterman. Finally, Greg and Zac wrap things up with some more spring and summer beer recommendations. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #732 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News Delorean Alpha5 reveal Buick Wildcat EV Concept reveal Revival of the Buick Electra name Production reveal of the Mercedes-AMG One Volkswagen's recently-bought Scout brand controversy Cars we're driving 2022 Ford Maverick EcoBoost 2022 Chrysler Pacifica Hybrid Pinnacle Interview with Eddie Alterman Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts Buick Chrysler Ford Mercedes-Benz Volkswagen Truck Coupe Minivan/Van SUV Concept Cars Electric Future Vehicles Luxury Off-Road Vehicles Performance Supercars Sedan

FCA to skip summer shutdowns as automakers rev up U.S. assembly lines

Thu, Jun 18 2020DETROIT — Several of FCA's facilities will skip their usual summer shutdowns to get a jump on rebuilding inventory, the company confirmed early Wednesday. The plants that will remain open include three in the United States (Jefferson North in Detroit, Toledo Assembly in Ohio, and Sterling Heights Assembly in suburban Detroit), one in Canada (Brampton Assembly in Ontario) and two in Mexico (Saltillo Truck Assembly and Saltillo Van Assembly). This will allow dealers to address depleted inventory of popular trucks and muscle cars, Automotive News reports. Other facilities not named will observe their normal one- and two-week breaks. Automakers are speeding up U.S. assembly lines to meet recovering demand, increasingly confident coronavirus safety protocols are working to prevent outbreaks in their plants but wary of the challenges workers face outside. Screening workers for COVID-19 using temperature scans and questionnaires, the automakers have detected some people who reported for work despite being sick. Some plants have been briefly shut down for disinfection, but so far, there has not been a major outbreak within a U.S. auto plant since most reopened May 18, company and United Auto Workers union officials said. The risk of an infection picked up outside a plant spreading along assembly lines remains a prime concern, however. An outbreak could shut down a factory costing a manufacturer millions of dollars a day. The disruption caused by the pandemic is creating other challenges as well. At Ford Motor Co's F-series pickup truck plant in Louisville, Kentucky, the company has given more than 1,000 workers leave related to COVID-19 concerns. It hired temporary workers to fill their jobs as the plant accelerates production of trucks critical to Ford's financial recovery. Demand for pickup trucks helped boost U.S. auto sales in May, and contributed to stronger than expected overall U.S. retail sales for the month. Officials of UAW Local 862, which represents workers at the Louisville plant, said a lack of child care was a significant issue for members. It had led many to stay away from the plant and collect increased unemployment benefits provided under the federal CARES coronavirus relief act. Ford has now begun arranging subsidized child care for UAW workers, Gary Johnson, the automaker's head of manufacturing told Reuters.

FCA goes big on little Fiat 500 EV, plans to build 80,000

Thu, Jul 11 2019TURIN, Italy — Fiat Chrysler plans to invest 700 million euros ($787 million) in an electric makeover of its iconic Fiat 500, a top executive said on Thursday, as the automaker seeks to move on from its failed bid to merge with France's Renault. FCA's chief operating officer for Europe, Middle East and Africa, Pietro Gorlier, announced the investment — the Italian-American company's biggest single bet on an electric vehicle — at its Mirafiori plan in Turin, northern Italy. "The plan is confirmed," Gorlier told reporters, when asked if FCA's investment in electric vehicle technology would remain unchanged after its $35 billion plan to merge with Renault, an electric car pioneer, collapsed last month. He said FCA would invest the 700 million euros to build a new production line at Mirafiori to turn out 80,000 of the new 500 BEV, its first battery electric vehicle to be marketed in Europe after a smaller, initial foray in the United States. Production will start in the second quarter of 2020, with capacity to be expanded later, Gorlier said. The 500 compact car is one of the group's most famous models, launched by Fiat in the late 1950s and quickly becoming a symbol of Italian urban design. The 700 million euros investment is part of a plan announced last year to invest 5 billion euros in Italy up to 2021. In abandoning its merger offer for Renault, FCA blamed French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Featured Gallery Fiat 500e Green Chrysler Fiat Electric