1985 Chrysler Lebaron And 1982 Chrysler Lebaron Convertibles on 2040-cars

Slatington, Pennsylvania, United States

|

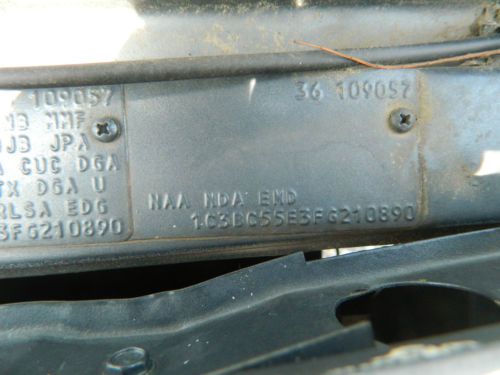

1985 Chrysler Turbo Lebaron Convertible (Blue) 1982 Chrysler Lebaron Convertible (Red) Transverse front-engine Front-wheel drive 2.2 L Turbo I I4 3 spd Automatic Trans Radio with AM/FM cassette player Power windows Power top Driver seat has a little wear Drivers window is off the track Needs some work, but drivable BOTH CARS HAVE CLEAN CAR FAXES Serial number of 1985 Chrysler blue 1C3BC55E3FG210890 MILEAGE 84,956 Serial number of 1982 Chrysler red 1C3B345B7CG184158 MILEAGE 89,931 |

Chrysler LeBaron for Sale

1985 chrysler lebaron convertible restored and ready to go!!

1985 chrysler lebaron convertible restored and ready to go!! 1985 chrysler lebaron base convertible 2-door 2.2l turbo - mint condition(US $5,700.00)

1985 chrysler lebaron base convertible 2-door 2.2l turbo - mint condition(US $5,700.00) 1987 chrysler lebaron convertible

1987 chrysler lebaron convertible 1985 chrysler lebaron(US $5,995.00)

1985 chrysler lebaron(US $5,995.00) 1993 chrysler lebaron landau(US $4,999.00)

1993 chrysler lebaron landau(US $4,999.00) 1993 chrysler lebaron base convertible 2-door 3.0l - 98,500 miles - wonderful

1993 chrysler lebaron base convertible 2-door 3.0l - 98,500 miles - wonderful

Auto Services in Pennsylvania

Wrek Room ★★★★★

Wolbert Auto Body and Repair ★★★★★

Warren Auto Service ★★★★★

Ultimate Auto Body & Paint ★★★★★

Ulrich Sales & Service ★★★★★

Tower Auto Sales Inc ★★★★★

Auto blog

FCA-Renault merger talks: France wants job guarantees and Nissan on board

Tue, May 28 2019PARIS — France will seek protection of local jobs and other guarantees in exchange for supporting a merger between carmakers Renault and Fiat Chrysler, its finance minister said on Tuesday, underscoring the challenges facing the plan. Renault Chairman Jean-Dominique Senard arrived in Japan to discuss the proposed tie-up with the French company's existing partner Nissan — another potential obstacle to the $35 billion-plus merger of equals. Renault and Italian-American rival Fiat Chrysler Automobiles (FCA) are in talks to tackle the costs of far-reaching technological and regulatory changes by creating the world's third-biggest automaker. Nissan found out about Renault's merger talks with Fiat Chrysler only days before they became public, four sources told Reuters, stoking fears at the Japanese carmaker that a deal could further weaken its position in a 20-year alliance with Renault. A deal between Renault and FCA would create a player ranked behind only Japan's Toyota and Germany's Volkswagen and target 5 billion euros ($5.6 billion) a year in savings. Some analysts, however, say the companies face a challenge to win over powerful stakeholders ranging from the French and Italian governments to trade unions and Nissan. Patrick Pelata, a former Renault chief operating officer, also criticized the deal plan for undervaluing Renault and threatening to overstretch its engineering resources. By valuing Renault at its market price, the all-share offer attributes a negative 6 billion euro value to Renault operations after deduction of its 43.4% stake in Nissan and 3.1% Daimler holding, Pelata told BFM radio. "That's hardly reasonable," he said. "And I think that shareholders, including the French state, are bound to take issue with this sooner or later." Pelata added: "FCA has big problem because they haven't invested for the future — they have no electric vehicle platform and they've done nothing in autonomous cars." French finance minister Bruno Le Maire told RTL radio on Tuesday that the plan was a good opportunity for both Renault and the European car industry, which has been struggling for years with overcapacity and subdued demand. France sets conditions Le Maire also said the French government would seek four guarantees in exchange for backing a deal that would reduce its 15% stake in Renault to 7.5% of the combined entity. "The first: industrial jobs and industrial sites.

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.

Auto industry insider previews tell-all book, What Did Jesus Drive?

Tue, 11 Nov 2014

"It's about some of the biggest crises in history. It's about who did it right and who did it wrong." - Jason Vines

Jason Vines, the former head of public relations at Chrysler, Ford and Nissan, has seen a lot during his more than 30-year career, and now he's offering a behind-the-scenes look at the auto industry in his tell-all book What Did Jesus Drive? that went on sale this month.