1982 Chrysler Lebaron Convertible 2-door 2.6l Florida Car Runs Great Low Miles on 2040-cars

Fitchburg, Massachusetts, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:mitsubishi 2.6 l

Fuel Type:GAS

Make: Chrysler

Model: LeBaron

Options: Cassette Player, Leather Seats, Convertible

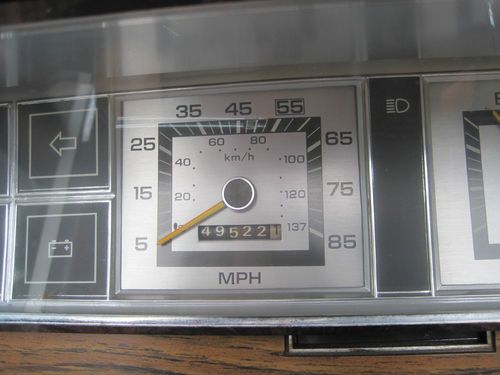

Mileage: 49,570

Exterior Color: White

Trim: convertible

Interior Color: Brown

Drive Type: FWD

Number of Cylinders: 4

Chrysler LeBaron for Sale

1992 chrysler lebaron *must see* exceptionally clean white power top convertible(US $3,995.00)

1992 chrysler lebaron *must see* exceptionally clean white power top convertible(US $3,995.00) 1984 chrysler lebaron convertible, mark cross woody edition, very rare(US $6,500.00)

1984 chrysler lebaron convertible, mark cross woody edition, very rare(US $6,500.00) 1995 chrysler lebaron gtc convertible 2-door 3.0l(US $1,500.00)

1995 chrysler lebaron gtc convertible 2-door 3.0l(US $1,500.00) 1995 chrysler lebaron gtc convertible 2-door 3.0l(US $1,850.00)

1995 chrysler lebaron gtc convertible 2-door 3.0l(US $1,850.00) 1982 chrysler lebaron conv only 61k new new new

1982 chrysler lebaron conv only 61k new new new 1993 chrysler lebaron le sedan 4-door 3.0l(US $2,500.00)

1993 chrysler lebaron le sedan 4-door 3.0l(US $2,500.00)

Auto Services in Massachusetts

Westgate Tire & Auto Center ★★★★★

Stewie`s Tire & Auto Repair ★★★★★

School Street Garage ★★★★★

Saugus Auto-Craft ★★★★★

Raffia Road Service Center ★★★★★

Quality Auto Care ★★★★★

Auto blog

FCA's profit rises ahead of Peugeot merger

Thu, Feb 6 2020MILAN — Fiat Chrysler (FCA) posted a 7% rise in fourth-quarter profit on Thursday, boosted by strong business in North America and better results in Latin America as it heads into a merger with France's PSA. The Italian-American carmaker said adjusted earnings before interest and tax (EBIT) rose to 2.12 billion euros ($2.3 billion), in line with a 2.11 billion forecast in Reuters poll of analysts. That left its adjusted operating profit for the year at 6.67 billion euros ($7.34 billion), just shy of its target of over 6.7 billion euros. Its adjusted EBITDA margin came in at 6.2%, in line with its target of more than 6.1%. A trader said Fiat Chrysler results were "a touch above" expectations and the carmaker's shares in Milan were up 3.4% at 1300 GMT following the results. Fiat Chrysler and Peugeot maker PSA agreed in December to combine forces in a $50 billion deal to create the world's No. 4 carmaker, in response to slower global demand and the mounting cost of making cleaner cars amid tighter emissions rules. Chief Executive Mike Manley said last month that talks with PSA were progressing well and that he hoped to complete the deal by early 2021. FCA reiterated its plan to boost adjusted EBIT to above 7 billion euros ($7.7 billion) this year. In slides prepared for an analyst call, FCA said it was monitoring the global impact of coronavirus in China. FCA operates in the country through a loss-making joint venture with Guangzhou Automobile Group (GAC) and has a 0.35% share of the Chinese passenger car market. Reporting by Giulio Piovaccari; Additional reporting by Danilo Masoni; Editing by Stephen Jewkes, Jason Neely and David Clarke. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Poor Chrysler 200 sales blamed for 1,420 layoffs in Sterling Heights

Wed, Apr 6 2016FCA will indefinitely lay off a total of 1,420 workers from its Sterling Heights Assembly and Stamping plants on July 5, according to The Detroit News. This decision will cut a 1,300-person shift that builds the Chrysler 200, and it will also affect 120 people who stamp the sedan's components. The company's statement said the decision would "better align production with demand." FCA plans to give these folks open full-time positions as they become available. Chrysler 200 sales are down 63 percent to just under 18,000 units so far in 2016. After the cuts, there will still be one shift to build the 200, but even then the model won't have much of a future. In January, CEO Sergio Marchionne announced that FCA would discontinue production of the 200 and Dodge Dart because customers were no longer interested in small sedans. All of the roughly 3,000 hourly workers at Sterling Heights have been on a temporary layoff since February 1, according to The Detroit News. They don't go back to work until next week. United Auto Workers Vice President Norwood Jewell released a statement saying that while the "shift reduction at Sterling Heights Assembly is unfortunate, it is not unexpected." However, he was fairly upbeat about the cuts because FCA plans to increase production capacity for trucks and SUVs. "I believe that in the long term this move will be a positive one for our members and the company," he said. During last year's labor negotiations, the UAW's deal reportedly included an agreement for FCA to move 200 and Dodge Dart production to Toluca, Mexico, but the company promised to build the Ram 1500 at Sterling Heights Assembly. FCA spokesperson Jodi Tinson gave no comment about future vehicles at the factory when asked by Autoblog. Related Video: Statement Regarding Indefinite Layoffs at SHAP In order to better align production with demand at its Sterling Heights Assembly Plant, FCA US notified the State of Michigan, the City of Sterling Heights and the UAW today that it intends to return the plant to a one shift operation, beginning July 5. The Company will place indefinitely laid off employees in open full-time positions as they become available within the Detroit labor market based on seniority. A Statement from UAW Vice President Norwood Jewell on FCA Announcement about Sterling Heights Assembly: While today's announcement of a shift reduction at Sterling Heights Assembly is unfortunate, it is not unexpected.

Fiat To Pay $3.65 Billion For Remaining Chrysler Shares

Thu, Jan 2 2014Italian automaker Fiat SpA announced Wednesday that it reached an agreement to acquire the remaining shares of Chrysler for $3.65 billion in payments to a union-controlled trust fund. Fiat already owns 58.5 percent of Chrysler's shares, with the remaining 41.5 percent held by a United Auto Workers union trust fund that pays health care bills for retirees. Under the deal, Fiat will make an initial payment of $1.9 billion to the fund, plus an additional $1.75 billion upon closing the deal. Chrysler will also make additional payments totaling $700 million to the fund as part of an agreement with the UAW. The deal is expected to close on or before Jan. 20, according to a statement from Chrysler. Sergio Marchionne, CEO of both Fiat and Chrysler, has long sought to acquire the union's shares in order to combine the two companies. "The unified ownership structure will now allow us to fully execute our vision of creating a global automaker that is truly unique in terms of mix of experience, perspective and know-how, a solid and open organization," Marchionne said in a statement issued by Turin, Italy-based Fiat. The deal eliminates the need for an initial public offering of the union fund's stake, which analysts had previously valued at $5.6 billion. Fiat went to court last year seeking a judgment on the price, but the trial date was set for next September. Marchionne can't spend Chrysler's cash on Fiat's operations unless the companies merge. In recent months he made it clear that he preferred to settle the dispute without an IPO, but filed the paperwork for the offering in September at the trust's request. Chrysler's profits have helped prop up Fiat on the balance sheet as the Italian automaker struggles in a down European market. The Auburn Hills, Mich., automaker earned $464 million in the third quarter on U.S. sales of the Ram pickup and Jeep Grand Cherokee, its ninth-straight profitable quarter. The results boosted Fiat, which earned $260 million in the quarter. Without Chrysler's contribution, Fiat would have lost $340 million. UAW/Unions Chrysler Fiat