Vintage 1983 Chrysler Imperial 2-dr H/t Running 66,000 Miles on 2040-cars

Shreveport, Louisiana, United States

|

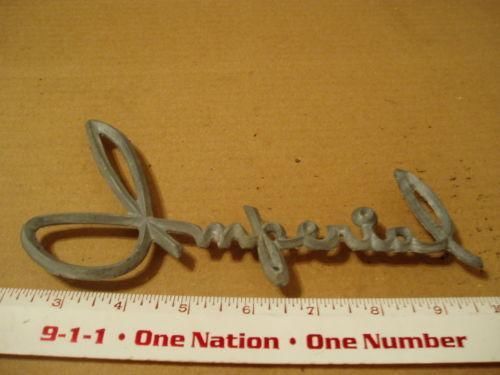

I AM SELLING THIS RARE 1983 CHRYSLER IMPERIAL (1427 MADE) FOR A NEIGHBOR OF MINE THAT DOES NOT HAVE ACCESS TO A COMPUTER. THIS CAR WAS BACKED INTO AND HIT ON THE RIGHT FRONT FENDER, (FENDER WAS DENTED BADLY) AND REMOVED FROM CAR. THE CAR HAS BEEN SITTING UNDER CARPORT FOR ABOUT A YEAR. THE BATTERY WAS CHARGED AND IT STARTED RIGHT UP AND RAN GREAT (GREAT RUNNING 318 C.I. CARBURATED ENGINE) TRANSMISSION WAS SHIFTING GOOD WHEN ACCIDENT OCCURED. I DON'T THINK IT DID ANY DAMAGE TO THE TRANSMISSION. THE INTERIOR IS NICE DARK BLUE WITH LEATHER POWER SEATS. AM/FM RADIO PLAYS GOOD. CASSETTE TAPE PLAYER WORKS. THE CAR WILL MOVE FORWARD AND BACK WARD AND STEER TO THE RIGHT, BUT WILL NOT STEER TO THE LEFT. (I THINK THE TIE ROD IS BENT) INTERIOR IS VERY NICE, SEATS ARE SOFT AND NOT TORN, BOTH DOOR PANELS ARE VERY NICE, AS IS DASH BOARD, NO CRACKS OR BROKEN PLASTIC. CAR HAS ORIGINAL 66,000 MILES. EXTEROR OF CAR HAS FADED AND HAS A FEW RUST SPOTS, MOSTLY SURFACE AND WILL NEED ATTENTION. THIS WOULD BE A GOOD PROJECT CAR OR A GREAT PARTS CAR. I HAVE NOT SEEN ANY OF THESE LISTED ON EBAY FOR SALE. MORE PHOTOS OF INTERIOR AND EXTERIOR WILL BE ADDED TOMORROW. VEHICHLE WILL HAVE TO BE TRAILERED OR TRANSPORTED AT BUYERS EXPENSE. THERE ARE NO WARRANTIES IMPLIED WITH THE SALE OF THIS VEHICHLE. A $300.00 DEPOSIT MUST BE MADE WITHIN 72 HOURS OF ACTUAL SALE. WILL STORE UP TO 30 DAYS WHILE YOU MAKE ARRANGEMENTS TO PICK UP OR SHIP CAR. YOU MAY CALL OWNER AT AREA CODE 318-200-1623 (LYLE) AFTER 5:PM CENTRAL TIME FOR ANY QUESTIONS YOU MAY HAVE.

|

Chrysler Imperial for Sale

Chrysler crown imperial sedan ready for restoration hemi v8

Chrysler crown imperial sedan ready for restoration hemi v8 1964 chrysler imperial crown 4 door hardtop with very low miles

1964 chrysler imperial crown 4 door hardtop with very low miles 1968 chrysler imperial crown 21,000 original miles. dodge hemi(US $20,000.00)

1968 chrysler imperial crown 21,000 original miles. dodge hemi(US $20,000.00) 1974 chrysler imperial lebaron(US $2,850.00)

1974 chrysler imperial lebaron(US $2,850.00) All original, 331 hemi, leather, a/c, power seats and windows, runs/drives great

All original, 331 hemi, leather, a/c, power seats and windows, runs/drives great 1964 chrysler imperial crown coupe 413 2 door hardtop, original 88k survivor(US $11,500.00)

1964 chrysler imperial crown coupe 413 2 door hardtop, original 88k survivor(US $11,500.00)

Auto Services in Louisiana

Webre Brother`s Repair Service Inc ★★★★★

Sterling Auto Repair ★★★★★

Sterling Auto Repair ★★★★★

Southland Dodge Chrysler Jeep ★★★★★

Randy`s Automotive ★★★★★

Pro Auto Sales ★★★★★

Auto blog

Consumer Reports no longer recommends Honda Civic

Mon, Oct 24 2016Consumer Reports annual Car Reliability Survey is out, and yes, there are some big surprises. First and foremost? The venerable publication no longer recommends the Honda Civic. In fact, aside from the walking-dead CR-Z and limited-release Clarity fuel-cell car, the Civic is the only Honda to miss out on CR's prestigious nod. At the opposite end there's a surprise as well – Toyota and Lexus remain the most reliable brands on the market, but Buick cracked the top three. That's up from seventh last year, and the first time for an American brand to stand on the Consumer Reports podium. Mazda's entire lineup earned Recommended checks as well. Consumer Reports dinged the Civic for its "infuriating" touch-screen radio, lack of driver lumbar adjustability, the limited selection of cars on dealer lots fitted with Honda's popular Sensing system, and the company's decision to offer LaneWatch instead of a full-tilt blind-spot monitoring system. Its score? A lowly 58. The Civic isn't the only surprise drop from CR's Recommended ranks. The Audi A3, Ford F-150, Subaru WRX/STI, and Volkswagen Jetta, GTI, and Passat all lost the Consumer Reports' checkmark. On the flipside, a number of popular vehicles graduated to the Recommended ranks, including the BMW X5, Chevrolet Camaro, Corvette, and Cruze, Hyundai Santa Fe, Porsche Macan, and Tesla Model S. Perhaps the biggest surprise is the hilariously recall-prone Ford Escape getting a Recommended check – considering the popularity of Ford's small crossover, this is likely a coup for the brand, as it puts the Escape on a level playing field with the Recommended Toyota RAV4, Honda CR-V, and Nissan Rogue. While Ford is probably happy to see CR promote the Escape, the list wasn't as kind for every brand. For example, of the entire Fiat Chrysler Automobiles catalog, the ancient Chrysler 300 was the only car to score a check – there wasn't a single Dodge, Fiat, Jeep, Maserati, or Ram on the list. That hurts. FCA isn't alone at the low end, either. GMC, Jaguar Land Rover, Mini, and Mitsubishi don't have a vehicle on CR's list between them, while brands like Mercedes-Benz, Volvo, Nissan, Lincoln, Infiniti, and Cadillac only have a few models each. You can check out Consumer Reports entire reliability roundup, even without a subscription, here.

GM says it favors fuel-efficiency rules based on historic rates

Mon, Oct 29 2018WASHINGTON — General Motors backs an annual increase in fuel-efficiency standards based on "historic rates" rather than tough Obama era rules or a Trump administration proposal that would freeze requirements, according to a federal filing made public on Monday. The largest U.S. automaker said the Obama rules that aimed to hike fleet fuel efficiency to more than 50 miles per gallon by 2025 are "not technologically feasible or economically practicable." The Detroit automaker said that since 1980, the motor vehicle fleet has improved fuel efficiency at an average rate of 1 percent a year. Fiat Chrysler Automobiles NV said in separate comments that the auto industry is complying with existing fuel efficiency requirements by using credits from prior model years. As a result, even if requirements are frozen at 2020 levels, "the industry would need to continue to improve fuel economy" as credits expire, it added, warning if the government hikes standards beyond 2020 requirements "the situation worsens ... without some significant form of offset or flexibility." Fiat Chrysler and Ford urged the government to reclassify two-wheel drive SUVs as light trucks, which face less stringent requirements than cars. A four-wheel drive version of the same SUV is considered a light truck. Ford backs fuel rules "that increase year-over-year with additional flexibility to help us provide more affordable options for our customers." GM's comments said it was "troubled" that President Donald Trump's administration wants to phase out incentives for electric vehicles. The Trump plan's preferred alternative freezes standards at 2020 levels through 2026 and hikes U.S. oil consumption by about 500,000 barrels per day in the 2030s but reduces automakers' collective regulatory costs by more than $300 billion. It would bar California from requiring automakers to sell a rising number of electric vehicles or setting state emissions rules. The administration of former President Obama had adopted rules, effective in 2021, calling for an annual increase of 4.4 percent in fuel-efficiency requirements from 2022 through 2025. GM has been lobbying Congress to lift the existing cap on electric vehicles eligible for a $7,500 tax credit. The credit phases out over a 12-month period after an individual automaker hits 200,000 electric vehicles sold, and GM is close to that point.

NHTSA investigating Chrysler for airbags, ignition switches

Wed, 18 Jun 2014Chrysler is being targeted by the National Highway Traffic Safety Administration in a pair of actions that focus on over 1.2 million Jeeps, minivans and crossovers.

The first is a "preliminary investigation" that focuses on an airbag issue afflicting the Jeep Commander built in model years 2006 and 2007 and Grand Cherokee from 2005 to 2006. In total, 700,000 vehicles could potentially be affected. It's not entirely clear what the airbag issue is, with The Detroit Free Press simply stating that the restraint systems in the affected Jeeps may be "faulty."

The other investigation is what's called a "recall query" and it covers a problem that General Motors should be familiar with. In this case, there could be a problem with the ignition switches of 525,000 vehicles, ranging from 2008 to 2010 Chrysler Town & Country and Dodge Grand Caravan minivans, to the 2008 to 2010 Dodge Journey crossover. Again, it's not entirely clear what sort of behavior prompted the 32 complaints that NHTSA has received on these vehicles.