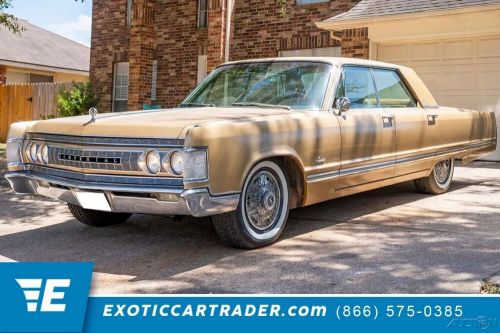

1967 Chrysler Imperial Crown on 2040-cars

Engine:440ci V8

For Sale By:Dealer

Fuel Type:Gasoline

Transmission:Automatic

Vehicle Title:Clean

VIN (Vehicle Identification Number): YM43K73149527

Mileage: 1

Drive Type: RWD

Exterior Color: Gold

Interior Color: Gold

Make: Chrysler

Manufacturer Exterior Color: Gold

Manufacturer Interior Color: Gold

Model: Imperial

Number of Doors: 2 Doors

Trim: Crown

Warranty: Vehicle does NOT have an existing warranty

Chrysler Imperial for Sale

1965 chrysler imperial crown sedan(US $8,900.00)

1965 chrysler imperial crown sedan(US $8,900.00) 1965 chrysler imperial(US $39,900.00)

1965 chrysler imperial(US $39,900.00) 1967 chrysler imperial crown coupe(US $27,000.00)

1967 chrysler imperial crown coupe(US $27,000.00) 1968 chrysler imperial crown(US $15,000.00)

1968 chrysler imperial crown(US $15,000.00) 1963 chrysler imperial crown(US $33,000.00)

1963 chrysler imperial crown(US $33,000.00) 1975 chrysler imperial lebaron(US $26,000.00)

1975 chrysler imperial lebaron(US $26,000.00)

Auto blog

Fiat Chrysler to pay $40 million fine for inflating sales numbers

Fri, Sep 27 2019DETROIT — Fiat Chrysler is paying $40 million to settle with U.S. securities regulators who say the automaker misled investors by overstating its monthly sales numbers over a five-year period. The Italian-American company inflated sales by paying dealers to report fake numbers from 2012 to 2016, the U.S. Securities and Exchange Commission alleged in a complaint. Fiat Chrysler agreed to pay the civil penalty and to stop violating anti-fraud, reporting and internal accounting control regulations, the SEC said Friday in a statement. The automaker did not admit or deny the agency's allegations, the statement said. "This case underscores the need for companies to truthfully disclose their key performance indicators," Antonia Chion, associate director in the SEC's Enforcement Division, said in the statement. She noted that the new vehicle sales figures give investors insight into the demand for an automaker's products, a key to assessing the company's performance. Fiat Chrysler said it has reviewed and refined its sales reporting procedures. It said the payment will not have a large impact on its financial statements. The agency said the automaker boasted about a streak of year-over-year sales increases into 2016, when the streak actually was broken in September of 2013. When the company disclosed the sales scheme in 2016, it said that it had a "reserve" stock of cars that had been shipped to big fleet buyers such as rental car companies but not recorded as sales. The SEC said employees called this database of actual but unreported sales the "cookie jar." The company dipped into those sales to stop the streak from ending, or when it would have missed other sales targets. Fiat Chrysler said it now records sales as soon as vehicles are shipped to customers. It has also take steps to ensure that a sale is immediately subtracted from its books when it finds out the deal was scuttled because the buyer backed out or couldn't get financing. The SEC probe is another in a long string of legal troubles for Fiat Chrysler. It also faces federal investigations into illegal payments to union officials through a training center, and a criminal probe into allegations that its diesel-powered trucks were programmed to cheat on emissions tests. The company has denied cheating, but federal prosecutors charged an engineer earlier this week and said he conspired with others. In June, Fiat Chrysler's U.S.

Weekly Recap: Chrysler forges ahead with new name, same mission

Sat, Dec 20 2014Chrysler is history. Sort of. The 89-year-old automaker was absorbed into the Fiat Chrysler Automobiles conglomerate that officially launched this fall, and now the local operations will no longer use the Chrysler Group name. Instead, it's FCA US LLC. Catchy, eh? Here's what it means: The sign outside Chrysler's Auburn Hills, MI, headquarters says FCA (which it already did) and obviously, all official documents use the new name, rather than Chrysler. That's about it. The executives, brands and location of the headquarters aren't changing. You'll still be able to buy a Chrysler 200. It's just made by FCA US LLC. This reinforces that FCA is one company going forward – the seventh largest automaker in the world – not a Fiat-Chrysler dual kingdom. While the move is symbolic, it is a conflicting moment for Detroiters, though nothing is really changing. Chrysler has been owned by someone else (Daimler, Cerberus) for the better part of two decades, but it still seemed like it was Chrysler in the traditional sense: A Big 3 automaker in Detroit. Now, it's clearly the US division of a multinational industrial empire; that's good thing for its future stability, but bittersweet nonetheless. Undoubtedly, it's an emotion that's also being felt at Fiat's Turin, Italy, headquarters as the company will no longer officially be called Fiat there. Digest that for a moment. What began in 1899 as the Societa Anonima Fabbrica Italiana di Automobili Torino – or FIAT – is now FCA Italy SpA. In a statement, FCA said the move "is intended to emphasize the fact that all group companies worldwide are part of a single organization." The new names are the latest changes orchestrated by CEO Sergio Marchionne, who continues to makeover FCA as an international automaker that has ties to its heritage – but isn't tied down by it. Everything from the planned spinoff of Ferrari, a new FCA headquarters in London and the pending demise of the Dodge Grand Caravan in 2016 has shown that the company is willing to move quickly, even if it's controversial. While renaming the United States and Italian divisions were the moves most likely to spur controversy, FCA said other regions across the globe will undergo similar name changes this year. Despite the mixed emotions, it's worth noting: The name of the merged company that oversees all of these far-flung units is Fiat Chrysler Automobiles. Obviously the Chrysler corporate name isn't completely history.

Dongfeng and PSA extend Chinese joint venture

Thu, Dec 19 2019BEIJING/PARIS — China's Dongfeng and Peugeot maker PSA are extending their business cooperation, despite the Chinese company reducing its stake in PSA to help smooth the French carmaker's merger with Fiat Chrysler Automobiles (FCA). Dongfeng said on Thursday it had agreed with PSA to extend the duration of their joint venture Dongfeng Peugeot Citroen Automobiles (DPCA). Under the deal, the venture could get the rights to PSA's new brands in China and will benefit from new technologies and intellectual properties, the Chinese company said. PSA was not immediately available for comment. The announcement comes a day after the companies said Dongfeng would reduce its 12.2% stake in PSA by selling 30.7 million shares to the French company. Analysts said the move could smooth U.S. regulatory approval for PSA's roughly $50 billion (GBP38.97 billion) merger with Italian-American carmaker FCA. The sale of Dongfeng's shares in PSA, worth around 680 million euros ($757 million), will leave the Chinese group holding around 4.5% of the merged PSA-FCA, which is set to become the world's fourth-biggest carmaker by sales volumes. "As the cooperation between Dongfeng and PSA deepens, we expect the joint venture to continue making good progress in China," a Dongfeng representative said. On a conference call, Dongfeng said DPCA would have exclusive rights to PSA's Opel cars should the partners agree to bring the brand to China, and enjoy lower prices on car parts imported from PSA. Earlier this year, a document seen by Reuters showed Dongfeng and PSA plan to cut jobs at Wuhan-based DPCA and reduce its number of car plants to try to make the venture more profitable. Chrysler Dodge Fiat Jeep RAM Citroen Peugeot China FCA PSA Dongfeng