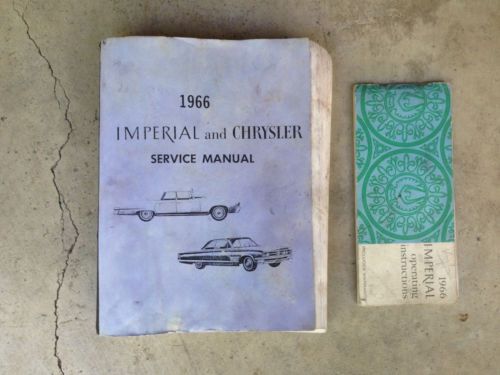

1966 Chysler Imperial Le Barron on 2040-cars

Grantville, Pennsylvania, United States

|

1966 Chysler Imperial Le Barron. Solid Body and frame. Runs and is drivable. Low miles, 440 big block. Not restored. All origianl. Car is listed locally and recerve the right to end auction at anytime. Sold as-is. Shipping to be handle by buyer. I can assist with the shipping once shipping method is determined.

Luke |

Chrysler Imperial for Sale

Auto Services in Pennsylvania

Wyoming Valley Kia - New & Used Cars ★★★★★

Thomas Honda of Johnstown ★★★★★

Suder`s Automotive ★★★★★

Stehm`s Auto Repair ★★★★★

Stash Tire & Auto Service ★★★★★

Select Exhaust Inc ★★★★★

Auto blog

Next Chrysler Town & Country will have foot-operated rear doors

Mon, Aug 31 2015Families are still months away from actually seeing the next-gen Chrysler Town & Country debut at the 2016 Detroit Auto Show, but details are continuing to trickle out about the upcoming minivan. Among several features rumored in the latest leak, the sliding doors and rear hatch are reportedly optional with foot activation, according to Automotive News. It should make loading the van easier for owners with their hands full. The T&C's powertrain sees some efficiency improvements, too. Under the hood, expect an upgraded version of the 3.6-liter Pentastar V6 and the already rumored nine-speed automatic, according to Automotive News. For the all-wheel-drive version of the minivan, an electric motor would provide the propulsion at the rear axle. Inside, all of the passengers can arrive with their devices fully charged thanks to USB ports for each of the three rows. Plus, for owners who need to make room to haul, the Stow 'N Go seating is now easier to use, too. Like the latest Honda Odyssey, fastidious buyers might even spec an optional vacuum. Earlier spy shots of the van indicate the switch to a rotary gearshift and upgraded infotainment, as well. Following the Detroit debut, the T&C goes into production in Windsor, Ontario, in late February 2016, Automotive News reports. The plug-in hybrid version would come towards the end of the year possibly capable of 75 mpge.

Junkyard Gem: 2001 Plymouth Neon

Sat, Sep 2 2023Chrysler's Plymouth brand was created in 1928 (and named after a brand of twine favored by farmers), in order to compete against Ford and Chevrolet for entry-level car shoppers. Plymouth stayed in third place in the US-market new-car sales hit parade for most of the years through the early 1950s and remained a strong (if gradually shrinking) player for decades after that. By the 1990s, though, it was tough to distinguish Plymouths from Dodges and DaimlerChrysler announced in late 1999 that the Plymouth Division would be getting the axe. 2001 was the last model year for Plymouth, with just one kind of vehicle sold for that year: the Neon. Today's Junkyard Gem is one of those final Plymouths, found in a Denver self-service yard recently. In the years just before the DaimlerChrysler "merger of equals," Chrysler had attempted to make the Plymouth brand more interesting. An updated version of the old Plymouth ship emblem was created, a Plymouth-badged car on the Chrysler LH platform was planned, the PT Cruiser was going to be a Plymouth, and then there was the Prowler crypto-hot-rod. Those dreams of a revived Plymouth bit the dust once Herr Schrempp took over. The Prowler and Voyager became Chryslers, while the PT Cruiser never had even a single year of Plymouth badging. The only 2001 car sold as a Plymouth was the humble Neon. Since the very beginning of Neon production as a 1995 model, there never had been much difference between the Neons with Dodge badges and the ones with Plymouth badges, continuing the tradition of the Dodge/Plymouth Colt and Dodge Omni/Plymouth Horizon. Earlier generations of Plymouths (e.g., the Valiant) had been mechanically identical to their Dodge-badged siblings, but at least they looked different and had smaller price tags. In 2001, the MSRP of a base Dodge Neon was $12,715, or about $22,156 in 2023 dollars. The price of the base 2001 Plymouth Neon? $12,715. At least the Plymouth Division got two model years in which to sell the second-generation version of the Neon. The engine is the SOHC version of Chrysler's 2.0-liter straight-four, rated at 132 horsepower and 130 pound-feet. Sorry, 2001 Plymouth shoppers, your Neons didn't get the 150-horse version that Dodge Neon R/T and ACR models received that year. This car has some extra-cost goodies. There's this three-speed automatic transmission, which had a $600 cost ($1,036 in today's money). It has the $1,000 air conditioning option as well ($1,742 now).

Trump tells Detroit 3 CEOs he wants more US jobs, calls environmentalists 'out of control'

Tue, Jan 24 2017As expected, President Donald J. Trump met with top executives from FCA, Ford, and General Motors this morning as part of a larger push to generate jobs in America. "I want new plants to be built here for cars sold here!", Trump said in a tweet ahead of the meeting. Not everything said in the meeting was made public, but the President later tweeted that he had a "Great meeting with automobile industry leaders." FCA CEO Sergio Marchionne, Ford chief Mark Fields, and GM's Mary Barra all echoed the positive vibes after the meeting. In a statement, Barra called the discussion "very constructive and wide-ranging," adding that it focused on "policies that support a strong and competitive economy and auto industry," and "that supports the environment and safety." That's noteworthy, because Trump is reported to have said "I am to a large extent an environmentalist. I believe in it, but it's out of control." Fields, speaking to reporters after the meeting, said, "We're excited about working together with the president and his administration on tax policies, on regulation and on trade to really create a renaissance in American manufacturing." The Ford CEO was specifically talking about Trump's withdraw from the Trans-Pacific Partnership. "We've repeatedly said that the mother of all trade barriers is currency manipulation, and TPP failed in meaningfully dealing with that, and we appreciate the president's courage to walk away from a bad trade deal," he said. Marchionne focused on American manufacturing in his statement after the meeting. "I appreciate the President's focus on making the US a great place to do business. We look forward to working with President Trump and members of Congress to strengthen American manufacturing." Perhaps equally as interesting as what was said and who was invited are what wasn't said and who wasn't invited. Trump has been very vocal about his distaste for US automakers' plants in Mexico, but no mention was made of the North American Free Trade Agreement by Trump or any of the Detroit CEOs after the meeting. We also have to wonder if Trump plans to meet with representatives from German, Japanese, and Korean automakers that have made massive investments into American plants and produce a large number of cars in this country. Related Video: News Source: Reuters, General Motors, Fiat Chrysler Automotive, Donald J.

Imperial queen victoria coupe cq, beautiful two tone maroon & black-straight 8

Imperial queen victoria coupe cq, beautiful two tone maroon & black-straight 8 1957 imperial 2 door project car or parts

1957 imperial 2 door project car or parts 1935 chrysler airflow c3 four door sedan custom imperial.

1935 chrysler airflow c3 four door sedan custom imperial. Clear

Clear Rare "barn find" - one of 650

Rare "barn find" - one of 650 1973 chrysler imperial lebaron hardtop 4-door 7.2l

1973 chrysler imperial lebaron hardtop 4-door 7.2l