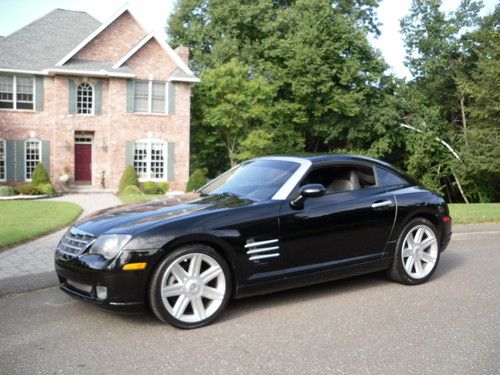

2007 Chrysler Crossfire Black On Black Convertable 59600 Miles on 2040-cars

Arlington, Texas, United States

Vehicle Title:Clear

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Transmission:Automatic

Make: Chrysler

Model: Crossfire

Options: Leather Seats, CD Player, Convertible

Trim: Base Convertible 2-Door

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: RWD

Mileage: 59,600

Exterior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Black

Crossfire: Chrysler

Chrysler Crossfire for Sale

2006 chrysler crossfire ltd heated leather spoiler 33k texas direct auto(US $14,980.00)

2006 chrysler crossfire ltd heated leather spoiler 33k texas direct auto(US $14,980.00) 2005 chrysler crossfire roadster limited with super extra low 51k highway miles(US $14,000.00)

2005 chrysler crossfire roadster limited with super extra low 51k highway miles(US $14,000.00) 2005 chrysler crossfire convertible roadster black 3.2l v6 with srt alloys(US $8,500.00)

2005 chrysler crossfire convertible roadster black 3.2l v6 with srt alloys(US $8,500.00) Black(US $10,998.00)

Black(US $10,998.00) One owner 13500 miles very rare croosfire limited best color no reserve

One owner 13500 miles very rare croosfire limited best color no reserve 2004 chrysler crossfire coupe 2-door 3.2l

2004 chrysler crossfire coupe 2-door 3.2l

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

2017 Chrysler Pacifica is perfect for town and country

Mon, Jan 11 2016The Pacifica has returned. In a surprising move, Chrysler revived the name of its old three-row CUV for the long-serving Town & Country's replacement. That's a bold strategy. Let's see if it pays off. Chrysler's new minivan offers a tremendous improvement on its predecessor in terms of interior and exterior design, available technology, and powertrain. Design inspiration is most clearly drawn from the brand's 200 sedan, both inside and out. Gone are the egg-crate grille, blocky headlights, and vertical taillights of the old van, all of which have been replaced with slim, stylish units. Doubtlessly destined for high-end trims, Chrysler will also offer a 200-style, two-tone interior with over 35 inches of screen real estate. 8.4 inches are reserved for the central UConnect display, while drivers have their own seven-inch display in the instrument cluster. As for the kiddies, they're the big winners, with a pair of ten-inch touchscreen displays in the back. Underhood, the big news is reserved for the new plug-in-hybrid powertrain. You can read all about that here. For right now, we'll focus on the familiar 3.6-liter Pentastar V6 and its accompanying nine-speed automatic transmission. There is 287 horsepower, 262 pound-feet of torque, and what will likely be a healthy improvement in fuel economy over the old Town & Country. You can read much more on the all-new Pacifica from our original post last night. We've also got a fresh gallery of live images from its big debut here at Detroit's Cobo Center, available up top.

With contract expiration days away, UAW targets GM first for negotiations

Tue, Sep 3 2019The United Auto Workers union on Tuesday said that it would target General Motors as the first of the Detroit automakers for talks ahead of the current four-year contract's expiration on Sept. 14. This year's contract talks between the union and GM, Ford and Fiat Chrysler Automobiles NV are expected to be contentious as U.S. new vehicle sales are slowing and automakers face rising costs associated with the development of electric vehicles and self-driving cars. Rising healthcare costs, job security, profit sharing and the use of temporary workers are expected to be major sticking points. GM in particular has been a target of union ire since announcing the closure of five North American plants late last year. That move drew a wave of criticism, including from U.S. President Donald Trump. Trump has repeatedly prodded GM and last week said the No. 1 U.S. automaker should begin moving its operations in China back to the United States. "We are prepared and we are all ready to stand up for our members, our communities and our manufacturing future," UAW President Gary Jones said in a statement. In a statement, GM said, "We look forward to having constructive discussions with the UAW on reaching an agreement that builds a strong future for our employees and our business." The contracts come at a difficult time for the UAW, as a federal corruption investigation into the union continues to grow. Last week, the FBI conducted searches at Jones' home, a union retreat and multiple other locations, including the home of the union's previous president, Dennis Williams. To date, seven people linked to the union and the automaker have been sentenced in the government's corruption investigation. Reporting by Nick Carey.

Detroit 3 to implement delayed unified towing standards for 2015

Mon, 10 Feb 2014Car buyers have a responsibility to be well-informed consumers. That's not always a very simple task, but some guidelines are self-evident. If you live in a very snowy climate, you generally know a Ford Mustang or Chevrolet Camaro might not be as viable a vehicle choice as an all-wheel drive Explorer or Traverse, for example. If you want a fuel-efficient car, it's generally a good idea to know the difference between a diesel and a hybrid. But what if it's kind of tough to be an informed consumer? What if the information you need is more difficult to come by, or worse, based on different standards for each vehicle? Well, in that case, you might be a truck shopper.

For years, customers of light-duty pickups have had to suffer through different ratings of towing capacities for each brand. For 2015 model year trucks, though, that will no longer be a problem. According to Automotive News, General Motors, Ford and Chrysler Group have announced that starting with next year's models, a common standard will be used to measure towing capacity. The Detroit Three will join Toyota, which adopted the Society of Automotive Engineers' so-called SAE J2807 standards way back in 2011.

The standard was originally supposed to be in place for MY2013, but concerns that it would lower the overall stated capacity for trucks led Detroit automakers to pass. Ford originally passed, claiming it'd wait until its new F-150 was launched to adopt the new standards, leading GM and Ram to follow suit. Nissan, meanwhile, has said it will adopt the new standards as its vehicles are updated, meaning the company's next-generation Titan should adhere to the same tow ratings as its competitors.