2006 Chrysler Crossfire Base Coupe 2-door 3.2l on 2040-cars

Woodbine, Georgia, United States

|

CHRYSLER CROSSFIRE 6-SPEED. I've had this car for about 5 years now, I have had NO issues with this car. The car has a scratch on the lower bumper, but is not noticeable unless I point it out. New high-speed tires on the back for a great ride !! I bought the car from the original owner. I love this car but Iam selling this car due to the fact of my family size and a two seater just wont work for us. (sell price is 12500.00 . no shipping, you will have to come pick it up)

Manufactured by Mercedes-Benz, Designed and sold by Chrysler. Comes with the original manuals Feel free to ask any questions I have not addressed. Thank you for your time.

|

Chrysler Crossfire for Sale

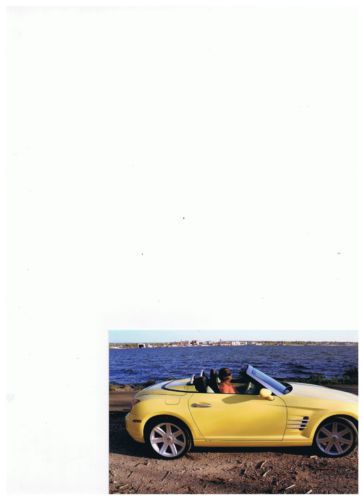

06 yellow convertable chrysler crossfire(US $23,000.00)

06 yellow convertable chrysler crossfire(US $23,000.00) One owner! lo miles! 2005 chrysler crossfire ltd hard to find! pristine!(US $14,900.00)

One owner! lo miles! 2005 chrysler crossfire ltd hard to find! pristine!(US $14,900.00) 2004 crysler crossfire 30k miles, 2 owner.(US $8,800.00)

2004 crysler crossfire 30k miles, 2 owner.(US $8,800.00) Only 3,700 miles - roadster convertible!!- see video----black w/ black top!

Only 3,700 miles - roadster convertible!!- see video----black w/ black top! 2005 chrysler crossfire limited convertible 2-door 3.2l(US $17,000.00)

2005 chrysler crossfire limited convertible 2-door 3.2l(US $17,000.00) 2005 crossfire limited coupe, low miles no reserve

2005 crossfire limited coupe, low miles no reserve

Auto Services in Georgia

Yancey Power Systems ★★★★★

Wright`s Car Care Inc ★★★★★

Wright Import Service Center The ★★★★★

VITAL Auto Repair ★★★★★

US Auto Sales - Stone Mountain ★★★★★

Tony`s Auto Repair ★★★★★

Auto blog

Fiat Chrysler's Marchionne is done talking about alliances

Sat, Apr 15 2017AMSTERDAM (Reuters) - Fiat Chrysler Chief Executive Sergio Marchionne rowed back on his search for a merger on Friday, saying the car maker was not in a position to seek deals for now and would focus instead on following its business plan. Marchionne had repeatedly called for mergers in the car industry and a tie-up has long been seen as the ultimate aim of his relaunch of Fiat Chrysler, which he is due to leave in early 2019 after 15 years at the helm. He sought a merger with General Motors two years ago but was rebuffed. Only last month he said Volkswagen - the market leader in Europe - may agree to discuss a tie-up with FCA in reaction to rival PSA Group's acquisition of Opel. Marchionne told the annual general meeting in Amsterdam he still saw the need for car companies to merge to better shoulder the large investments needed, but said Fiat Chrysler was not talking to Volkswagen. "On the Volkswagen issue, on the question if there are ongoing discussions, the answer is no," he said. He added, without elaborating, that Fiat Chrysler was not at a stage where it could discuss any alliances. "The primary focus is the execution of the plan," he said. FCA has pledged to swing to a 5 billion euro net cash position by 2018, from net debt of 4.6 billion euros at the end of 2016 - an achievement that Marchionne has said would put it in a better position to strike a deal in the future. Volkswagen, which is still reeling from an emissions scandal that hurt its profits, initially spurned FCA's approach. However, CEO Matthias Mueller said last month the group had become more open on the issue of tie-ups and invited Marchionne to speak to him directly rather than with the press. Fiat Chrysler Chairman John Elkann underlined the message that finding a merger partner was not a priority. "I'm not interested in a big merger deal," he said. "Historically, deals are struck at times of difficulty ... we don't want to be in trouble." Elkann is the scion of Fiat's founder and top shareholder the Agnelli family. He has said in the past he was prepared to have the Agnelli's stake severely diluted in exchange for a minority holding in a larger auto group. "I believe the priority for FCA is to press ahead with this ambitious (business) plan despite the difficult environment," he said. FCA pledged in January to nearly halve net debt this year, as part of the 2018 plan. Doubts remain about its exposure to a peaking U.S.

Recharge Wrap-up: Renault-Nissan at COP22, BMW launches Cruise e-Bike

Thu, Oct 6 2016The Renault-Nissan Alliance has been chosen to provide a fleet of electric cars for the UN's COP22 Climate Conference in Marrakesh, Morocco. The group will provide 50 passenger EVs – the Renault Zoe, Nissan Leaf, and Nissan e-NV200 – to shuttle delegates to and from conference venues. The Alliance will also provide more than 20 charging stations to support the shuttle fleet. The group provided electric shuttles for the historic COP21 summit in Paris last year. Read more from Renault-Nissan. FCA, Iveco, and gas grid company Snam have signed an agreement to boost natural gas as a cleaner alternative fuel for Italy. Under the Memorandum of Understanding, FCA and Iveco will work together to develop CNG vehicles, while Snam will invest in CNG supply facilities like filling stations to support a growing fleet. Italy leads Europe in the amount of natural gas consumed for transport, with 1 million vehicles currently on the road. Read more at Green Car Congress. LG Chem has officially announced it will build a battery plant in Poland to the tune of about $340 million. Located near Wroclaw in southwestern Poland, the plant is expected to produce 100,000 batteries a year for 200-mile EVs beginning in 2019. The plant could help Poland in its goal to reduce pollution by introducing a million EVs on its roads by 2025. "We will turn the Poland EV battery plant into a mecca of battery production for electric vehicles around the world," says UB Lee, President of LG Chem's Energy Solution Company. Construction begins in the second half of 2017. Read more from Automotive News Europe. BMW has introduced the Cruise e-Bike. Its Bosch Performance Line electric motor provides electric assistance at speeds of up to 15 mph. The battery can be either be removed or remain on the bike for charging, which takes 3.5 hours for a full charge. "BMW aims to be the leading provider of premium mobility services, and our bicycle collection furthers that mission," says BMW Accessory and Lifestyle Manager Eric Riehle. "As we enter the holiday season, these bikes make the perfect present for those wishing for their first BMW." The BMW Cruise e-Bike costs $3,430. Read more from BMW.

Stocks down as automakers, Boeing lead China's hit list in trade spat

Wed, Apr 4 2018Shares in U.S. exporters of everything from planes to tractors fell on Wednesday after China retaliated against the Trump administration's tariff plans by proposing duties on key U.S. imports including soybeans, beef and chemicals. U.S. automakers' products are prominent on China's list of tariff targets, yet shares of automakers ended higher on Wednesday as Wall Street stocks changed course in the afternoon when investors' trade fears subsided. Tesla shares closed 7.3 percent higher at $286.94, Ford shares gained 1.6 percent to close at $11.33, and GM shares were up 3 percent at $38.03. Aircraft maker Boeing closed down 1 percent, weighing the most on the Dow Jones Industrial Average as documents from China's Ministry of Commerce and the U.S. manufacturer showed the move would affect some older Boeing narrowbody models. It was not immediately clear how much the tariffs would impact its newer aircraft. Boeing said it was assessing the situation while analysts from JP Morgan said the proposals from China looked to have been calibrated carefully to avoid a major impact on the planemaker. Fellow Dow component 3M lost as much as 2.4 percent. And farming equipment maker Deere lost nearly $10 per share at its lowest. The company urged the two countries to work toward a resolution to "limit uncertainty for farmers and avoid meaningful disruptions to agricultural trade." The speed with which the trade spat between Washington and Beijing is ratcheting up — the Chinese government took less than 11 hours to respond with its own measures — led to a sharp selloff in global stock markets and commodities. China was hitting back against U.S. President Donald Trump's plans to impose tariffs on $50 billion in Chinese goods with similar tariffs on U.S. goods even as Trump said the country is "not in a trade war with China." "Everybody knew they were going to retaliate. The question was how strong of a retaliation. Today's move clearly shows that they mean business," said Adam Sarhan, chief executive of 50 Park Investments in New York. China levied 25 percent additional tariffs on U.S. goods, but unlike Washington's list that covers many obscure industrial items, Beijing's covers 106 key U.S. imports including soybeans, planes, cars, whiskey and chemicals. Trump denied that the tit-for-tat moves amounted to a trade war between the world's two economic superpowers.