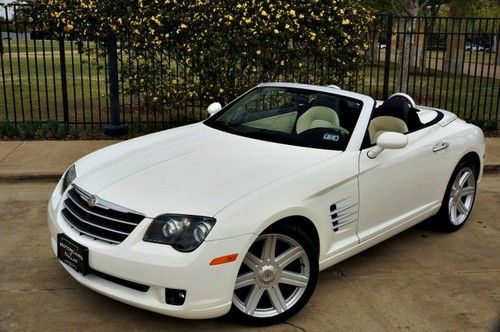

2005 Chrysler Crossfire Single Cd Heated Seats Rear Spoiler Power Top on 2040-cars

Carrollton, Texas, United States

For Sale By:Dealer

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Warranty: Vehicle has an existing warranty

Make: Chrysler

Model: Crossfire

Trim: Limited Convertible 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drive Train: Rear Wheel Drive

Mileage: 57,824

Number of Doors: 2

Sub Model: Limited

Exterior Color: White

Number of Cylinders: 6

Interior Color: Gray

Chrysler Crossfire for Sale

Convertible 3.2l cd 4 wheel disc brakes abs brakes am/fm radio air conditioning

Convertible 3.2l cd 4 wheel disc brakes abs brakes am/fm radio air conditioning 2004 chrysler crossfire

2004 chrysler crossfire 2004 chrysler crossfire base coupe 2-door 3.2l(US $16,000.00)

2004 chrysler crossfire base coupe 2-door 3.2l(US $16,000.00) Wty 2005 chrysler crossfire 6 speed manual trans sports coupe 05 3.2l v6 slk(US $7,950.00)

Wty 2005 chrysler crossfire 6 speed manual trans sports coupe 05 3.2l v6 slk(US $7,950.00) 2006 black v6 6-speed manual navigation miles:63k

2006 black v6 6-speed manual navigation miles:63k 2004 crossfire limited*38k miles*6 speed*pristine cond.warranty*$13995/offer(US $13,995.00)

2004 crossfire limited*38k miles*6 speed*pristine cond.warranty*$13995/offer(US $13,995.00)

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

For some, getting a Fiat 500e last week was almost free

Sun, Mar 22 2015Auto-racing clubs know a thing or two about moving fast. And a couple of them out in California appeared to do just that when a bunch of incentives for the Fiat 500e electric vehicle added up to a pretty sweet deal. Actually, a borderline free one. Green Car Reports was kind enough to do the math on the calculation of an $83-a-month, three-year lease deal on that included a $2,100 perk and required an $11,000 downpayment on the $32,000 car. California and federal government incentives for EVs cut that downpayment down to $1,000 out of pocket once the incentives ($7,500 from the feds, $2,500 from the state) were factored in by the leasing company. Then, Fiat-Chrysler was throwing in another $1,000 for folks who were leasing a car from another car company, hence the freebie. That means some lucky people, at least temporarily, were able to work basically a zero-downpayment agreement for a three-year lease on a car whose monthly payment is the equivalent of about two full tanks of gas. Once word of those perks got around to some California racing clubs, about 100 500e vehicles to be moved off of California lots during the past week or so. Plugged in, indeed. Related Videos: Featured Gallery 2013 Fiat 500e: Review View 40 Photos News Source: Green Car Reports Green Chrysler Fiat incentives fiat 500e

Prosecutors indict three FCA employees in alleged emissions-cheating case

Tue, Apr 20 2021Federal prosecutors indicted three Fiat Chrysler Automobiles (FCA, now Stellantis) employees as part of an investigation into alleged emissions cheating. Charges unsealed on April 20, 2021, accuse the defendants of helping rig the emissions control system fitted to the 3.0-liter turbodiesel V6 used in some models during the 2010s. Prosecutors claim Emanuele Palma, Sergio Pasini, and Gianluca Sabbioni played a determining role in developing a defeat device that allowed the V6 to obtain certification from the Environmental Protection Agency (EPA) while polluting too much in normal driving conditions. Jeep and Ram began making the engine available in the Grand Cherokee and the 1500, respectively, in 2014, but the charges state plans to game the EPA started in 2011. Palma, Pasini, and Sabbioni knowingly mislead federal regulators, the charges claim; they called it "cycle beating," according to The Detroit News. While the three men were part of FCA's research and development department, they started the project while working for an Italian supplier named VM Motori, which FCA purchased in 2013. Pasini and Sabbioni are each charged with one count of conspiracy to defraud the United States and to violate the Clean Air Act, one count of conspiracy to commit wire fraud, and six counts of violating the Clean Air Act. They could spend several years behind bars if they're found guilty. Both are currently in their home country of Italy. Palma's legal troubles are more serious. He was charged with several counts in September 2019, though four wire fraud charges were dropped in November 2020. He lives in Bloomfield Hills, a city located on the far outskirts of Detroit. Prosecutors claim motorists spent over $4 billion on over 100,000 trucks and SUVs fitted with the non-compliant engine between January 2013 and September 2017. FCA has already agreed to pay $800 million to resolve civil claims from the Justice Department, state officials and customers, though it significantly has not admitted guilt. It stressed that "it did not engage in any deliberate scheme to install defeat devices to cheat emissions tests."

You can own Don Draper's 1964 Imperial Crown Convertible

Tue, May 24 2016In AMC's Mad Men Jon Hamm's character may have been a jerk, but Don Draper's 1964 Imperial Crown Convertible is fantastic. One of just 922 droptop Imperials built for 1964, Draper's land yacht is up for auction as part of a broader sale of Mad Men props. Alongside stuff like Roger Sterling's Ray-Bans or Draper's copy of Dante Alighieri's Inferno, the big Imperial is the undisputed star of the show. According to the auction page, fewer than 200 exist today, meaning that even without its Hollywood provenance, this is an exceedingly rare vehicle. Under hood, there's a 413-cubic-inch V8 wedge mated up to a push-button, three-speed TorqueFlite automatic transmission. Typical of a big, 1960s luxury vehicle, the Imperial gets power steering, power brakes, and power windows. Even the roof is electric. Cosmetically, the auction site claims Draper's convertible was repainted once, 20 years ago, going from a "drab" Roman Dark Red to today's California Red. In the interior, the only change are new carpets. This isn't the first time Draper's Imperial has crossed the auction block. It sold at a Palm Springs auction in February 2015 for just $23,625, before a St. Louis dealership listed it on eBay for $39,900 less than a month later. That online listing has long since disappeared, so there's no telling if it actually sold or not before being listed as part of this latest auction. Regardless, with fewer than 1,000 made, fewer than 200 in existence, a credit on a critically acclaimed TV show, and a history of reasonable sale prices, this is one big, 1960s land yacht worth considering. The auction starts on June 1 and runs through June 15. Related Video: