2005 Chrysler Crossfire Limited Convertible 2-door 3.2l All New Tires! 24-27mpg on 2040-cars

Gig Harbor, Washington, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:V-6

Fuel Type:GAS

For Sale By:253.219.6225

Make: Chrysler

Model: Crossfire

Trim: Limited Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 37,896

Exterior Color: Red

Interior Color: Gray

Number of Doors: 2

Number of Cylinders: 6

On Oct-27-12 at 07:28:37 PDT, seller added the following information:

Please note: this is not covered with any warranty... All sales are final.

Chrysler Crossfire for Sale

2005 chrysler crossfire roadster limited htd pwr leather seats 3.2l v6 automatic(US $14,850.00)

2005 chrysler crossfire roadster limited htd pwr leather seats 3.2l v6 automatic(US $14,850.00) 2006 chrysler crossfire limited coupe 2-door 3.2l

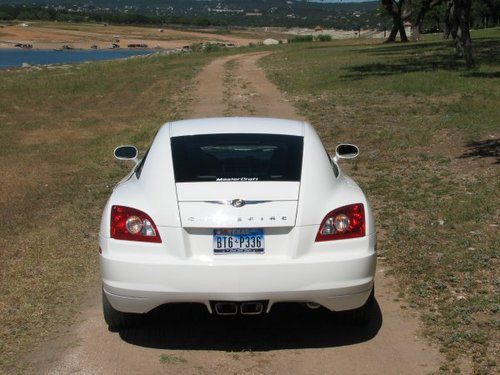

2006 chrysler crossfire limited coupe 2-door 3.2l 2004 chrysler crossfire coupe 6 spd power spoiler 35k texas direct auto(US $11,780.00)

2004 chrysler crossfire coupe 6 spd power spoiler 35k texas direct auto(US $11,780.00) 2008 chrysler crossfire ltd htd leather spoiler 39k mi texas direct auto(US $15,980.00)

2008 chrysler crossfire ltd htd leather spoiler 39k mi texas direct auto(US $15,980.00) 2006 chrysler crossfire limited coupe 2-door 3.2l(US $15,200.00)

2006 chrysler crossfire limited coupe 2-door 3.2l(US $15,200.00) 2006 chrysler crossfire ltd htd leather pwr spoiler 38k texas direct auto(US $15,480.00)

2006 chrysler crossfire ltd htd leather pwr spoiler 38k texas direct auto(US $15,480.00)

Auto Services in Washington

Werner`s Crash Shop ★★★★★

Wayne`s Auto Repair ★★★★★

Washington Auto Credit ★★★★★

Universal Auto Body & Service ★★★★★

Tri-Cities Battery-Auto Repair ★★★★★

The Audio Experts with Discount Car Stereo ★★★★★

Auto blog

2017 Chrysler Town & Country shows its 200-inspired face

Wed, Oct 21 2015Chrysler's new Town & Country is expected to debut in the next several months, featuring a new plug-in hybrid powertrain on top of a new look. While we're still short on details about the new propulsion system, a new round of spy photos is giving us a great look at the T&C's modernized aesthetic. In short, think of a puffed up, ultra-versatile Chrysler 200, and you'll have an idea of what the new Town & Country will look like. Spied on what we're guessing is Fiat Chrysler's US headquarters – seeing body shells like this just hanging around the Auburn Hills, MI campus isn't strange, although this does seem like an especially haphazard case – the new van's look is far less upright than the current model. In general, this new vehicle should be sleeker and, dare we say, more compact than the current Town & Country. Alongside the all-wheel-drive plug-in model, our spies report the new T&C will be offered with a 3.2-liter V6, which we're betting was pilfered from the Cherokee, the only other FCA model to use the smaller version of the Pentastar. It's unclear if all-wheel drive will be featured on the ICE-only model. Beyond the class-exclusive PHEV powertrain, our spies report the new van will combat the Honda Odyssey's nifty, built-in vacuum cleaner with a unit of its own. Other innovations will include hands-free side doors – we're guessing these would be some version of the increasingly popular smart tailgates, which simply require a kick of the foot to open. Of course, we'll know all about the new Town & Country early next year, with its expected debut slated for the 2016 Detroit Auto Show. Featured Gallery 2017 Chrysler Town and Country: Spy Shots Image Credit: Brian Williams / SpiedBilde Green Spy Photos Detroit Auto Show Chrysler Green Driving Minivan/Van Hybrid chrysler town and country

Revisiting the 2008-09 auto bailout that saved GM and Chrysler

Fri, Sep 2 2016The Federal Reserve stayed open late on December 31, 2008. There's almost no way you could remember that because barely anyone knew at the time. But General Motors had to pay its bills, and the Fed wired money so GM could still buy things in January. Without those funds, the nation's largest automaker wouldn't have seen much of 2009. It's one of many heart-stopping moments that illustrate just how close Detroit's Big Three came to extinction nearly a decade ago. They're chronicled in a new movie, Live Another Day, premiering in theaters September 16. Filmmakers Bill Burke and Didier Pietri interviewed nearly all of the key executives, federal officials, and union chiefs to recreate the auto industry's most perilous period. The movie begins in the aftermath of Lehman Brothers' demise amid the global financial meltdown. Things looked bleak for American carmakers, and their CEOs were laughed off Capitol Hill when they sought a Wall Street-style bailout. "It was a feeling that it was the end of the world," Pietri told Autoblog in an interview where he and Burke previewed the film. Saved by last-minute loans authorized by the Bush Administration after Congress refused to act, Detroit staggered into 2009 with a faint pulse. Live Another Day illustrates the downward spiral that played out that winter as President Obama and his task force – with little prior knowledge of the auto industry – wrestled over the fate of hundreds of thousands of jobs. GM's longtime CEO Rick Wagoner was fired in March. Fiat CEO Sergio Marchionne suddenly appeared as a savior for Chrysler, with his own motives. Obama rejected restructuring plans from the automakers. Chrysler declared bankruptcy on April 30. GM followed June 1. The sequence was very public, but Pietri and Burke showcase lesser-known events that shaped the outcome. They also seek to dispel the notion that the government rescued GM and Chrysler from incompetent leaders. "We never subscribed to the theories that the management structures of the companies were a bunch of idiots who didn't know what is going on," Pietri said. At one point, Chrysler executives were negotiating with Marchionne and Fiat. Unbeknownst to them, the government was having its own talks with the Italian automaker. The filmmakers also cast light on the bankruptcy process, which was shredded to shepherd two of America's industrial icons through reorganizations.

2017 Chrysler Pacifica Hybrid electrifies the family hauler

Mon, Jan 11 2016The 2017 Chrysler Pacifica Hybrid is the first-ever hybrid minivan – why didn't anyone think of this before? The extra jolt of electric propulsion lets Chrysler estimate this hauler can get a very green 80 miles per gallon equivalent, with 30 miles of full electric range. To make those amazing numbers possible, the Pacifica Hybrid uses a version of the 3.6-liter Pentastar V6 that runs on the Atkinson cycle for improved efficiency, matched with an electric motor. A 16-kWh lithium-ion battery sits underneath the second-row floor to supply the energy. The PHEV doesn't launch until the latter half of 2016, but Chrysler currently estimates the powertrain's output at 248 horsepower, versus 287 hp from the non-hybrid Pacifica. Charging the system to full takes just two hours from a 240-volt outlet. Other than the charging port just head of the driver's door and different wheel designs, the Pacifica Hybrid looks the same as the other model. The nearly identical styling isn't a bad thing because this is one of the most attractive minivans ever. The aesthetics are similar inside, too, but the battery removes the ability to stow the second row of seats. However, the third row can still fold flat. First hybrid powertrain in minivan segment "Due to its large footprint and multiple daily trip patterns, the minivan is ideally suited for electrification technology," said Bob Lee, Vice President and Head of Engine, Powertrain and Electrified Propulsion Systems Engineering, FCA – North America. "The all-new 2017 Chrysler Pacifica lives up to this promise and then some, with efficiency, power and refinement." Launching in second half of 2016, the Pacifica Hybrid is the industry's first electrified minivan. With an estimated 248 horsepower, the vehicle will deliver an estimated range of 30 miles solely on zero-emissions electric power from a 16-kWh lithium-ion (Li-ion) battery. In city driving, it is expected to achieve an efficiency rating of 80 miles per gallon equivalent (MPGe), based on U.S. Environmental Protection Agency standards. When the battery's energy is depleted to a certain threshold, the Pacifica Hybrid becomes a part-time electric vehicle, like a conventional hybrid. Power to the wheels is supplied by the electric drive system or supplemented by a specially adapted new version of the award-winning FCA US Pentastar 3.6-liter V-6 engine.