2004 Chrysler Crossfire - Sapphire Blue, 2 Sets Of Wheels on 2040-cars

Rocky Mount, Virginia, United States

|

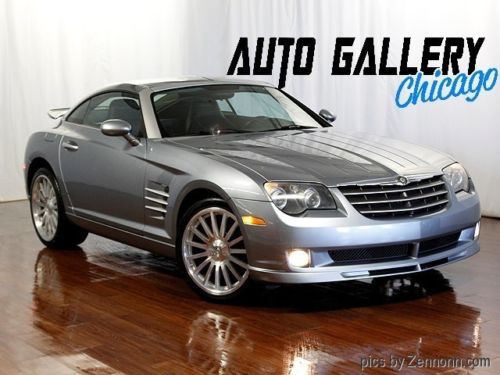

This has been a great car but I need something with a backseat now. Comes with the Vossen wheels pictured (VVC084 - 2500$ new) and the original set of wheels. The Vossen's have new Yoko S-drive radials. The rear Vossens are 20s and the fronts are 19s where the originals wheels are rear 19, and front 18. Feel free to email with any questions or for more pics.

|

Chrysler Crossfire for Sale

2005 chrysler crossfire roadster limited convertible bluetooth usb cd 5-speed(US $14,950.00)

2005 chrysler crossfire roadster limited convertible bluetooth usb cd 5-speed(US $14,950.00) 05 blaze red 3.2l v6 autostick convertible *alloy wheels *low miles *florida

05 blaze red 3.2l v6 autostick convertible *alloy wheels *low miles *florida 330 hp srt-6,(US $11,990.00)

330 hp srt-6,(US $11,990.00) 2005 chrysler crossfire srt-6 convertible 2-door 3.2l(US $19,250.00)

2005 chrysler crossfire srt-6 convertible 2-door 3.2l(US $19,250.00) 2005 chrysler crossfire base convertible 2-door 3.2l(US $11,500.00)

2005 chrysler crossfire base convertible 2-door 3.2l(US $11,500.00) 2004 chrysler crossfires,white, estate sale ,clean title.

2004 chrysler crossfires,white, estate sale ,clean title.

Auto Services in Virginia

Wrenches on Wheels ★★★★★

Virginia Tire & Auto ★★★★★

Transmissions of Stafford ★★★★★

Shorty`s Automotive Inc ★★★★★

Shell Rapid Lube ★★★★★

Salem Car Shop Inc ★★★★★

Auto blog

Toyota Land Cruiser, GMC Sierra and the long-term fleet | Autoblog Podcast #558

Mon, Oct 22 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski. They talk about driving a pair of short-term test cars, the Toyota Land Cruiser and GMC Sierra AT4, as well as two of Autoblog's long-term test cars, the 2018 Kia Stinger GT and 2018 Chrysler Pacifica Hybrid. Following the test fleet talk is a discussion of a new program from Lyft and the Chinese-market Ford Territory. And of course everything is wrapped up with yet another Spend My Money segment in which we Autoblog editors help a reader choose a car to buy.Autoblog Podcast #558 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Short-term cars: Toyota Land Cruiser and GMC Sierra AT4 Long-term cars: Kia Stinger GT and Chrysler Pacifica Hybrid Lyft subscription program Ford Territory Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Podcasts Chrysler GMC Kia Toyota toyota land cruiser chrysler pacifica chrysler pacifica hybrid kia stinger gt

Fiat Chrysler open to mergers, and PSA is looking for one

Fri, Mar 8 2019GENEVA — Fiat Chrysler (FCA) is open to pursuing alliances and merger opportunities if they make sense, but a sale of its luxury brand Maserati is not an option, Chief Executive Mike Manley said on Tuesday. "We have a strong independent future, but if there is a partnership, a relationship or a merger which strengthens that future, I will look at that," Manley told reporters at the Geneva Motor Show. Asked whether he would consider selling Maserati to China's Geely Automobile Holdings, as suggested by recent media reports, Manley said: "Maserati is one of our really beautiful brands and it has an incredibly bright future. ... No." FCA is often cited as a possible merger candidate. Bloomberg said this week that the Italian-American carmaker was attractive to France's PSA Group given its exposure to the U.S. market and its popular Jeep brand. The Detroit News' headline on the situation Friday read, "Fiat Chrysler CEO open to a deal as PSA circles" and stated that Manley's open-to-just-about-anything comments were aimed directly at PSA. Bloomberg said talks between the two were preliminary and said PSA chief Carlos Tavares has also contemplated mergers with General Motors or Jaguar Land Rover, which is losing money for Indian owner Tata. PSA has enjoyed a decade of turnaround and has $10.2 billion in net cash available. The maker of Peugeot, Citroen and DS, acquired Opel and Vauxhall in 2017 and made them almost instantly profitable. Manley, who took over after the death of Sergio Marchionne, said he currently had no news on possible deals. Manley also said the world's seventh-largest carmaker, which is lagging rivals in developing hybrid and electric vehicles, would take the least costly approach to comply with increasingly more stringent European emissions regulations. "There are three options. You can sell enough electrified vehicles to balance your fleet. Two: You can be part of a pooling scheme. Three is to pay the fines," he said. "I don't see a scenario when (carmakers) continue to subsidize technologies ... indefinitely." The carmaker had said last June it would invest 9 billion euros ($10.19 billion) over the next five years to introduce hybrid and electric cars across all regions to be fully compliant with emissions regulations. Asked about a 5-billion-euro investment plan for Italy FCA announced in November but then put under review, Manley said the plan had been confirmed as originally presented.

Fiat seeking $10B in financing to buy Chrysler

Thu, 30 May 2013As Fiat looks to become the full owner of Chrysler, all it has standing in its way is the retiree trust of the United Auto Workers, which currently holds the remaining 41.5 percent of the company as the result of the Pentastar's bankruptcy deal. The Detroit News is reporting that that Fiat is currently talking to numerous banks in an attempt to raise around $10 billion to fund the purchase of Chrysler's remaining stake with enough left over to refinance the debt of both companies. We've known that Fiat has been working to obtain the capital to buy out Chrysler for some time now, but this is the first time we've seen Fiat tip its hand about how much cash it thinks it will need to close the deal.

The first order of business is a legal dispute over the value of the UAW's stake in Chrysler, which the report indicates could cost Fiat around $3.5 billion. The acquisition of remaining shares could happen by this summer, but it sounds like CEO Sergio Marchionne (above) might not be ready for a full merger until next year.