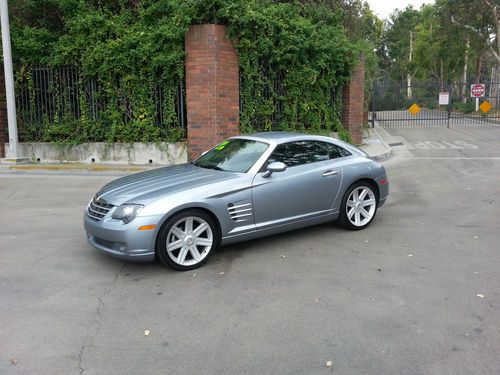

2004 Chrysler Crossfire Base Coupe 2-door 3.2l Silver/saphire!! on 2040-cars

Ozark, Missouri, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Chrysler

Model: Crossfire

Warranty: Unspecified

Trim: Base Coupe 2-Door

Options: Leather Seats, CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 88,210

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: Base

Exterior Color: Silver

Interior Color: Gray

Number of Doors: 2

Number of Cylinders: 6

Chrysler Crossfire for Sale

2005 chrysler crossfire limited 2 door coupe 12554 mi.(US $15,000.00)

2005 chrysler crossfire limited 2 door coupe 12554 mi.(US $15,000.00) 2004 chrysler crossfire base coupe 2-door 3.2l(US $9,500.00)

2004 chrysler crossfire base coupe 2-door 3.2l(US $9,500.00) 2007 chrysler crossfire limited convertible with 20k! lqqk! no reserve! nr!

2007 chrysler crossfire limited convertible with 20k! lqqk! no reserve! nr! Nonsmoker, heated seats, infinity sound, perfect carfax!(US $9,900.00)

Nonsmoker, heated seats, infinity sound, perfect carfax!(US $9,900.00) 2004 chrysler crossfire**1 owner**palm springs california rust free car**mint***(US $8,900.00)

2004 chrysler crossfire**1 owner**palm springs california rust free car**mint***(US $8,900.00) 2004 chrysler crossfire limited. 6-speed,graphite metallic

2004 chrysler crossfire limited. 6-speed,graphite metallic

Auto Services in Missouri

Total Tinting & Total Customs ★★★★★

The Auto Body Shop Inc. ★★★★★

Tanners Paint And Body ★★★★★

Tac Transmissions & Custom Exhaust ★★★★★

Square Deal Transmission ★★★★★

Sports Car Centre Inc ★★★★★

Auto blog

Mixed sales results, but automaker stocks rise on need for cars in Houston

Fri, Sep 1 2017DETROIT — The Big Three Detroit automakers on Friday reported better-than-expected August sales and issued optimistic outlooks for demand as residents of the Houston area replace flood-damaged cars and trucks after Hurricane Harvey, sending their stocks higher. General Motors, Ford and Fiat Chrysler posted mixed August U.S. sales, with GM up 7.5 percent and Ford and Fiat Chrysler down. Japanese automaker Toyota improved sales by nearly 7 percent, while Honda fell 2.4 percent. Still, analysts focused on the potential for Detroit automakers to cut inventories and stabilize used vehicle prices as residents of Houston, the fourth largest city in the United States, are forced to replace tens of thousands, perhaps hundreds of thousands, of vehicles after the devastation from Hurricane Harvey. Mark LaNeve, Ford's U.S. sales chief, told analysts on Friday that following Hurricane Katrina in 2005 "we saw a very dramatic snapback" in demand. That said, Ford sales fell 2.1 percent in August. It sold 209,897 vehicles in the United States, compared with 214,482 a year earlier. Sales were down 1.9 percent in the Ford division and off 5.8 percent at Lincoln. Demand was down for cars, crossovers and SUVs. It was not clear how many vehicles in the Houston area will be scrapped, LaNeve said, saying he had seen estimates ranging from 200,000 to 400,000 to 1 million. Ford's Houston dealers may have lost fewer than 5,000 vehicles in inventory, he said. Ford is the No. 1 automaker in the Houston market, with 18 percent share, according to IHS Markit. The company plans to ship used vehicles to Houston dealers and has "every indication we would have to add some production" of new vehicles to meet demand, LaNeve said. Investor concerns about inventories of unsold vehicles and falling used car prices have weighed on Detroit automakers' shares most of this year. Now, automakers can anticipate a jolt of demand from a big market that is a stronghold for Detroit brand trucks and SUVs. "It's got to be a positive for the industry," LaNeve said. Investors appeared to agree. GM shares rose as much as 3.3 percent to their highest since early March. Ford increased 2.8 percent at $11.34, and Fiat Chrysler's U.S.-traded shares were up 5.2 percent $15.91, hitting their highest in more than five years. GM reported a 7.5 percent increase in U.S. auto sales in August, helped by robust sales of crossovers across its four brands.

Maserati Levante will borrow Chrysler Pacifica Hybrid's PHEV powertrain

Wed, Mar 9 2016The plug-in hybrid tech from the 2017 Chrysler Pacifica Hybrid minivan will move seriously upmarket into a future version of the Maserati Levante crossover. The PHEV model should arrive around early 2018 or possibly the end of 2017, division boss Harald Wester told Motor Trend. Wester was blunt about the reason for using the minivan's powertrain. "A standalone program would be suicidal so we have to look at FCA," he said to Motor Trend. However, he expects the PHEV to comprise a tiny portion of the luxury CUV's sales volume – possibly as low as six percent. The Pacifica Hybrid will be the first PHEV minivan in the US when it arrives in the second half of 2016. The powertrain combines a 3.6-liter V6 that runs on the more efficient Atkinson cycle, and two electric motors, which are in the gearbox. A 16-kWh lithium-ion battery under the floor stores the energy for the system. Chrysler estimates the setup can carry the minivan 30 miles purely on electric power and achieve 80 MPGe. The first examples of the Levante should arrive in the US in August, according to Motor Trend. Maserati plans initially to offer its luxury crossover here with two twin-turbocharged 3.0-liter V6s. Base models use a version with 350 horsepower and 368 pound-feet of torque. The S trim gets some extra grunt thanks to a tune that makes 430 hp and 427 lb-ft. Both models come with an eight-speed automatic transmission, all-wheel drive, and a limited-slip differential. The Maserati will have a fleet of posh, European crossovers to fight against, and the PHEV will possibly offer an edge to entice a few green-minded, wealthy customers. Related Video:

Chrysler and Fiat offering $1,000 rebates to VW owners as Marchionne gets tough

Mon, 10 Dec 2012The throw-down between Fiat CEO Sergio Marchionne and Volkswagen has heated up in earnest. According to Bloomberg, Fiat and Chrysler are now offering current Volkswagen owners in the US $1,000 rebates to trade in their ride. It's the latest in a series of shots Marchionne has taken at his German rival. As you may recall, the Fiat executive entered into a spat with Volkwagen board chairman Ferdinand Piëch and CEO Martin Winterkorn in October after the duo called for Marchionne's resignation from presidency of the European Automotive Manufacturers Association (AECA). At the time, the Volkswagen executives were quoted as saying Fiat would not survive the European economic downturn.

In response, Marchionne called the German executives "reprehensible," and accused Volkswagen of using a pricing strategy that has created created a "bloodbath" in the EU. Volkswagen has taken to steep discounting to carve out ever-larger slices of market share in Europe, but the company has a much smaller foothold in the US. Marchionne may be trying to hit Volkswagen where the manufacturer is weakest with the new Fiat new incentive program.

Late last week, the Fiat executive was voted to a second term as ACEA president.