Limited Suv 5.7l Cd Heavy Duty Service Group Trailer Tow Group 8 Speakers on 2040-cars

Miami, Florida, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Chrysler

Warranty: Unspecified

Model: Aspen

Mileage: 80,645

Options: CD Player

Sub Model: Limited

Power Options: Power Windows

Exterior Color: Other

Interior Color: Gray

Number of Cylinders: 8

Vehicle Inspection: Inspected (include details in your description)

Chrysler Aspen for Sale

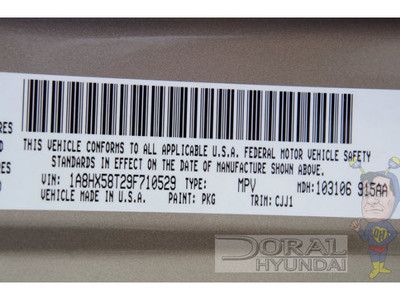

2008 chrysler aspen limited automatic 4-door suv

2008 chrysler aspen limited automatic 4-door suv Chrysler aspen 2007 limited,4x4,"hemi",leather,moon,sat,6cd,trailer tow,video(US $15,500.00)

Chrysler aspen 2007 limited,4x4,"hemi",leather,moon,sat,6cd,trailer tow,video(US $15,500.00) Mint limited suv 5.7l cd 4x4 navigation running boards heated seats sunroof

Mint limited suv 5.7l cd 4x4 navigation running boards heated seats sunroof 2007 chrysler aspen 2wd 4dr limited(US $13,998.00)

2007 chrysler aspen 2wd 4dr limited(US $13,998.00) Leather 3rd row roof rack mp3 dvd alpine audio sunroof navigation alloy wheels

Leather 3rd row roof rack mp3 dvd alpine audio sunroof navigation alloy wheels 70k clean miles nav sunroof leather hemi navigation chrome wheels autoamerica

70k clean miles nav sunroof leather hemi navigation chrome wheels autoamerica

Auto Services in Florida

Zip Auto Glass Repair ★★★★★

Willie`s Paint & Body Shop ★★★★★

Williamson Cadillac Buick GMC ★★★★★

We Buy Cars ★★★★★

Wayne Akers Truck Rentals ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Chrysler Pacifica hybrid minivans recalled due to fire risk

Wed, Jun 10 2020Chrysler Pacifica plug-in-hybrid minivans are being recalled because the connection to the vehicles' 12-volt battery may pose a fire risk. The company says 27,634 minivans are affected, from the 2017 through 2020 model years. The regular gas-engine Pacifica is not part of the recall. The issue is with the minivans' standard 12-volt battery that powers the vehicles' accessories, not the high-voltage battery that is part of the hybrid powertrain. The connection to the battery may degrade, posing the risk of fire. Chrysler says it knows of "a small number" of fires that have occurred and one minor injury. Dealers will inspect the connection to check for corrosion. In the meantime, Pacifica hybrid owners are advised not to park their vehicle inside a garage, building, or other structure, or near other vehicles. They're also asked not to carry liquids that might spill in the second-row seating area. Starting June 16, Pacifica hybrid owners can enter their VIN number at the following websites to see if their vehicle is among those being recalled: recalls.mopar.com or, in Canada, recalls.mopar.ca. Chrysler also will be contacting owners of affected vehicles by mail. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Ford delays North American production restart from coronavirus lockdown

Tue, Mar 31 2020Ford said on Tuesday it was postponing its plan to restart production at its North American plants due to safety concerns for its workers amid the coronavirus pandemic. To generate cash, the No. 2 U.S. automaker had said last week it was poised to restart production at some plants in North America as early as April 6, bringing back such profitable vehicles as its top-selling F-150 full-sized pickup, the Transit commercial van and SUVs. But on Tuesday, Ford said it had been aiming to resume production at several key U.S. plants on April 14, but would now instead do so at dates it would announce later on. "The health and safety of our workforce, dealers, customers, partners and communities remains our highest priority," Kumar Galhotra, president of Ford's North American operations, said in a statement. Still, the automaker will open a plant in Ypsilanti, Michigan, during the week of April 20, that will make ventilators to treat patients afflicted by the coronavirus. Rival Fiat Chrysler Automobiles said last week it plans to resume production in North America on April 13. General Motors has shuttered its plants indefinitely and has not provided a date for vehicle production to restart. It is facing a delay in the production launch of its redesigned large SUVs and is delaying work on other SUVs. "Once it is safe to resume production, we will do so," a GM spokesman said. As of Monday, Volkswagen was shooting for an April 5 reopening at its Tennessee plant. Honda, Nissan and Subaru facilities in North America will remain closed through April 6, and Hyundai through April 10. Toyota was planning to reopen its North American plants April 17. Plants/Manufacturing Chrysler Fiat Ford GM coronavirus

Fiat shareholders green-light Chrysler merger, end of an Italian era

Fri, 01 Aug 2014Fiat has just taken a major step away from its Italian heritage, as shareholders officially approved the company's merger with Chrysler. That move will lead to the formation of Fiat Chrysler Automobiles NV, a Dutch company based in Great Britain and listed on the New York Stock Exchange, according to Automotive News Europe.

The company captured the two-thirds majority at a special shareholders meeting, although there are still a few situations that could defeat the movement. According to ANE, roughly eight percent of shareholders opposed the merger, which is a group large enough to defeat the plan, should they all exercise their exit rights outlined in the merger conditions.

Meanwhile, Fiat Chairman John Elkann (pictured above, right, with CEO Sergio Marchionne and Ferrari Chairman Luca Cordero di Montezemolo), the great-great-grandson of Fiat founder Giovanni Agnelli, reaffirmed his family's commitment to the company beyond the merger. Exor, the Agnelli family's holding company, still maintains a 30-percent stake in Fiat.