2023 Chrysler 300 Series Touring on 2040-cars

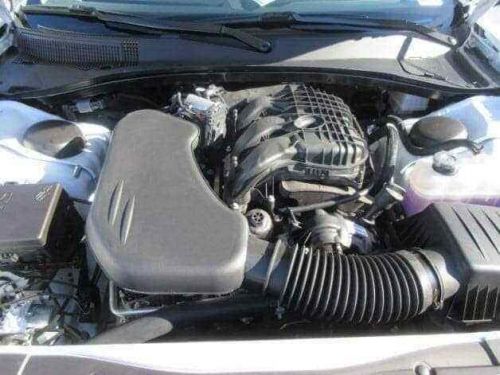

Engine:3.6L V6 24V VVT Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:8-Spd Auto 8HP50 Trans (Buy)

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C3CCAAG6PH707488

Mileage: 14

Make: Chrysler

Trim: TOURING

Drive Type: Touring RWD

Features: ENGINE: 3.6L V6 24V VVT, LINEN/BLACK, CLOTH BUCKET SEATS, MOPAR INTERIOR APPEARANCE GROUP, QUICK ORDER PACKAGE 2EE, SPORT APPEARANCE PACKAGE, TIRES: 245/45R20 BSW AS PERFORMANCE, TRANSMISSION: 8-SPEED AUTOMATIC 8HP50, WHEELS: 20" X 8.0" BLACK NOISE ALUMINUM

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: 300 Series

Chrysler 300 Series for Sale

2022 chrysler 300 series touring l(US $29,391.00)

2022 chrysler 300 series touring l(US $29,391.00) 2023 chrysler 300 series touring l rwd(US $45,866.00)

2023 chrysler 300 series touring l rwd(US $45,866.00) 2023 chrysler 300 series touring(US $37,274.00)

2023 chrysler 300 series touring(US $37,274.00) 2023 chrysler 300 series touring(US $37,274.00)

2023 chrysler 300 series touring(US $37,274.00) 2023 chrysler 300 series touring(US $37,274.00)

2023 chrysler 300 series touring(US $37,274.00) 2023 chrysler 300 series touring(US $37,274.00)

2023 chrysler 300 series touring(US $37,274.00)

Auto blog

Michigan Gov. Gretchen Whitmer says manufacturing can reopen May 11

Thu, May 7 2020Michigan Governor Gretchen Whitmer on Thursday said the state's factories can reopen next Monday, May 11, removing one of the last major obstacles to North American automakers bringing thousands of laid-off employees back to work amid the coronavirus pandemic. While reopening the manufacturing sector, Whitmer also extended her state's stay-at-home order by about two weeks to May 28, citing a desire to avoid a second wave of COVID-19, the respiratory illness caused by the novel coronavirus. “WeÂ’re not out of the woods yet, but this is an important step forward," Whitmer said in a statement. "As we continue to phase in sectors of our economy, I will keep working around the clock to ensure our businesses adopt best practices to protect workers." This week, General Motors and Fiat Chrysler Automobiles said they were targeting resuming vehicle production in North America on May 18, but suppliers would need time to prepare ahead for that date. Ford has not said what date it is targeting. The governor previously extended the state's coronavirus stay-at-home order through May 15, but had lifted restrictions for some businesses. Neighboring Ohio had allowed manufacturing to resume this past Monday, putting pressure on Whitmer to follow suit. Michigan's shutdown had stymied efforts by the Detroit Three and rival automakers to restart vehicle assembly anywhere in the United States, because so many critical parts suppliers are based in the state. Automakers and their suppliers already have begun gearing up for a possible resumption of work at their U.S. plants, but needed the official go-ahead from Whitmer. Industry officials had been pressing Whitmer to allow suppliers to reopen starting May 11 so the automakers could resume operations on their target date. They also wanted the green light so they can press Mexico to open its auto sector as suppliers there are also critical for the industry restart. The automakers' plans were tacitly approved on Tuesday by the United Auto Workers union, which represents the Detroit automakers' hourly U.S. plant workers. The union had previously said early May was "too soon and too risky" to restart manufacturing. Under Whitmer's new order, factories must adopt measures to protect workers, including daily entry screening, no-touch temperature screening as soon as possible and use of protective gear like face masks. Automakers have already rolled out such policies.

FCA-Renault revival may hinge on willingness to cut Nissan stake

Mon, Jun 10 2019Fiat Chrysler Automobiles and Renault are looking for ways to resuscitate their collapsed merger plan and secure the approval of the French carmaker's alliance partner Nissan, according to several sources close to the companies. Nissan is poised to urge Renault to significantly reduce its 43.4% stake in the Japanese company in return for supporting a FCA-Renault tie-up, two people with knowledge of its thinking also told Reuters. It is still far from clear whether any concerted effort to revive the complex and politically fraught deal can succeed. FCA Chairman John Elkann abruptly withdrew his $35 billion merger offer in the early hours of June 6 after the French government, Renault's biggest shareholder, blocked a vote by its board and demanded more time to win Nissan's backing. Nissan representatives had said they would abstain. The failure, which FCA and Renault blamed squarely on the French government, deprived both companies of an opportunity to create the world's third-biggest carmaker with 5 billion euros ($5.6 billion) in promised annual synergies. It also shone a harsh light on Renault's relations with Nissan, which have gone from frayed to fried since the November arrest of former alliance Chairman Carlos Ghosn, now awaiting trial in Japan on financial misconduct charges he denies. REVIVAL TALKS Italian-American FCA — whose brand stable encompasses Fiat runabouts, Jeep SUVs, RAM pickups, Alfa Romeo luxury cars and Maserati sports cars — has so far turned a deaf ear to suggestions by French officials that its merger proposal could be revisited. But since the breakdown, Elkann and his French counterpart Jean-Dominique Senard have had talks about reviving the plan that left the Renault chairman and his Chief Executive Thierry Bollore upbeat about that prospect, three alliance sources said. Renault and a spokesman for FCA declined to comment. One of Elkann's senior advisors on the Renault merger bid, Toby Myerson, was expected at Nissan headquarters in Yokohama on Monday for exploratory discussions with top management, two people with knowledge of the matter said. Nissan CEO Hiroto Saikawa is likely to attend. Myerson did not respond to a message from Reuters seeking comment. The meeting comes amid mounting strains that may preclude compromise, after Senard warned Saikawa that Renault was prepared to block key Nissan governance reforms in a dispute over board committees.

Chrysler Q3 profits surge to $611M but per-unit profits trouble

Thu, 06 Nov 2014Chrysler Group has announced its third-quarter financial results a little later than its crosstown rivals at General Motors and Ford, but the company has reason to celebrate thanks to strong numbers across the board.

The biggest attention-grabber from the automaker is that its net income was up 32 percent in the third quarter to $611 million, compared to $464 million over the same period last year. Modified operating profit was also strong at $946 million - a 10 percent gain. Furthermore, net revenue grew as well to $20.7 billion - 18 percent higher Q3 2013.

Growing sales pushed the strong financials. Chrysler Group sold about 711,000 vehicles worldwide for the quarter, up 18 percent from a year ago. Things looked especially good in the US, where its market share grew to 12.3 percent, versus 11.2 percent in Q3 2013.