2013 Chrysler 300 Base on 2040-cars

4135 East State Road 44, Wildwood, Florida, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:8-Speed Automatic

VIN (Vehicle Identification Number): 2C3CCAAG0DH632217

Stock Num: P397

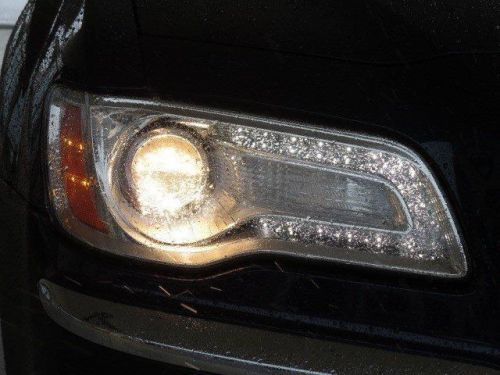

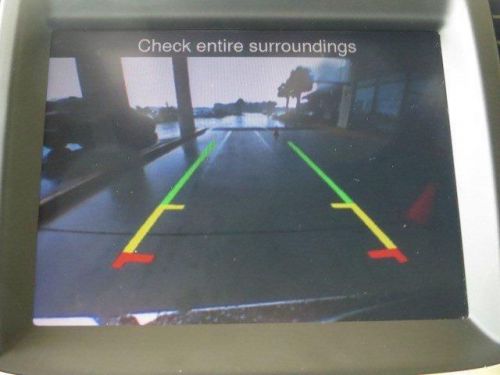

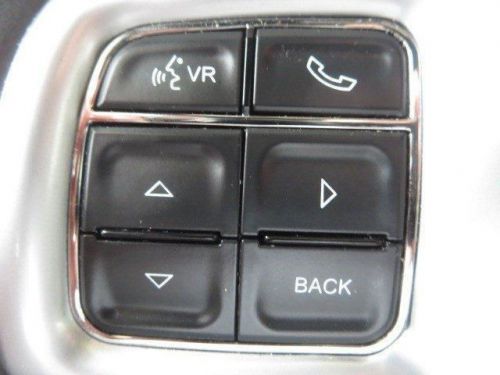

Make: Chrysler

Model: 300 Base

Year: 2013

Exterior Color: Blue

Options: Drive Type: RWD

Number of Doors: 4 Doors

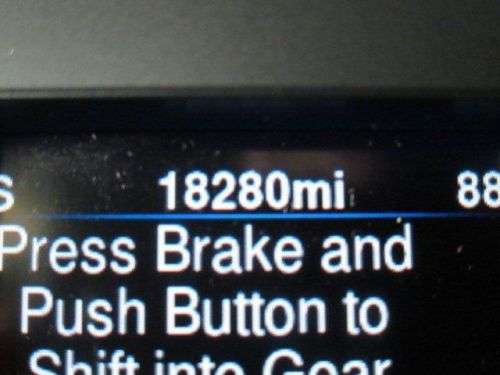

Mileage: 18275

Please visit us at www.georgenahaschevrolet.com for a complete list of vehicles. We have many new, certified and pre owned vehicles to choose from. If you don't find what your looking for we can locate a vehicle for you. George Nahas Chevrolet 4135 E State Rd 44, Wildwood, FL 34785 Call 888-474-6598

Chrysler 300 Series for Sale

2008 chrysler 300 limited(US $10,995.00)

2008 chrysler 300 limited(US $10,995.00) 2005 chrysler 300c base(US $8,900.00)

2005 chrysler 300c base(US $8,900.00) 2013 chrysler 300 s(US $30,000.00)

2013 chrysler 300 s(US $30,000.00) 2014 chrysler 300 base(US $31,540.00)

2014 chrysler 300 base(US $31,540.00) 2014 chrysler 300 base(US $31,540.00)

2014 chrysler 300 base(US $31,540.00) 2014 chrysler 300 base(US $35,035.00)

2014 chrysler 300 base(US $35,035.00)

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Jeep Cherokee faces on-sale delay

Sat, 23 Mar 2013A report in The Wall Street Journal looks at some of the obstacles to the 2014 Jeep Cherokee that go beyond its mootable yet "very contemporary" looks, almost all of them based on Fiat's financial position. Starting with that sheetmetal, in defense of it SRT president Ralph Gilles and Jeep design head Mark Allen said they wanted to "make sure the design still looks modern five years from now."

The WSJ piece doesn't cite longevity as a factor, instead saying that its features originated in a design for an Alfa Romeo, the transformation into a Jeep design meant allowing Chrysler get it to market more quickly and save "hundreds of millions of dollars" in engineering.

The need for Fiat to save money while it weathers the European situation has cut budgets for development, engineering and the pace of retooling the Toledo, Ohio plant to build the Cherokee. In a familiar case of snowballing at work, among the effects will be pushing back the Cherokee's volume sales date and delaying updates to some of Chrysler's other products.

Chrysler banks $507 million in Q2, trims 2013 earnings forecast

Tue, 30 Jul 2013Chrysler has some good news and some bad news. First, profits were up 16 percent over the second quarter of 2012, bringing the Auburn Hills, Michigan-based manufacturer $507 million on the back of strong demand for trucks and SUVs (a recurring theme this quarter, particularly in the US). Q2 revenue was up as well, from $16.8 billion in 2012 to $18 billion in 2013. The bad news is that the Pentastar's overall earnings forecast for net income in 2013 has been trimmed from $2.2 billion to between $1.7 and $2.2 billion, according to Automotive News.

In addition to the adjusted net income forecast, Chrysler tweaked its operating profit from $3.8 billion to between $3.3 and $3.8 billion. This has gone largely unexplained by Chrysler, perhaps hoping the news of a three-percent increase in its transaction prices for Q2 will allow it to sweep this adjustment under the rug.

The star of the show for Chrysler has been its US sales, which saw a 10-percent jump, both bettering the industry average of eight percent and improving over the same stretch of 2012. As with the increase in transaction prices, Chrysler has the new Ram pickup and Jeep Grand Cherokee to thank. Perhaps most worrying from this report, though, is that every brand in the automaker's stable saw an increase in sales... except for the Chrysler brand itself.

The current state of Chrysler: 10 questions with CEO Chris Fuell

Tue, Feb 14 2023In case you missed it, Chrysler is still a happening item. The V8-powered 300C was a hit when it was revealed last year, selling out in mere hours. The Pacifica minivan is a rocking family bus, and there are some concepts floating around, too. That said, it’s been a minute since we sat down with Chrysler to see whatÂ’s new. CEO Christine Fuell — known as Chris — has been on the job since 2021. To get a sense of where she thinks the company is now and where itÂ’s headed, we sat down with Fuell at last week's Chicago Auto Show for a one-on-one chat. From jokes about a Pacifica Hellcat to where Chrysler stands on controversial post-purchase subscription services, we take a look at what Fuell and Chrysler are up to. Read on below for the Q&A. Autoblog: WhatÂ’s the future for the Pacifica name plate? Fuell: Pacifica's the hero of the brand, and as we look toward the future, we want to make sure that Chrysler is known not just as a minivan brand, but a brand that makes minivans. We created the segment nearly 40 years ago. Autoblog: Is more electrification a path that you see for a minivan in the future? Fuell: It certainly is a natural progression Â… migrating to full electrification in the minivan is just kind of the natural next step. We made a commitment to fully electrify the portfolio by 2028, and so, every new product that we launch between now and then will be exclusively a battery electric propulsion system. Autoblog: Everybody likes to joke about the Pacifica Hellcat, but with electrification Â… ? Fuell: You can put some interesting tuning experiences in a minivan. Not saying that we would, but itÂ’s possible. Autoblog: Concerning the Chrysler 300C that sold out instantly, does it give you any pause in that journey to electric in seeing how rabid people are about this really cool V8 sedan? Fuell: In terms of the popularity of a V8, when you're going down this path of clean mobility, it can create a bit of a dichotomy in terms of what the brand really stands for. But at the end of the day, the 300 was a very important product to the brand when it launched in 2005. It set a tremendous trend for not only design but attracted a lot of new customers to the brand that we hadn't seen before and, so we wanted to send it off in a real respectful celebration.